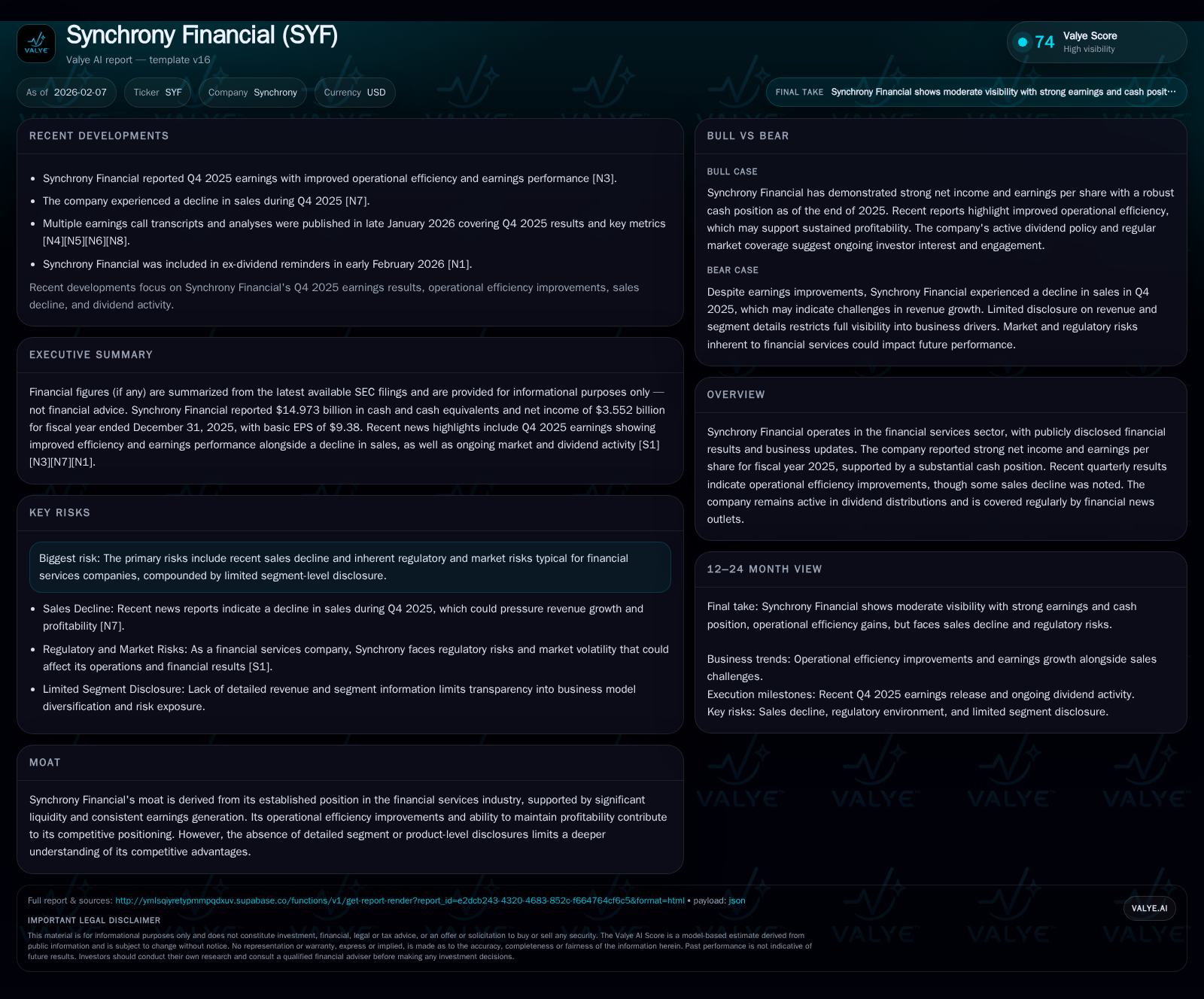

Synchrony Financial’s 2025 Performance: Navigating Earnings Strength Amid Sales Challenges

Synchrony balances robust net income and liquidity with operational efficiency gains against a backdrop of sales softness and limited segment transparency.

In fiscal 2025, Synchrony Financial demonstrated strong profitability with net income exceeding $3.5 billion and a substantial cash position near $15 billion. This financial fortitude was bolstered by improved operational efficiency visible in its Q4 earnings beat, though tempered by notable sales declines that cloud growth prospects. The company maintains steady dividend payments reflecting shareholder value priorities, while industry comparisons highlight diverse competitive dynamics. However, an opaque disclosure environment and regulatory risks complicate full visibility into its business trajectory.

Unpacking Synchrony’s 2025 Financial Fortitude: Earnings and Cash Balance

Synchrony Financial closed fiscal year 2025 reporting net income of approximately $3.55 billion coupled with nearly $15 billion in cash and cash equivalents — a testament to its sustained profitability and liquidity resources [F1, S1]. Such sizeable cash holdings afford Synchrony operational flexibility crucial within the highly regulated and capital-intensive financial sector it occupies. This foundation underpins the company’s ability to withstand market pressures and pursue efficiency initiatives even when top-line momentum softens.

This strong bottom-line performance reflects Synchrony’s capacity to generate consistent earnings despite volatility commonly faced by credit-focused financial institutions. The company's earnings strength hints at disciplined expense management and prudent risk controls, positioning it well for near-term stability.

Efficiency on the Upswing: Operational Highlights Behind Q4 Beat

The company’s Q4 2025 results notably outperformed consensus analyst estimates due to marked operational efficiency improvements [N2–N5]. Cost containment strategies played a pivotal role as Synchrony leveraged process optimizations and technology investments to streamline operations. Margin analysis from recent disclosures indicates tighter control over provisioning expenses and enhanced underwriting precision contributed materially to improved profit metrics.

Management emphasized during earnings calls that these efficiency gains offer partial buffers against macroeconomic uncertainties amid fluctuating credit demand [N3]. The episodic nature of these gains suggests ongoing focus on margin expansion without sacrificing portfolio quality, which is key given emerging sales pressures.

Sales Softness Amid Strength: The Sales Decline Conundrum

However, beneath robust earnings lies a troubling narrative of declining sales activity documented in recent quarters [N12]. Reports point toward fewer active customer accounts and softer purchase volumes impacting revenue growth trajectories [N9]. The company acknowledged these trends in their latest filings as potential headwinds that could constrain future top-line performance absent strategic offsets [S1].

This divergence between earnings strength and declining sales illustrates the complex interplay between improving internal efficiencies versus external market demand conditions. The contraction may stem from heightened competition in the consumer credit space or shifts in consumer spending patterns post-pandemic recovery phases.

Dividend Policy & Shareholder Value: Stability in a Shifting Landscape

Synchrony continues to reinforce shareholder value through steady dividend distributions, maintaining payout consistency amid evolving operational dynamics [N11]. This approach signals confidence in underlying cash flows while providing investors tangible returns during periods of uncertainty.

Dividend policy discussions within the MD&A sections confirm management views dividends as integral to balanced capital allocation frameworks [S1], underscoring their preference for rewarding shareholders alongside reinvestment for efficiency improvements.

Moat Analysis: Liquidity and Profitability as Competitive Pillars

At the core of Synchrony’s competitive positioning is its robust liquidity — nearly $15 billion available — coupled with recurring earnings generation forming a meaningful moat [valye_report_excerpt.moat, F1]. This financial strength enables investment in technology platforms essential for operational efficiencies and customer experience enhancements.

While exact product or business segment details remain limited, the firm’s consistent profitability suggests successful navigation of credit risks and cost structures sufficient to deter new entrants or smaller competitors with weaker financial backing.

Risk Matrix: Regulatory Shadows and Data Disclosure Gaps

Operating within financial services inherently exposes Synchrony to intricate regulatory frameworks impacting capital requirements, compliance costs, and lending practices [valye_report_excerpt.risks, S1]. These factors elevate execution risk particularly amidst evolving federal regulations targeting consumer credit markets.

Compounding this are gaps in publicly disclosed segment-level data limiting external stakeholder ability to parse detailed revenue or risk exposures by product lines or geographies [S1, S2]. This opacity clouds comprehensive assessment of business resilience under stress scenarios.

Market Positioning Through Industry Peers Lens

Comparing Synchrony against peers like Bread Financial reveals parallel themes of operational control juxtaposed with sales challenges [N1]. Bread’s recent quarterly beat included revenue growth not mirrored fully by Synchrony's reported declines, highlighting varying exposure to end-market segments or differing strategic responses [N13].

These peer insights contextualize Synchrony's performance within broader industry currents where efficiency gains form part of viability strategies but sustaining volume metrics remains critical for long-term competitiveness.

Management Commentary Deconstructed: Insights From Earnings Calls

Across recent earnings dialogues spanning Q3 2024 through Q4 2025 transcripts [N3, N6, N7], management consistently signals prioritization of operational agility paired with measured risk appetite. They articulate awareness of deteriorating active account trends but reinforce confidence in cost discipline initiatives cushioning impact on net income margins.

Moreover, leadership's articulation points towards leveraging technological advancements aimed at streamlining underwriting processes while cautiously monitoring portfolio credit quality amidst evolving borrower behaviors.

Forward-Looking Considerations: Navigating Growth With Limited Transparency

Looking ahead, Synchrony's path appears defined by balancing sporadic sales softness against its sturdy profitability engine and liquidity buffer [valye_report_excerpt.overview]. Without granular visibility into segmental contributions or geographic splits, projecting precise growth trajectories warrants caution [valye_report_excerpt.risks].

Analyst commentary underscores this duality — recognizing the firm's solid balance sheet position while flagging potential top-line uncertainties amid competitive pressures and regulatory evolutions [N14]. Optimizing operational efficiencies will remain central to offsetting external headwinds as Synchrony attempts sustainable advancement.

This analysis synthesizes publicly available data from SEC filings and recent news sources reflecting Synchrony Financial's multifaceted financial picture through early 2026. It aims to provide thoughtful context without advocating specific investment actions. Readers should consider various factors including macroeconomic conditions affecting consumer finance markets when interpreting these findings.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments