Pathward Financial’s Moat Tested Amid Strong Earnings and Regulatory Complexities

An incisive look at Pathward Financial’s business resilience, deposit dynamics, and risk landscape amidst market enthusiasm.

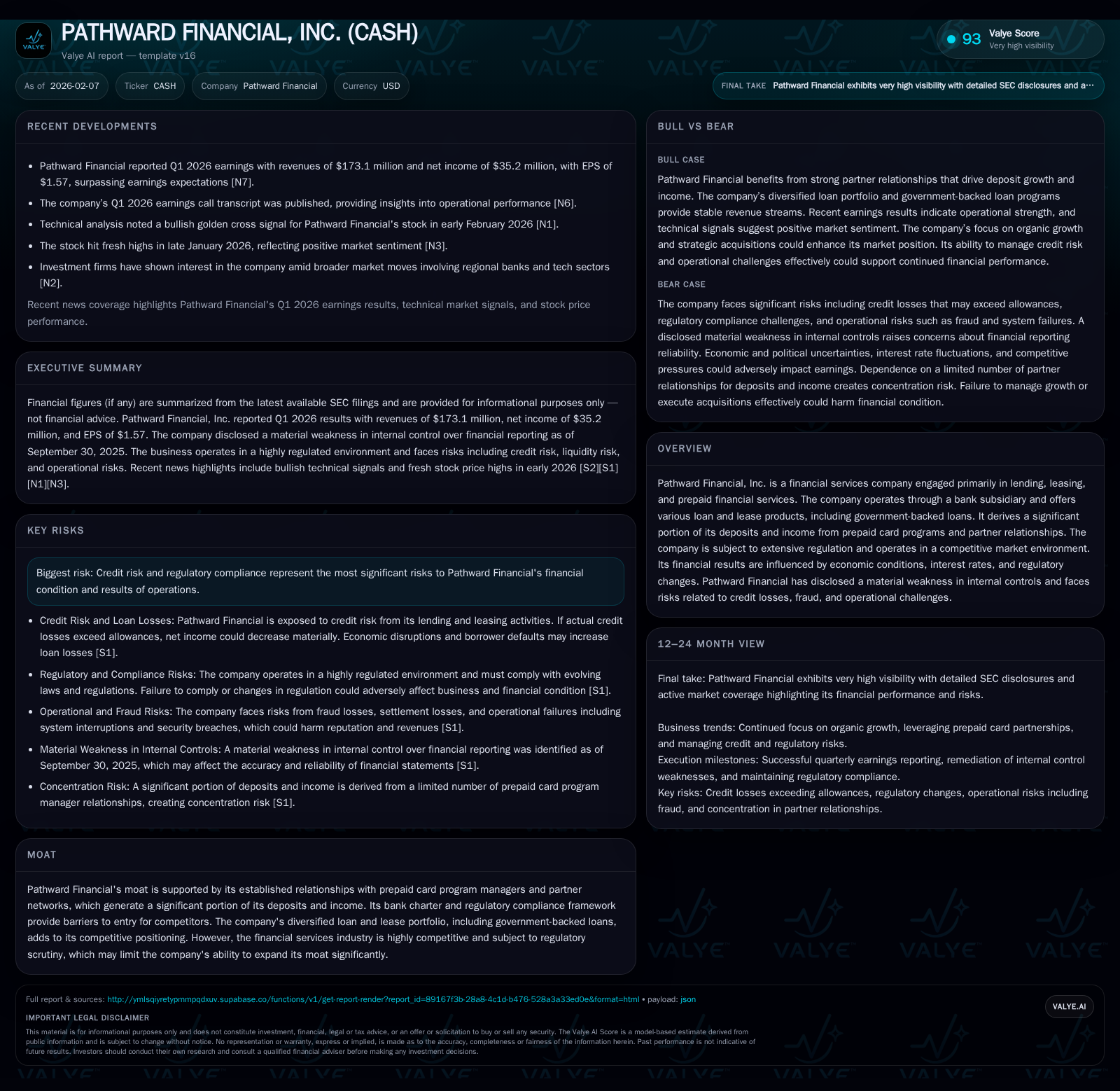

Pathward Financial, trading under the ticker CASH, is currently experiencing heightened investor interest underscored by a golden cross technical indicator and recent price highs signaling optimism in its growth trajectory. The company's core business blends prepaid card programs, government-backed loans, and leasing activities, with a significant portion of its deposits sourced from partner-managed prepaid services. While financial results have beat estimates recently, bolstered by robust deposit growth and fee income, Pathward faces enduring challenges including material weaknesses in internal controls, credit risks inherent to lending operations, and the intricacies of regulatory compliance. These factors frame a nuanced outlook balancing solid operational momentum against persistent sector risks.

Riding the Momentum: Market Signals and Investor Sentiment

The recent surge in Pathward Financial’s stock price is underscored by technical analysis markers such as a golden cross—a bullish signal generated when the short-term moving average crosses above the long-term moving average—suggesting strengthening momentum among investors [N1]. This event aligns temporally with the company hitting fresh price highs early in 2026 [N2], bolstered by renewed optimism around its earnings prospects. Market commentary further highlights sizeable new investments into Pathward shares and derivatives contracts reflective of institutional confidence [N9]. Such enthusiasm paints a picture of an emerging narrative where investors are pricing in robust pipeline growth and operational strengths.

Yet beneath this surface lies tension: Pathward’s disclosed material weaknesses in internal controls and inherent credit risks caution against unmitigated optimism. This juxtaposition invites deeper scrutiny into whether strong technical indicators fully capture underlying operational realities or if sentiment outpaces fundamentals.

Unpacking Pathward’s Core Business Model: Prepaid Cards to Government-Backed Loans

At its heart, Pathward Financial operates a hybrid financial services platform primarily anchored in prepaid financial services while maintaining diversified lending exposures. The company leverages established relationships with prepaid card program managers that channel vast flows of deposits into mostly noninterest-bearing transactional accounts [S1], constituting over 95% of its deposit portfolio. This stable deposit base provides a low-cost funding advantage critical for competitive loan pricing.

Complementing this are leasing arrangements alongside government-backed loan programs stemming from its bank subsidiary. These government-backed loans add credit quality ballast while offering revenue diversification beyond prepaid transactional fees. The integration between deposit gathering via prepaid cards and loan originations crafts an interlinked ecosystem where partner relationships drive both sides of the balance sheet [valye_report_excerpt].

This strategic blend enables revenue streams from interest income on loans as well as fee-based income linked to payment processing networks—a symbiosis diversifying earnings and embedding Pathward within fragmented financial service value chains.

Deposit Portfolio Dynamics and Rate Sensitivity: Securing Funding in a Fluid Environment

Pathward's deposit mix is predominantly noninterest-bearing checking accounts—approximately 95.5% as of September 2025—principally sourced from partner-managed prepaid card programs [S1]. Interest-bearing checking accounts, savings deposits, money market accounts, wholesale deposits, and certificates of deposit together form a small fraction (<5%) of total deposits. Time certificates of deposit remain minimal (less than 0.05% of total deposits), indicating little reliance on rate-sensitive term funding.

Approximately 64% of the deposit portfolio bears variable rate processing expenses tied contractually to partner agreements indexed to the Effective Federal Funds Rate (EFFR) [S1]. This creates an unusual dynamic—while these deposits are low-cost due to their mostly noninterest-bearing nature, associated expense volatility linked to EFFR movements affects net interest margin management. Additionally, borrowings via Federal Home Loan Bank advances offer flexible liquidity backstops to manage cyclical deposit fluctuations or fund loan demand at potentially favorable spreads.

Liquidity policy appears conservative yet agile; pledged collateral including debt securities supports borrowing capacity upwards of $1 billion [S1]. Such an arrangement affords some insulation from abrupt shifts in depositor behavior or market stress events but remains dependent on continued partner relationship stability.

Navigating Competitive Moats: Partner Networks and Barriers to Entry

Pathward’s moat is primarily grounded in entrenched prepaid card program manager partnerships that generate significant deposit volumes alongside recurring fee-based revenues [valye_report_excerpt]. These relationships are not easily replicable due to contractual complexities, trust requirements, and the integrated nature of service delivery.

The regulatory framework surrounding its banking charter further reinforces barriers against new entrants. Obtaining such charters entails rigorous oversight related to capital adequacy, compliance monitoring, cybersecurity standards, privacy protections, and audit trail mandates—thresholds that deter smaller fintech players lacking scale or institutional experience.

However, the broader financial services industry landscape remains highly competitive. Established large banks increasingly encroach on prepaid space through direct partnerships or proprietary offerings; fintech disruptors continue innovating payment solutions; meanwhile regulatory authorities impose stricter supervision—limiting dramatic moat expansion. Thus Pathward's defensive advantages require vigilant ongoing investment in partnership maintenance and regulatory adherence.

How Pathward balances sustaining these moats against competitive pressures while fostering organic growth constitutes a central strategic challenge going forward.

Risk Realities: Credit, Compliance, and Operational Challenges

Inherent risks defined within Pathward’s disclosures emphasize credit losses as paramount given exposure in lending sectors sensitive to economic cycles [valye_report_excerpt][S1][S2]. Although diversified by stream—including government-backed loans mitigating default likelihood—the allowance for credit losses must anticipate deteriorations prudently.

Material weaknesses identified in internal controls introduce operational risk complications that could impair accurate financial reporting or fraud detection frameworks [valye_report_excerpt]. Fraud exposure extends beyond internal lapses to settlement risk within payments networks—an endemic hazard requiring continual mitigation strategies.

Regulatory compliance presents an omnipresent challenge; evolving data protection laws (e.g., privacy statutes), anti-money laundering standards, cybersecurity mandates, and audit rigor amplify organizational complexity [valye_report_excerpt][S1][S2]. The company reports no change in risk factors per its latest quarterly filing but underscores persistent vigilance necessities [S2].

These combined dimensions highlight that while management navigates strong earnings trends today, latent risks could create disruptions if not proactively managed.

Recent Financial Performance in Depth: Earnings Beats and Margin Analysis

Pathward delivered Q1 2026 results exceeding analyst expectations marked by top-line revenue near $173 million and net income surpassing $35 million [F1][N4]. Revenue strength was attributable largely to organic deposit expansion from prepaid programs fueling increased fee income as well as net interest margin accretion driven by loan portfolio performance [N3][N5]. Operating margins showed improvement reflecting scalable infrastructure alongside disciplined expense control despite investment in compliance functions.

The earnings call highlighted management confidence around sustaining growth trajectories citing active onboarding within prepaid segments and favorable credit trends within commercial finance units [N3]. This momentum signals effective leverage of core strategic initiatives pairing payments-related deposits with diversified lending offerings.

Yet underlying complexities around deposit expense volatility linked to contract indices presented margin uncertainty scenarios discussed during calls underscoring cautious forward guidance.

Strategic Growth Prospects and Organic Expansion Ambitions

Management articulates priorities centered on organic growth fueled by broadening product penetration within existing partnered prepaid platforms alongside incremental buildout of financing verticals leveraging bank charter advantages [valye_report_excerpt][S1]. New customer acquisition efforts combine digital onboarding innovations aligned with compliance protocols designed to scale volume efficiently without compromising control frameworks.

The potential introduction of complementary financial products could deepen revenue streams but carries execution risks particularly given heightened regulatory scrutiny and operational sophistication demanded [valye_report_excerpt]. Furthermore, dependence on a concentrated base of key program managers suggests concentrated counterparty risk impacting growth continuity if partnerships falter unexpectedly.

Successful navigation will require calibrated investments balancing innovation speed against embedded systemic controls—critical for translating growth ambitions into sustainable financial returns.

The Regulatory Landscape and Its Impact on Pathward’s Trajectory

Operating under a full banking charter subjects Pathward Financial to comprehensive oversight spanning capital requirements, consumer protection mandates, cybersecurity protocols, data privacy laws such as GLBA or CCPA analogs—and audit rigor designed to mitigate fraud or systemic risk exposures [valye_report_excerpt][S1][S2]. This regulatory environment doubles as both shield and constraint—the bank charter deters competition enabling foundational moat support but also imposes substantial compliance costs stretching administrative resources.

Additionally, evolving legislation regarding payments systems settlement finality rules or anti-financial crime regulations necessitates continual adaptation impacting product design timelines as well as technology infrastructure investments. Management's disclosure about existing internal control issues amplifies attention on remediating gaps essential for regulatory satisfaction.

Strategically understanding these dynamics underlines why regulatory positioning forms both protective moat dimension yet requires high organizational discipline partaking significantly in Pathward’s operating equation.

Valuation Considerations: What Market Bets Suggest About Future Potential

Recent market activity—highlighted by multi-million-dollar options positions betting on upward price moves alongside sustained volume spikes—indicates pronounced buy-side conviction about Pathward’s near-term potential [N9][N1]. Price multiples embed expectations for continued double-digit earnings growth supported by secular trends favoring digital payment adoption combined with specialized lending opportunities inherent in government-backed channels.

However valuation must be tempered through prism acknowledging persistent credit risks highlighted by loss allowance sensitivity; operational vulnerability signaled via disclosed internal control weaknesses; plus heavy dependence on few strategic partners whose business continuity remains critical for deposit stability. Thus intrinsic value drivers intertwine with scenario-dependent risks that may compress margins or increase cost structures disproportionately should adverse developments arise.

Investors face balancing optimistic future cash flow profiles against embedded structural sensitivities accentuating due diligence scope needed when interpreting share performance beyond technical signals alone.

This analysis synthesizes publicly available information up to February 2026 concerning Pathward Financial’s business strategy, market positioning, financial results, risk profile, and valuation context without extending investment recommendations. Readers should consider this report informational rather than prescriptive. Continued monitoring of company disclosures alongside evolving macroeconomic conditions remains advisable for any stakeholders evaluating Pathward Financial’s trajectory.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments