STERIS plc: Navigating Regulatory Strength Amid Earnings Beat and Market Skepticism

Analyzing STERIS’s earnings resilience, regulatory moat, and the impact of macro pressures on market perception.

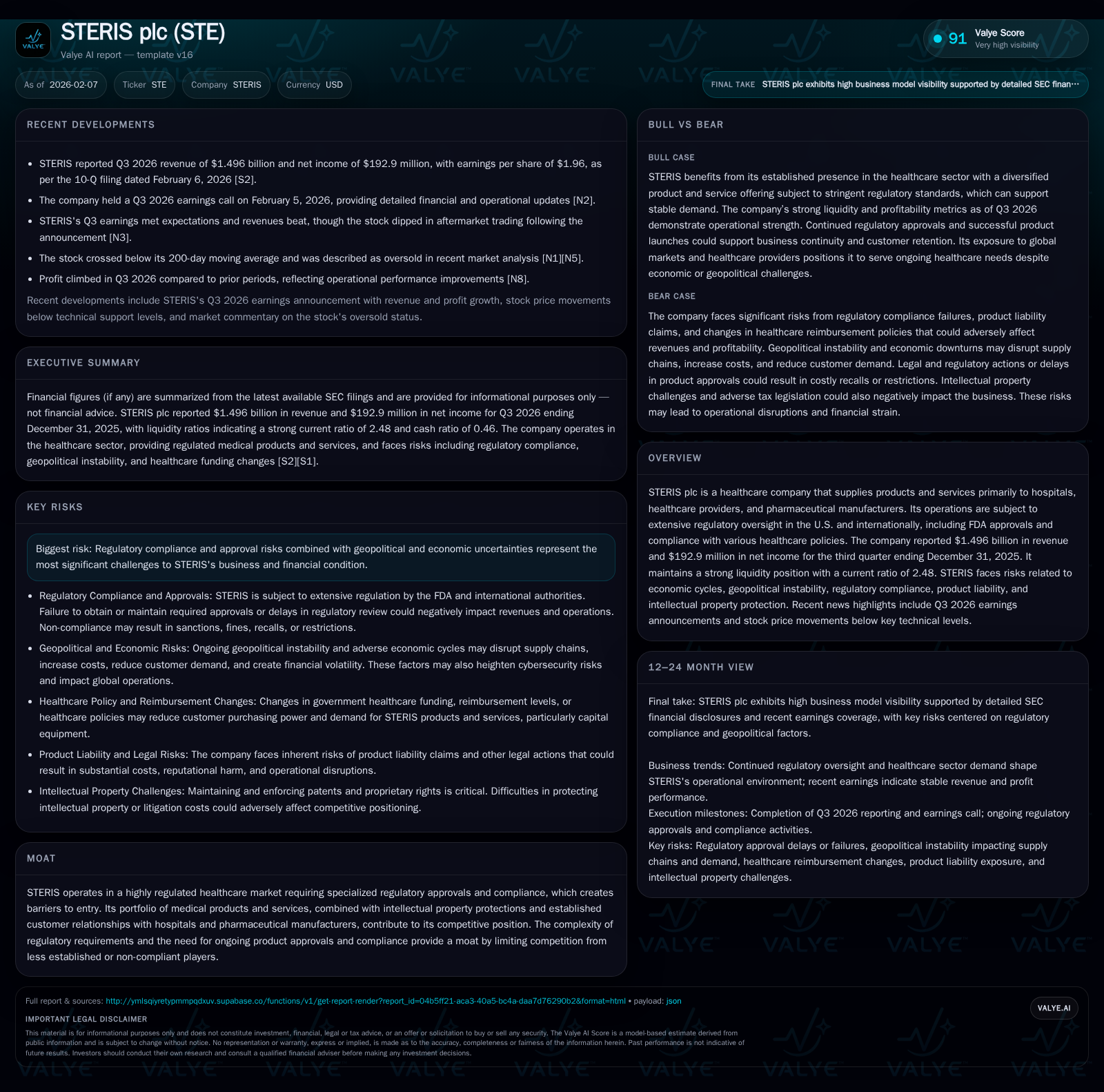

STERIS plc remains a critical supplier to healthcare infrastructure, demonstrated by a solid beat in Q3 2026 revenues despite stock price weakness below technical supports. The company’s regulatory complexity and intellectual property serve as meaningful barriers to entry, enhancing its competitive position in a challenging geopolitical and economic backdrop. However, rising costs from litigation and inflation, coupled with broad macroeconomic uncertainties, create hurdles that temper investor enthusiasm despite operational strengths. This report explores STERIS’s financial health, segment dynamics, risk landscape, and strategic initiatives that will shape its trajectory going forward.

Precisely Positioned: STERIS at the Crossroads of Healthcare Supply

STERIS plc operates at the vital intersection of healthcare delivery and pharmaceutical manufacturing support, supplying highly specialized products and services that hospitals and manufacturers depend upon for sterile processing and infection prevention. This role is compounded by the demanding regulatory environment where FDA clearances, international compliance mandates, and ongoing quality standards act not merely as operational checkpoints but as strategic barriers to entry. Such complexities limit competition primarily to those who can sustain rigorous regulatory scrutiny combined with sustained intellectual property development. As a result, STERIS maintains durable customer ties in a marketplace where switching costs are high and trust is paramount [S1][N1].

The company’s commercial model benefits from the recurring nature of its services and consumables alongside capital equipment sales, embedding STERIS deeply within clinical workflows. In essence, STERIS is less a commodity supplier than a technology-dependent partner navigating an ecosystem where safety-critical outcomes drive purchasing decisions.

Q3 2026 Earnings Review: Revenue Strength vs. Market Reaction

In the quarter ended December 31, 2025, STERIS reported revenues of $1.496 billion—surpassing consensus estimates—with net income amounting to $192.9 million [F1][N1]. This marks continued execution on organic growth strategies plus contributions from recent acquisitions such as those stemming from BD asset transfers captured in prior periods [S1]. Despite this top-line strength, the company’s shares fell below key technical supports including the 200-day moving average shortly after earnings release [N7].

This apparent disconnect stems partially from nuanced investor reactions to guidance tone amid persistent macroeconomic headwinds—such as inflationary pressures and uncertain healthcare capital budgets—that may blunt near-term margin expansion. Analysts also highlight that while headline results met or slightly exceeded forecasts, increased costs related to litigation settlements (notably the Illinois EO case) have raised concerns about expense trajectory [N2][N3]. In addition, broader market volatility in medtech sectors seems to have catalyzed profit taking despite fundamental durability [N9]. Thus, the earnings release functioned as both affirmation of financial resilience yet as a catalyst exposing underlying investor caution.

Segment and Geographic Dynamics: Dissecting Revenue Growth Drivers

STERIS’s revenue composition reveals growth concentrated in its service and consumable product lines with capital equipment experiencing modest declines year-over-year [S1]. Service revenues rose approximately 9%, reflecting expanding contracts in healthcare facilities requiring sterile-processing maintenance support systems. Consumables grew over 12%, underscoring increased usage embedded in procedural throughput.

Geographically, Ireland exhibited an impressive near-30% revenue surge driven by combined gains across capital equipment, consumables, and service offerings—representative of strategic regional investment paying off via diversified market penetration [S1]. The U.S. remains the dominant market with a mid-single-digit percentage revenue increase buoyed by stable hospital spending despite some softness in capital equipment purchases reflecting cautious budgeting.

Other foreign regions—comprising Europe, Middle East, Africa (EMEA), Asia Pacific, Latin America—show more measured growth offset partially by softer Canadian demand [S1]. This mix underlines STERIS’s global footprint balancing mature stable markets with higher-growth international economies where infrastructure modernization elevates consumable adoption.

The Regulatory Moat: How Compliance Shapes Competitive Advantage

Uniquely within healthcare supply chains focused on sterilization technology and procedural support devices, STERIS navigates a maze of domestic FDA requirements alongside equivalent international regulatory standards that demand continuous certification renewals and product validations [valye_report_excerpt.moat].

These stringent controls restrict rapid competitor entry since protracted R&D cycles must incorporate exhaustive safety testing paired with intellectual property filings protecting technological innovations. Moreover, longstanding relationships with hospitals and pharmaceutical manufacturers are fortified through trust accrued over years ensuring compliance integrity—a critical factor given patient safety implications.

Consequently, while certain competitors can replicate components or resell standard commodities, few can rival STERIS’s comprehensive compliance infrastructure entwined with tailored service delivery creating high barriers to dislodging incumbents.

Navigating Risks: Geopolitical and Economic Headwinds in Play

As outlined in filings under Risk Factors [S1], political instability globally imparts considerable uncertainty into supply chain reliability—exacerbated by rising tariffs or shifting trade policies which can inflate production costs or delay delivery timelines. Inflation exerts upward pressure on raw material costs (plastics, metals) alongside energy expenses pivotal to manufacturing operations.

Economic slowdowns potentially depress hospital capital expenditure budgets while squeezing governmental healthcare funding streams that many clients depend upon directly or indirectly. This environment may depress volumes or prompt pricing concessions impacting margin profiles.

Interlinked altogether are challenges around patient care delays due to pandemic residual effects which continue to distort normal utilization patterns [valye_report_excerpt.risks]. Cybersecurity risks amplified by geopolitical tensions represent an additional latent threat given the increasing integration of medical devices into digital infrastructures.

Financially vulnerable customers might curtail payments leading to elevated bad debt reserves; supply chain interruptions may force costly workarounds—all converging on compressed operational leeway.

Financial Fortitude: Liquidity and Profitability Metrics Explained

At quarter-end December 31, 2025, STERIS held cash and cash equivalents totaling approximately $423.7 million supporting its healthy current assets figure of $2.286 billion against current liabilities of $922 million—translating into a robust current ratio of about 2.48 signaling strong liquidity management within volatile conditions [F1].

Gross profit margins expanded modestly year-over-year supported by favorable pricing (130 basis points), improved product mix (70 basis points), material cost efficiencies (30 basis points), partly offsetting inflation’s negative impact estimated at around 150 basis points for fiscal 2025 [S1]. This indicates disciplined control amid cost inflationary environments.

Operating expenses rose notably by over 11% driven principally by selling general & administrative increases as well as discrete charges tied to the Illinois EO litigation settlement amounting to roughly $48 million after resolution terms finalized in early fiscal 2025 [S1][S2]. Research & development spend grew steadily but cautiously focused on targeted product enhancements rather than broader expansion at this stage.

The intersection of rising SG&A legal-associated expenditures with sustained R&D underscores management's balancing act between defending legacy exposures while preparing future growth vectors.

Stock Movement Contextualized: Technical Levels and Investor Sentiment

Despite operational beats in Q3 earnings metrics, STERIS shares succumbed post-release pressure sliding beneath their long-term 200-day moving average—a widely observed barometer among technical traders indicating potential trend reversals or oversold conditions [N7][N9].

Such moves often reflect short-term liquidity-driven dynamics where market participants react not only to fundamental performance but also positioning adjustments linked to broader indices rotation out of cyclical medtech stocks amidst macroeconomic tightening concerns.

The fact that shares became oversold opens potential windows for volatility but simultaneously reveals skepticism about sustainability of margin improvements given lingering cost pressures including litigation settlements [N9]. Thus short-term stock behavior mirrors complex interplay between fundamentals affirmed on earnings day versus prevailing risk sentiment prevailing across healthcare tech sectors.

Strategic Outlook: Innovation, R&D Focus, and Litigation Updates

STERIS continues channeling research funds into advancing core sterile processing technologies along with gastrointestinal (GI) endoscopy procedural device supports aiming to enhance reliability plus ease-of-use attributes—a response to evolving clinical demands underscored in fiscal MD&A disclosures [S1 MD&A]. Maintaining technological relevance remains critical given substitution risks from alternative sterilization methods emerging globally.

On the legal front, culmination of significant Illinois EO litigation claims marked by confidential settlements has crystallized material one-time operating expense recognition potentially clearing path toward normalized expense bases going forward though residual monitoring persists [S1 Risk Factors].

Management appears intent on leveraging innovation pipelines supported by stable demand fundamentals while seeking efficiency gains counterbalancing residual legal impacts contributing to SG&A inflation.

Synthesis: Balancing Risks and Opportunities for Going Forward

STERIS occupies a defensible niche within essential healthcare supply chains buttressed by regulatory moats yielding resilient revenue streams amid complex compliance demands. Its Q3 performance reinforced this foundational strength as growth in service/consumables segments supported solid profitability despite escalating cost headwinds largely driven by legal settlements plus inflation-related input prices.

Yet external factors — including geopolitical volatility that fuels supply disruptions plus economic uncertainties that constrain customer purchasing behavior — impart heightened risk profiles whispering caution over near- to medium-term outlooks. Market reactions encapsulating these tensions manifested through share price pullbacks below key technical levels underscore how sentiment currently diverges from underlying fundamental steadiness.

For stakeholders attuned to nuanced dynamics informing healthcare infrastructure suppliers like STERIS, appreciating the layered interplay between regulatory complexity leverage versus operating margin compression will be vital for contextualizing ongoing company developments amid volatile macro environments.

Disclaimer: This analysis is for informational purposes only based on publicly available information as of February 7th, 2026. It does not constitute investment advice or recommendations regarding any security mentioned herein.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments