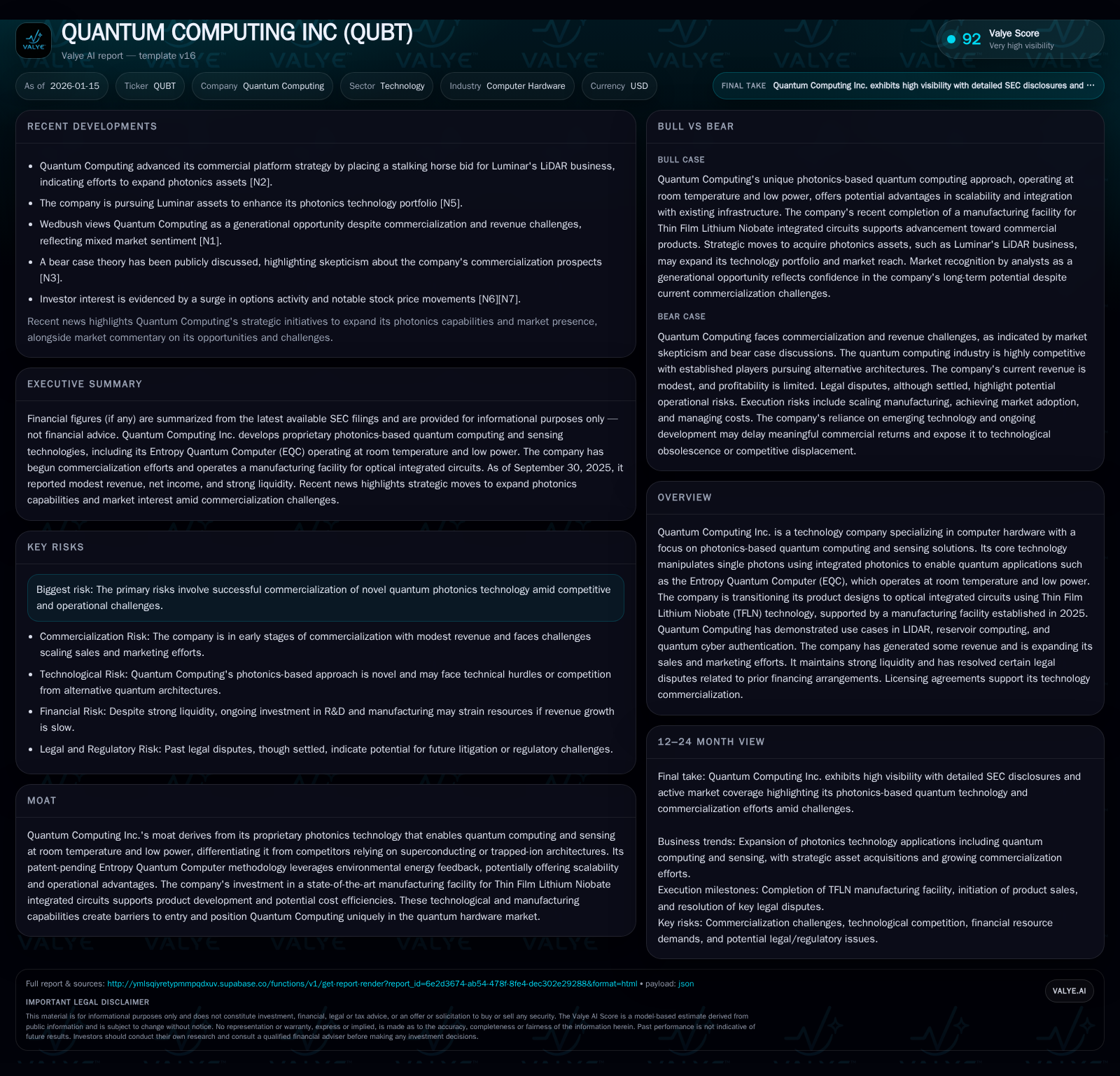

Quantum Computing Inc. Finalizes $110M Acquisition of Luminar Semiconductor to Bolster Photonics Platform

The acquisition enhances Quantum Computing’s vertical integration in photonics, impacting its technology roadmap and manufacturing capabilities.

Quantum Computing closed a $110M all-cash acquisition of Luminar Semiconductor, strengthening photonics capabilities and vertical integration in its quantum technology platform.

The acquisition enhances Quantum Computing’s vertical integration in photonics, impacting its technology roadmap and manufacturing capabilities.

Valye News Insights

Quantum Computing Inc. completed the all-cash acquisition of Luminar Semiconductor, a subsidiary of Luminar Technologies, for $110 million, expanding its photonics technology assets. This supports QCi’s goal to become a vertically integrated provider of quantum and photonics platforms domestically, improving supply chain control and technology synergy.

This acquisition marks a concrete step beyond prior intentions, potentially accelerating product development and manufacturing efficiencies. The financial impact depends on integration success and the pace of commercial adoption of the combined photonics capabilities. The deal highlights ongoing investment needs amid a complex commercialization path.

Future outcomes include successful integration leading to enhanced product offerings and faster commercialization, or challenges that could limit near-term benefits. A less favorable scenario would be if the acquisition diverts focus or capital from core quantum technology development, affecting competitive positioning.

Key milestones to watch are operational integration of Luminar Semiconductor assets, advancements in the product roadmap using acquired technology, commercial traction with new photonics-enabled solutions, and updates on capital expenditure or R&D spending related to this expanded platform.

Key numbers

- $110 million acquisition price

What changed

- Completion of Luminar Semiconductor acquisition

- Progress toward vertical integration of photonics and quantum platforms

- Strengthening of technology roadmap through expanded semiconductor assets

Bottom line: The acquisition expands Quantum Computing Inc.’s photonics technology base and manufacturing scope, marking a strategic step toward vertical integration that could influence future product development and commercialization.

Key takeaways

- Transaction was an all-cash deal valued at $110 million

- Luminar Semiconductor was a wholly owned subsidiary of Luminar Technologies

- Acquisition aligns with QCi’s strategy to integrate photonics and quantum platforms domestically

- Supports QCi’s technology roadmap and manufacturing capabilities

Risks / what to watch

- Integration risk: The success of combining Luminar Semiconductor’s assets with Quantum Computing’s existing technologies remains to be demonstrated.

- Commercialization risk: Financial benefits depend on the pace and scale of product development and market adoption post-acquisition.

- Financial risk: The $110 million cash outlay will impact liquidity and may require balancing investment priorities amid ongoing R&D spending.

- Execution risk: Timely operational alignment and synergy realization are critical to avoid distraction from core quantum technology commercialization.

News Context

- Quantum Computing Inc. completed the acquisition of Luminar Semiconductor, Inc. in an all-cash transaction valued at $110 million.

- Luminar Semiconductor was previously a wholly owned subsidiary of Luminar Technologies, Inc.

- The acquisition aims to strengthen Quantum Computing’s technology roadmap and advance its goal of becoming a vertically integrated domestic provider of photonics and quantum platforms.

Sources

This article is general in nature and often relies heavily on company press releases and other third-party public sources, which may be promotional, incomplete, or occasionally inaccurate. It also incorporates AI-generated analysis, assumptions, scenarios, and broader public background context to help place the news in a wider industry narrative. As a result, it may contain errors or omissions. Always verify important details using primary sources (company filings, official releases, and direct statements). This is not financial advice and is not a recommendation to buy or sell any security.

Disclaimer: Research-only. Not investment advice.

Comments