Ispire Technology’s Balancing Act: Innovating Vaping Hardware Amid Regulatory and Financial Challenges

An in-depth analysis of Ispire Technology’s proprietary vaping innovations, regulatory hurdles, and financial headwinds shaping its near-term trajectory.

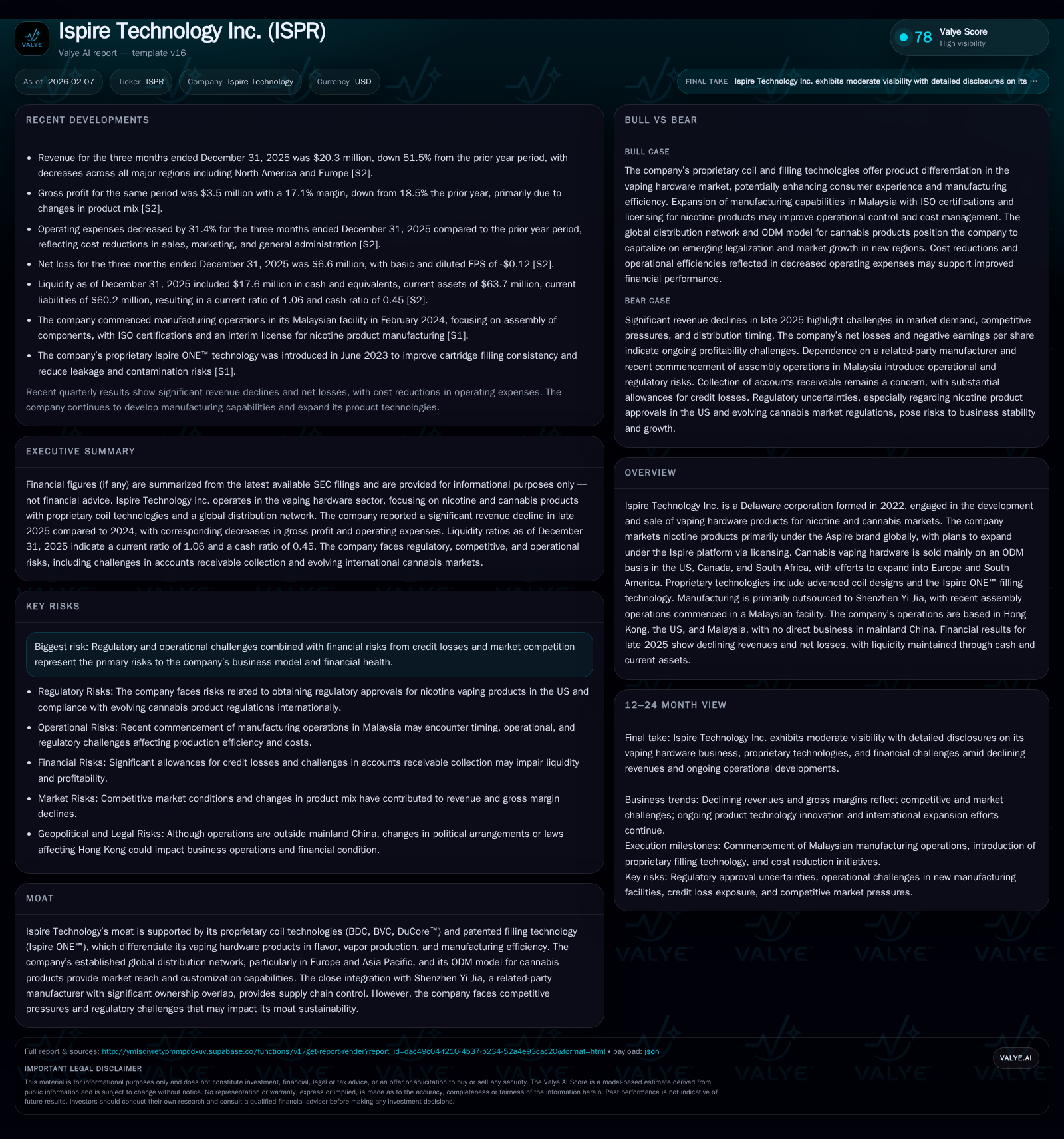

Ispire Technology Inc. leverages advanced coil and filling technologies to differentiate its nicotine and cannabis vaping hardware in competitive global markets. However, the company is navigating a tightening regulatory environment, particularly in the U.S., alongside significant financial stresses marked by a declining revenue base and mounting credit loss allowances. Its strategic pivot toward licensing expansion and an ODM model in cannabis hardware aims to diversify income streams, but operational reliance on a related-party manufacturer and evolving consumer preferences add layers of complexity. This detailed exploration reveals how Ispire’s technological strengths are tested against tough external pressures and internal liquidity challenges.

Ispire’s Innovative Coil and Filling Technologies: The Core Competitive Edge

Ispire Technology Inc.’s foundation rests firmly on its proprietary vaping hardware technologies, which define its value proposition in the nicotine and cannabis markets. Key among these are the BDC (Bottom Dual Coil), BVC (Bottom Vertical Coil), and DuCore™ coil designs — each representing incremental advances targeting improved flavor fidelity, vapor output, coil longevity, and manufacturing efficiency. The BDC technology utilizes dual coils placed at the bottom of the tank to generate higher temperatures and wider heating surfaces. This design theoretically enables richer flavor profiles and denser vapor compared to conventional single-coil systems.

Meanwhile, the BVC coil embraces a vertical heating wire enveloped by cotton wicking material designed for uniform temperature dispersion from the e-liquid tank, improving taste purity while extending component lifespan. Notably, this technology traces its lineage back to Aspire Global's 2014 innovation phase but continues to be refined under Ispire’s stewardship. Complementing these coil structures is the patented Ispire ONE™ filling system—an innovation enhancing user ease by streamlining refilling mechanisms while minimizing leakage risks.

Collectively, these advancements form a technological moat that supports differentiated product offerings amid commoditization pressures typical within vaping hardware sectors. The R&D emphasis on optimizing coil life spans alongside enhanced user experience anchors Ispire’s brand reputation globally,[S1],[valye_report_excerpt].

Navigating a Regulatory Labyrinth in Nicotine and Cannabis Vaping Markets

While innovative technology fuels product appeal, regulatory complexities pose significant constraints on market expansion. In the U.S., stringent FDA requirements govern the marketing authorization of nicotine vaping devices—a costly and protracted process necessary before new products can enter or remain in the market.[S1],[S2] Compliance burdens extend beyond just product approval; laws affecting flavors, advertising limitations aiming at youth prevention, and variable state-level cannabis laws compound uncertainties.

For cannabis-related hardware, legalization remains patchy globally with the U.S. federal status of cannabis imposing severe limitations despite state-level relaxations. Consequently, Ispire has adopted a measured territorial approach—prioritizing sales mainly within the U.S., Canada, South Africa, while cautiously gearing up for European and South American expansions only as legal frameworks allow.[valye_report_excerpt] This cautious stance reflects not only regulatory risk mitigation but also operational realities related to supply chain adjustment and market education.

Regulatory flux introduces delay risks impacting product cycles and sales forecasting—especially as competitors rush to innovate compliant devices suited for multi-jurisdictional distribution.[S2]

Financial Stresses: Analyzing Recent Declines and Liquidity Challenges

Financial statements through late 2025 highlight mounting challenges exacerbated by declining top-line momentum. Revenues fell approximately 16% year over year—from about $152 million in FY2024 to $127 million in FY2025—driven primarily by reduced sales volumes within North America where regulatory hurdles remain high.[S1],[F1]

This reduction correlates with heightened allowances for credit losses pegged at $20.9 million as of December 31, 2025 versus $18 million mid-year—an indicator of increasing difficulty collecting receivables amid customers’ stressed cash flows largely attributable to volatility within cannabis retail sectors.[S1],[S2] The company’s net loss widened sharply to over $39 million for FY2025 compared to roughly $14.7 million in FY2024,[S1] reflecting aggressive operating expense ratios now absorbing nearly half of revenues.

Operational liquidity is somewhat sustained by cash reserves nearing $17.6 million; however, working capital is thin with a current ratio barely above 1 (approximate 1.06) suggesting minimal cushion against short-term obligations.[F1] Combined with recurring net losses this positions Ispire cautiously requiring ongoing cost vigilance or fresh capital infusions absent rapid market recovery.

Global Distribution Footprint: Growth, Shifts, and Market-Specific Strategies

Geographically dissecting sales reveals shifting compositions underpinning financial outcomes: European markets constitute over half (58.1%) of sales as of FY2025 up from 43% prior year,[S1] denoting successful penetration or increased uptake possibly linked to more permissive regulatory climates or consumer openness towards vaping products.

Conversely North American contributions declined steeply—from approximately 41.5% down to 25.5%—reflecting tougher U.S. FDA scrutiny alongside competitive crowding in Canadian channels.[S1] Asia Pacific markets hold steady but modest shares (~9-10%), excluding mainland China which remains off-limits due to trade policies.[valye_report_excerpt]

Strategically, ramping up European presence serves as a partial hedge against North American uncertainties while efforts to initiate tailored licensing agreements under developed Ispire platform brand concepts aim at accelerated international reach without direct distribution overheads.

ODM Model for Cannabis Hardware: Opportunities Beyond Direct Product Sales

In cannabis segments, Ispire pivots from traditional branded sales toward an Original Design Manufacturer (ODM) model supplying hardware customized for sale under various client brands primarily within legal U.S., Canadian, and South African jurisdictions.[valye_report_excerpt] This approach mitigates direct exposure to complex plant regulation regimes including onerous tax codes such as IRS Section 280E applicable to cannabis operators but irrelevant here since Ispire abstains from handling consumable oils itself.

ODM enables flexible product differentiation per customer specification—from coil configurations to aesthetic elements—enhancing adaptability across fragmented markets dominated by multi-state operators, co-packers, or boutique brands.[S1] While margins may compress compared to branded lines due to cost-sharing necessities inherent in customization, this model offers scale benefits through diversified client relationships reducing concentration risk.

The Interwoven Supply Chain with Shenzhen Yi Jia: Risks and Advantages

Ispire outsources primary manufacturing operations predominantly to Shenzhen Yi Jia—a related party sharing overlapping ownership interests—which concentrates control over production quality timelines yet raises governance questions often viewed skeptically by external stakeholders.[valye_report_excerpt],[S1]

Advantages include streamlined communication channels ensuring proprietary technology transfer integrity plus reduced supplier disintermediation risk common in hardware sectors sensitive to IP fidelity. However, embedded risks manifest from potential preferential treatment issues or less transparent pricing negotiations—a complexity heightened if financial distress pressures mount causing counterparty destabilization.

Such interlocked arrangements necessitate diligent oversight balancing operational integration benefits against impartiality expectations increasingly demanded by institutional investors or regulators.

Future Prospects: Licensing Expansion Under the Ispire Platform

Recognizing capital constraints limiting direct global rollouts especially amid volatile credit conditions,[S1],[valye_report_excerpt] Ispire strategizes expanding its nicotine product footprint through licensing under its newly established Ispire platform brand identity distinct from legacy Aspire branding.

Initial licensing deals have launched with selected partners aimed at leveraging local market expertise while generating steady royalty income streams without substantial incremental capital investment or inventory risks.[valye_report_excerpt]

Should this initiative mature successfully it could mitigate financial burdens intrinsic to manufacturing scale-ups while providing flexibility aligned with jurisdictional compliance variance—a critical advantage as each region adapts regulatory postures dynamically.

Market Dynamics: Competitor Pressures and Consumer Taste Evolution

Competition intensifies as both entrenched tobacco conglomerates adapt strategies incorporating vape devices into portfolio extensions alongside nimble startups innovating around evolving consumer preferences ranging from flavor variety adjustments toward cleaner ingredient perceptions.[S1],[S2]

Ispire faces continuous pressure not only technologically—to maintain superior coil performances—but also strategically—to capture adult consumers seeking both product reliability and novel experiences amid widespread anti-vaping sentiment targeting youth usage downstream effects.[valye_report_excerpt]

Consumer taste fluctuations sometimes render specific formulations or device formats obsolete rapidly; thus agility in R&D pipeline coupled with nuanced marketing becomes essential rather than reliance solely on past patent advantages.

Disclaimer: This analysis is based on publicly available information gathered up to early 2026 including SEC filings (Forms 10-K &10-Q) alongside Valye News excerpts intended solely for informational purposes without any form of investment advice or recommendation regarding securities offered by Ispire Technology Inc.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments