Mid-America Apartment Communities' Adaptive Strengths Amid Residential Real Estate Shifts

An in-depth look at MAA’s financial robustness, dividend appeal, and risk navigation as it outperforms peers in a fluctuating market.

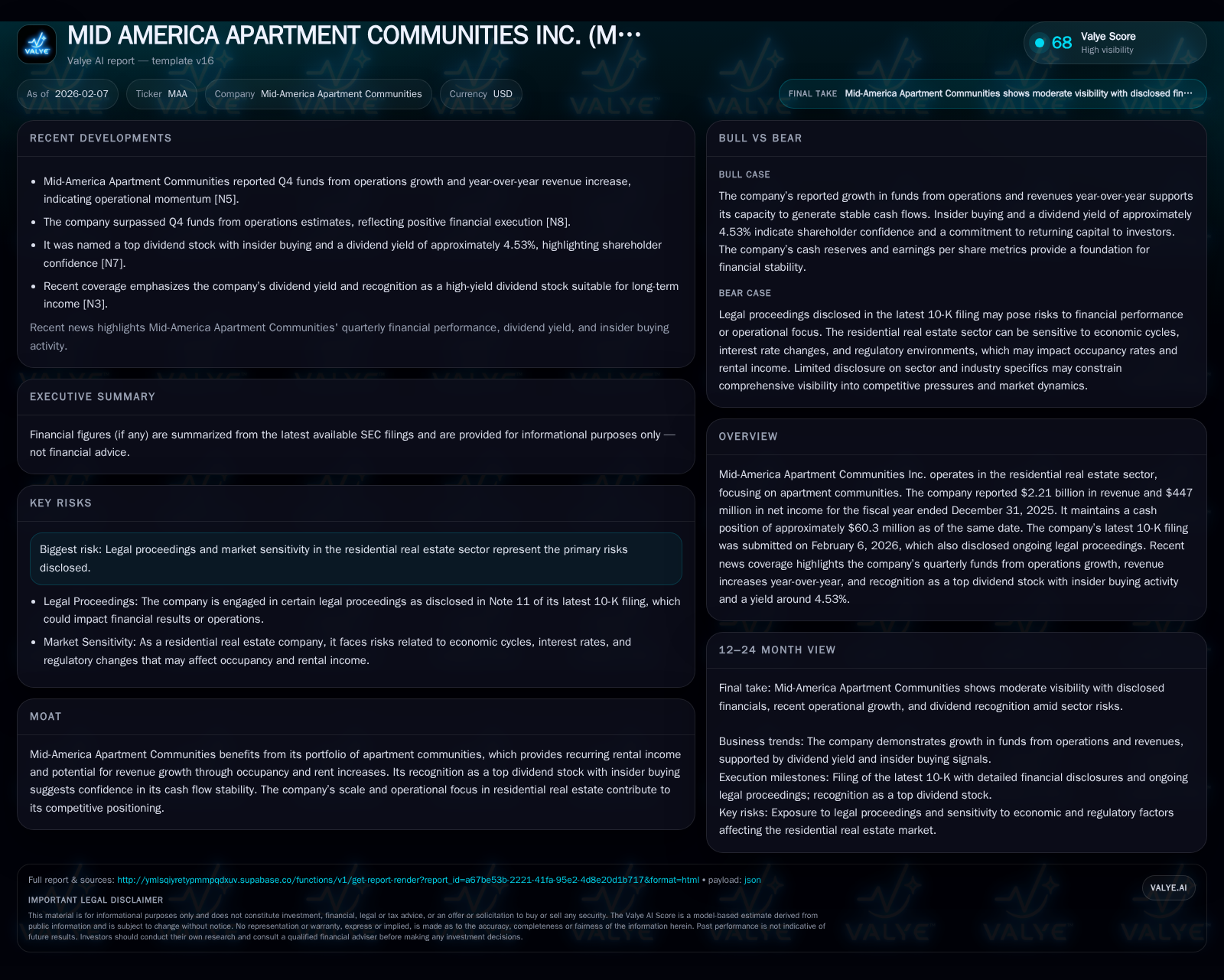

Mid-America Apartment Communities (MAA) showcased resilient financial performance in fiscal 2025, with revenue exceeding $2.2 billion and net income nearing $447 million, complemented by a cash reserve of over $60 million. The company’s Q4 funds from operations (FFO) surpassed estimates, highlighting operational momentum against industry peers. Insider buying activity alongside a compelling dividend yield around 4.53% underscores confidence in cash flow stability. Nevertheless, legal proceedings and sector-wide sensitivities remain pertinent considerations as MAA charts forward.

Mid-America Apartment Communities at a Glance: Core Business and Market Standing

Mid-America Apartment Communities Inc. (MAA) has established itself as a significant entity within the residential real estate domain through its concentrated investment in apartment communities. This core business model centers on owning and managing rental properties that produce consistent recurring revenues fundamental to its financial foundation [valye_report_excerpt]. The company’s strategy leverages scale—operating across multiple markets—to sustain occupancy rates and systematically pursue rent escalations. Such diversification reduces volatility tied to local market idiosyncrasies while cementing a base for steady cash flows.

MAA’s operational focus on apartment communities allows it to benefit from long-term demographic trends favoring rental housing demand, including urbanization and changing preferences among younger cohorts seeking residential flexibility. This positioning not only forms the bedrock of the company’s moat but also informs its potential to generate both organic revenue growth and dividend sustainability.

Decoding Fiscal 2025: Revenue, Profitability, and Cash Position Insights

The fiscal year ending December 31, 2025, manifested robust financial outcomes for MAA, with total revenues climbing to $2.21 billion and net income settling around $447 million [F1], [S1]. These figures highlight the company’s capacity to convert its asset base into meaningful profitability despite persistent headwinds faced broadly across real estate sectors.

Notably, MAA maintained a solid liquidity profile with cash and cash equivalents totaling approximately $60.3 million as per its latest disclosures [F1]. This cash buffer enhances flexibility to address operating needs or capitalize on opportunistic investments without immediate reliance on capital markets.

The profitability margin reflected here suggests effective cost controls alongside revenue expansion, underscoring disciplined management amidst inflationary pressures in costs such as maintenance and property taxes.

Quarterly Momentum: Analyzing Q4 Funds From Operations Against Peers

Mid-America Apartment Communities’ fourth quarter funds from operations (FFO) reported a beat over consensus estimates [N8], [N10]. This outperformance is indicative of operational resilience given recent macroeconomic uncertainties affecting wage inflation and living costs which can temper renter affordability.

When juxtaposed with sector peers like Camden [N3] and AvalonBay [N9], who also posted revenue gains albeit with varying degrees of earnings beats and dividend increases, MAA stands out due to its ability to convert top-line growth into greater-than-expected FFO performance. This suggests superior portfolio management or enhanced occupancy dynamics relative to competitors.

Conversely, other prominent REITs such as Equity Residential experienced FFO misses despite year-over-year revenue increases [N4], reflective of the nuanced challenges permeating the sector. Essex Property recorded core FFO below estimates while still achieving revenue upticks [N7]. Somewhere between these trajectories lies MAA’s balanced approach that has allowed it not only to match but exceed forecasts.

This quarterly momentum reflects strategic execution aligned with market conditions favoring select apartment community operators capable of adjusting rents prudently without sacrificing occupancy.

Dividend Strategy Under the Microscope: Insider Buying and Yield Implications

Mid-America’s dividend yield hovers near an attractive 4.53%, making it a notable income proposition among real estate investment trusts [N6]. The high-yield status dovetails with insider transactions—specifically stock purchases by company executives—which reflects meaningful internal conviction regarding future cash flow reliability.

The coalescence of dividend attractiveness and insider buying serves as a dual signal; externally, it draws income-focused investors seeking durable payout streams, while internally it implies management’s confidence in the sustainability of distributions absent adverse developments [N5], [N12].

Supplementing this narrative are reminders from market watchers about MAA’s Series A preferred shares yielding beyond 8%, broadening shareholder options for yield enhancement within the capital structure [N12]. Regular ex-dividend notices reinforce the consistency integral to income investor appeal [N13].

This dividend strategy operates not just as an isolated capital return mechanism but also as a strategic anchor fortifying shareholder loyalty amid competitive pressures.

Navigating Risks: Legal Proceedings and Sector Sensitivities Explained

Despite compelling operational metrics, scrutiny around legal proceedings disclosed in MAA’s February 2026 Form 10-K cannot be overlooked [S1], [valye_report_excerpt]. While details remain limited publicly, ongoing litigation inherently introduces uncertainty which could impact expenses or reputation if unresolved unfavorably.

Moreover, residential real estate remains sensitive to macroeconomic variables including interest rate fluctuations affecting borrowing costs and consumer affordability dynamics influencing tenant retention rates. Inflationary impacts on maintenance expenditures or local tax regimes add complexity to operational forecasting.

MAA’s transparent acknowledgment of these exposures signals prudent risk governance but simultaneously warrants continued monitoring by stakeholders cognizant of potential downside vectors within this segment.

Comparative Performance: MAA Versus Leading Residential REITs in Recent Quarters

Placing Mid-America alongside industry giants such as Camden, AvalonBay, Equity Residential, and Essex Property reveals differentiated competencies. Both Camden and AvalonBay combined earnings beats with increased dividends—a testament to their robust pricing power and capital discipline [N3], [N9]. Equity Residential's mixed results exposed vulnerability despite stable lease collections [N4]. Essex Property faced pressure on core FFO though achieving revenue growth highlighted operational resilience under strain [N7].

MAA emerges competitively strong given its ability not only to exceed Q4 FFO projections but also sustain incremental revenue enhancements year-over-year [N8], marking it amongst top performers in execution efficacy during this reporting cycle. Its dividend maintenance paired with insider endorsement further elevates its comparative standing beyond mere earnings metrics.

Such benchmarking underscores that MAA's portfolio quality combined with tactical lease management constitutes an advantage situating it favorably within peer group dynamics.

Moat Analysis: Scale, Operational Focus, and Portfolio Strength

At the core of Mid-America Apartment Communities’ defensibility is its expansive footprint across various apartment complexes delivering predictable rental incomes encapsulated in a tightly managed asset base [valye_report_excerpt]. This scale affords negotiating leverage with vendors and service providers while enabling operational best practices transfer across properties.

The company's specialization solely within residential apartments facilitates deep market expertise enabling nimble response to tenant requirements or regulatory evolutions unlike more diversified real estate conglomerates where fragmented focus can dilute responsiveness.

These attributes combine into a moat typified by high entrance barriers for competitors lacking comparable reach or brand recognition in residential leasing markets. Recurring cash flows from broad geographic exposure buffer cyclicality risks inherent in localized disruptions.

Collectively, these factors construct sustainable competitive advantages that underpin valuation resilience despite external headwinds challenging broader commercial real estate sectors.

Investor Sentiment & Analyst Upgrades: Contextualizing Market Confidence

Positive internal sentiment reverberates beyond insider stock accumulation; external validation arrives via recent analytical reassessment exemplified by BMO Capital Markets upgrading MAA's rating early February 2026 [N14]. Such evaluations typically reflect refined views on earnings quality improvements or balance sheet fortification signaling bullish forward-looking potential.

Market attention towards dividends alongside perceived defensive qualities propels favorable investor reception aligning buy-side perspectives with corporate stewardship displayed through insider share purchases documented concurrently [N6]. This convergence fosters constructive price discovery narratives cementing MAA’s stature within income-oriented portfolios anchored by cash flow durability considerations.

Hence investor psychology around MAA blends fundamental performance confidence with tactical endorsement by those intimately familiar with growth trajectories.

Outlook and Strategic Considerations for Sustainable Growth

Looking ahead without explicit numerical guidance demands extrapolation rooted in demonstrated financial health, strategic dividends policy continuity, risk awareness delineated through legal disclosures, and relative outperformance vis-à-vis peers [valye_report_excerpt], [N1], [S1].

Growth prospects may lean heavily on enhancing portfolio occupancy through selective acquisitions or revitalizing existing communities to capture rent premium opportunities amid persistent housing demand trends. Concurrently prudent leverage management remains critical given fluctuating interest rate environments impacting cost structures.

Continuous monitoring of litigation developments is essential since material adverse outcomes could alter capital allocation priorities negatively affecting shareholder returns or expansion capabilities.

Ultimately MAA’s blueprint appears poised for measured scaling that balances income reliability with capital appreciation potential set against evolving macroeconomic constraints furnishing a pragmatic yet cautiously optimistic narrative going forward.

This analysis synthesizes publicly available SEC filings and vetted news sources solely for informational purposes intended for knowledgeable investors familiar with REIT dynamics; it does not constitute investment advice.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments