Alpine Income Property Trust: Resilience and Strategy Amid Net Lease Market Dynamics

An in-depth exploration of Alpine Income Property Trust’s strong portfolio performance, strategic acquisitions, and navigation of evolving tax and economic conditions.

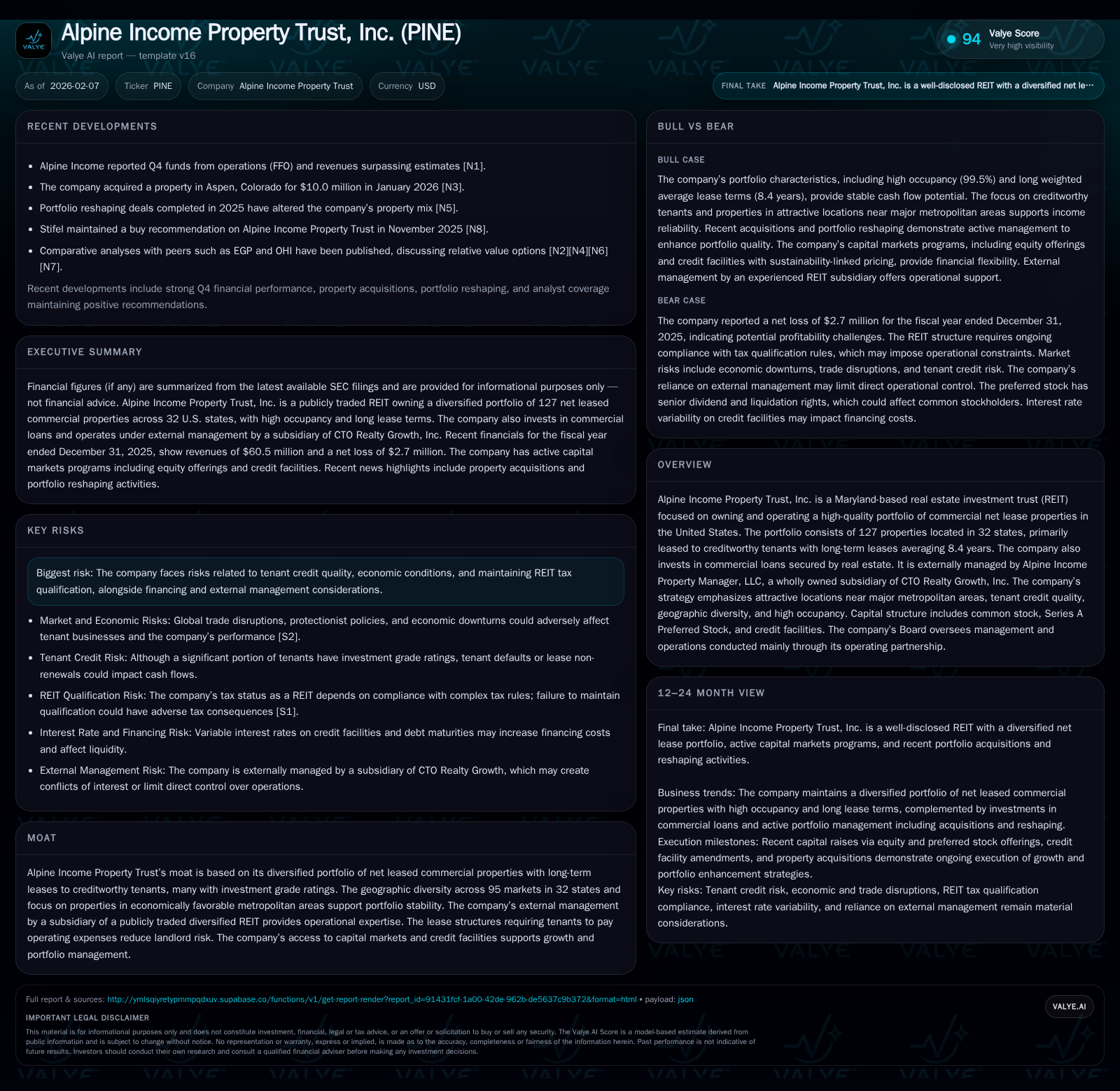

Alpine Income Property Trust (PINE) delivered Q4 results that notably outpaced market expectations, reflecting operational strength grounded in a high-quality portfolio of net leased commercial properties. The company’s acquisition of a premium Aspen property exemplifies its strategic focus on metropolitan assets with creditworthy tenants and long-term leases averaging over eight years. Navigating recent REIT tax reforms, Alpine is positioned to leverage enhanced TRS asset thresholds and dividend deductions, potentially bolstering future earnings retention. Despite robust fundamentals and geographic diversity spanning 95 markets in 32 states, ongoing risks include tenant credit exposure, macroeconomic uncertainties, and external management considerations.

Surpassing Expectations: Analyzing Q4 Performance

Alpine Income Property Trust kicked off 2026 with fourth quarter results that exceeded market forecasts, signaling operational health amid an environment still digesting inflationary pressures and interest rate normalization. According to their latest earnings release [N1], the company generated revenues totaling approximately $60.5 million for the full year ended December 31, 2025 [F1], surpassing analysts’ consensus estimates. While net income registered a modest loss of $2.66 million [F1], this reflects non-cash items and near-term costs rather than underlying cash generation. Indeed, Alpine’s focus on stable rental income streams mitigates earnings volatility. The company's cash and equivalents position stood at about $4.6 million [F1], supporting liquidity to manage ongoing operations and tactical acquisitions.

This performance snapshot anchors the narrative that Alpine’s well-curated portfolio continues delivering consistent cash flows backed by durable tenant commitments despite slight bottom-line headwinds.

The Portfolio Backbone: Net Lease Properties Driving Stability

At the heart of Alpine’s business model lies its concentrated ownership of net leased commercial properties — a segment distinguished by its risk-transferring lease structures where tenants pay most operating expenses. The portfolio encompasses 127 properties distributed across 32 states spanning roughly 4.3 million rentable square feet [S1]. Importantly, these are not random assets but ones strategically located predominantly near major metropolitan statistical areas (MSAs), with over half the annualized base rent coming from MSAs housing more than one million people.

The weighted average remaining term on leases clocks in at a notable 8.4 years [S1], underpinning predictability in income streams far beyond typical short-term leases seen elsewhere in commercial real estate. This longevity is bolstered by high occupancy levels — reported at an exceptional 99.5% as of year-end [S1] — signaling stability rarely matched outside triple-net segments.

Moreover, tenant credit quality is paramount; approximately 51% of base rent stems from tenants or parent companies possessing investment grade ratings [S1]. This mix considerably reduces downside risk related to default or rent interruptions, as many lessees operate in sectors resilient against e-commerce disruption.

Strategic Acquisitions: The Aspen Purchase in Context

January’s $10 million acquisition of a property located in Aspen, Colorado, further epitomizes the company’s disciplined expansion approach [N3]. This transaction enhances Alpine’s footprint within attractive metropolitan locales renowned for economic vibrancy and affluence.

Analyzed by recent industry commentary [N5], such moves reinforce geographic diversity and satisfy the investment mandate emphasizing tenant creditworthiness coupled with asset location quality. Aspen's status as a premium market with solid demographic fundamentals validates this addition as synergistic to Alpine's existing portfolio strategy.

By selectively investing in these top-tier assets amidst a challenging capital landscape, Alpine reaffirms its commitment to portfolio enhancement rather than volume chasing.

Navigating REIT Tax Changes Post-OBBBA Legislation

The enactment of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025 introduced meaningful modifications to REIT taxation rules affecting Alpine [S2]. Critical among these is the increase in allowable taxable REIT subsidiary (TRS) securities holdings from 20% to 25% effective for taxable years beginning after December 31, 2025.

This adjustment affords Alpine greater operational flexibility within its TRSs — entities typically used to hold non-qualifying or ancillary businesses — enabling expanded activities without jeopardizing REIT status. Furthermore, OBBBA solidified the permanence of the previously temporary 20% deduction on qualified REIT dividends for individuals and other taxpayers.

Combined with restored exclusions for depreciation-related loan expense calculations impacting interest deductions [S2], these changes likely improve profit retention capacity and tax efficiency moving forward.

Tenant Creditworthiness and Lease Durations: Risk Mitigation Factors

One cannot overstate how Alpine’s emphasis on long-duration leases with creditworthy tenants acts as a bulwark against market volatility [S1]. Unlike shorter-term leasing arrangements susceptible to turnover disruptions amid economic uncertainty, Alpine secures long-term commitments averaging more than eight years.

The weighted lease structure requires tenants to reimburse or directly cover associated property operating expenses—including taxes, insurance, assessments, utilities, maintenance—thereby shifting most variable risks away from Alpine itself [S1].

Crucially, tenants’ creditworthiness — with over half judged investment-grade— ensures timely rent payments underpinning steady distributions. In practical terms, this profile confers predictable revenue inflows that enhance cash flow visibility critical for managing debt maturities and dividend policies.

Geographic Footprint and Market Diversity as Competitive Moats

Alpine’s presence across an expansive geographical tapestry—95 markets spread over two-thirds of U.S. states—constitutes a formidable moat buffering localized downturns while capitalizing on regional economic strengths [S1].

With more than half base rents originating from MSAs boasting populations exceeding one million residents, Alpine benefits from economies rooted in population density driving demand for commercial spaces leased by stable corporates.

Importantly, such mosaic diversification reduces concentration risk inherent in portfolios overly reliant on single industries or geographies. This breadth stabilizes overall income streams during cyclical downturns impacting singular regions or sectors.

External Management Dynamics and Capital Structure Insights

Uniquely positioned within the externally managed REIT framework, Alpine contracts its operational control to Alpine Income Property Manager LLC—a wholly owned entity of publicly traded CTO Realty Growth Inc.—favoring specialized expertise infusion without direct employee overhead [S1]. This management arrangement enables access to seasoned leadership experienced across varied property types yet manifests typical complexities around expense allocations inherent to external management models.

Capital-wise, Alpine balances funding between common stock issuance, Series A Preferred Stock instruments providing stable dividend commitments to investors, alongside bilateral credit facility arrangements facilitating capital deployment flexibility [S1]. Such mix supports acquisition initiatives like Aspen while preserving liquidity cushions vital during fluctuating debt markets.

Though this structure promotes strategic agility aligned with CTO’s broader portfolio competencies, investors often scrutinize associated fees vis-à-vis internally managed peers.

Comparative Value Assessments Versus Sector Peers

Industry analysis comparing PINE against peer REITs Equinix Growth Partners (EGP) and Omega Healthcare Investors (OHI) reveals nuanced valuation contrasts centered on portfolio composition nuances [N2][N4]. Analysts note Alpine’s advantage through longer net lease durations combined with superior tenant credit ratings relative to certain competitors tending toward riskier renewals or less diversified tenant bases.

These factors translate into comparatively steadier cash flow projections justifying tighter valuation spreads despite general sector headwinds facing net lease REITs amid rising interest rates. Consequently, PINE often features favorably when measured through risk-adjusted yield frameworks that incorporate lease covenant quality alongside growth trajectories derived from disciplined acquisitions like Aspen.[N2][N4]

Potential Risks in a Shifting Economic and Regulatory Landscape

Despite strengths enumerated above, Alpine must navigate multifaceted challenges embedded within current macroeconomic and regulatory environments. Per disclosures filed in their recent Form 10-K and quarterly updates [S1][S2], principal risks include:

- Tenant Credit Exposure: Dependence on investment-grade lessees mitigates but does not eliminate potential defaults especially if economic slowdowns intensify unexpectedly.

- Trade Policy Uncertainty: Global trade frictions coupled with protectionist tendencies can erode broader economic momentum possibly impacting tenants’ operational environments adversely.[S2]

- Financing Risks: Leveraging via credit facilities exposes the company to refinancing uncertainties amid tightening financial conditions.

- REIT Qualification Compliance: Continuous adherence to complex IRS rules including asset tests post-OBBBA remains critical; failure could trigger adverse tax consequences.[S1][S2]

- External Management Costs: Reliance on third-party manager involves fee structures potentially weighing on profitability relative to self-managed peers.

Navigating these risks prudently while leveraging structural portfolio advantages will be essential for sustaining long-term shareholder value formation.

This analysis synthesizes publicly available information drawn primarily from recent SEC filings and news releases reflecting Alpine Income Property Trust’s defined strategies and operating context as of early February 2026. Readers should consider evolving market conditions that may impact future performance outcomes beyond those currently disclosed or anticipated here.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments