How Mitek Systems Builds a Resilient Moat with AI-Driven Biometrics and Strategic Growth

Mitek Systems leverages its advanced AI, biometrics, and acquisition strategy to address evolving digital identity threats at scale.

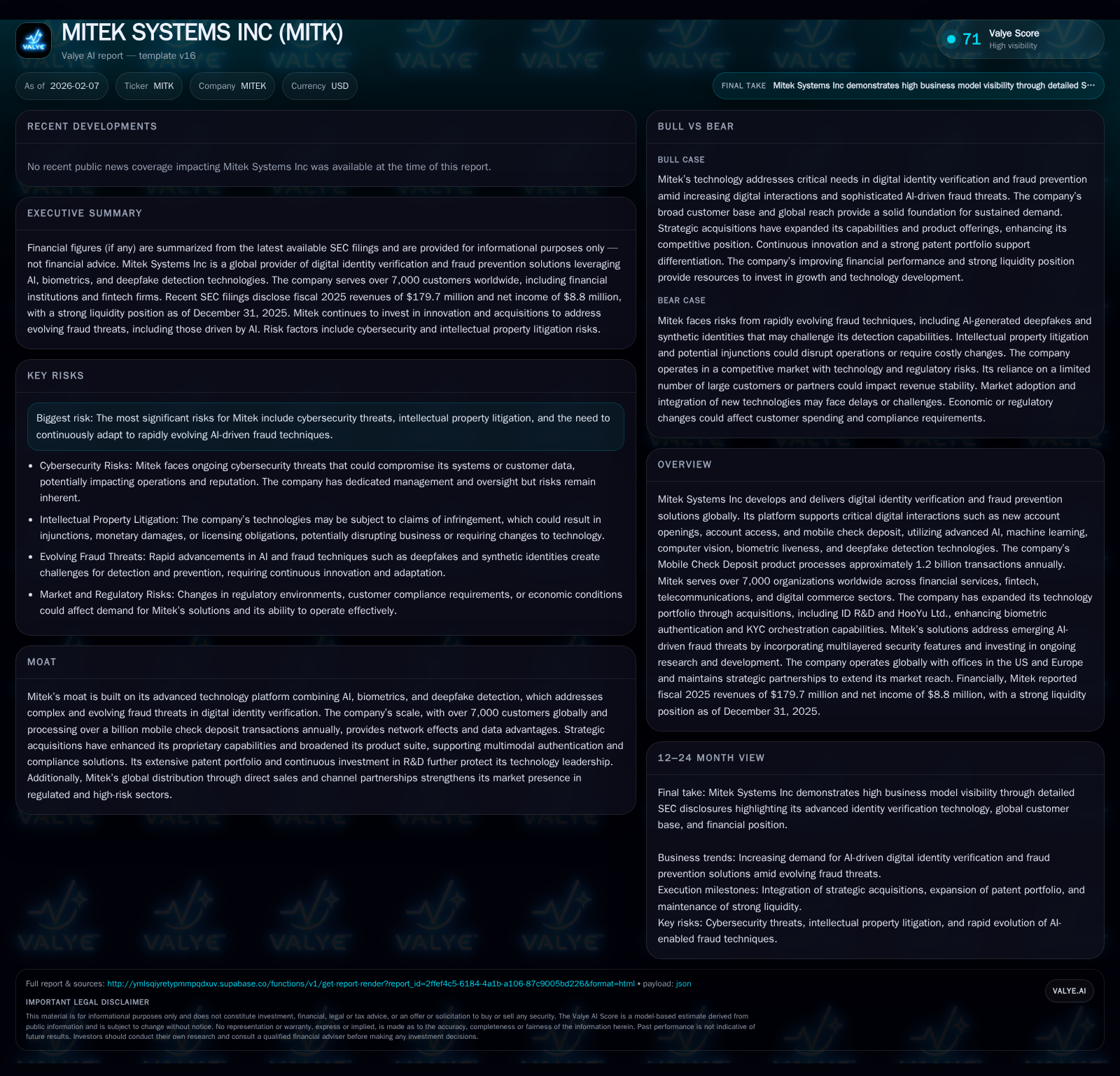

Amid escalating digital fraud challenges, Mitek Systems stands out by integrating sophisticated AI, machine learning, biometric liveness, and deepfake detection into a comprehensive platform that processes over one billion mobile check deposits annually. The company’s global reach extends across more than 7,000 customers spanning financial services, fintech, telecommunications, and digital commerce sectors. Strategic acquisitions such as ID R&D and HooYu Ltd. have broadened its authentication and KYC orchestration capabilities, fortifying its competitive moat alongside a robust patent portfolio. While the cybersecurity landscape and intellectual property risks pose material concerns, Mitek’s governance structures and continuous R&D investment underpin its resilient position in an intensely dynamic industry.

Mitek’s Technological Edge: Building a Fortress with AI and Biometrics

In today’s digital economy where fraud techniques evolve relentlessly—especially those empowered by artificial intelligence—Mitek Systems has positioned itself as a pioneer in identity verification technology. Its core platform weaves together deep learning algorithms, biometric authentication including facial recognition enhanced by liveness detection protocols, and cutting-edge deepfake detection. This multilayered approach is not simply defensive architecture but an adaptive fortress which continuously hardens as new fraud patterns emerge.

Central to Mitek’s technological prowess is its Mobile Check Deposit product which annually processes around 1.2 billion transactions worldwide [valye_report_excerpt]. Handling this volume endows Mitek with invaluable real-time data that powers iterative model training cycles, sharpening the precision of fraud detection and legitimate user experience alike. The company actively invests in R&D to evolve these capabilities further, fortifying its moat against increasingly complex AI-driven attacks [N3].

A Deep Dive into Mitek’s Business Model and Scale

Mitek’s business model capitalizes on vast transaction volumes coupled with deep integration across industries where heightened identity assurance is critical. Over 7,000 clients globally incorporate Mitek's solutions into workflows supporting new account openings, secure account access management, mobile deposits, and broader digital commerce interactions [valye_report_excerpt]. This diverse customer base includes institutions from traditional banking to cutting-edge fintechs as well as telecom providers.

This breadth creates powerful network effects. As more entities transact via Mitek's ecosystem, the platform accrues expansive datasets that enhance verification algorithms' effectiveness — crucial for staying ahead of fraudulent actors exploiting novel vulnerabilities. Scale also enables attractive pricing models anchored on volume usage while supporting continuous improvements that smaller competitors struggle to replicate [F1].

Strategic Acquisitions: Amplifying Capabilities and Market Reach

Mitek’s acquisition strategy demonstrates deliberate expansion beyond standalone identity verification into holistic customer identity orchestration. The purchase of ID R&D brought advanced biometric capabilities such as voice recognition and behavioral biometrics directly into its suite [N1]. Similarly, acquiring HooYu Ltd., a UK-based provider specializing in KYC orchestration workflows—and connected identity verification services—bolstered Mitek’s reach into regulatory compliance verticals [N4].

These integrations enable clients to deploy multimodal authentication flows tailored to their risk tolerances and compliance demands without juggling disparate vendors. Earnings call insights highlight effective operational merging of these technologies under a unified platform umbrella that enhances upsell opportunities while maintaining technical leadership [N1][N4].

Financial Snapshot: Solid Growth Fueled by Innovation

Financially, Mitek enters calendar year 2026 demonstrating resilience alongside innovation-led growth vectors. Recent quarterly results reported revenue modestly exceeding expectations while net income remained positive at approximately $2.77 million for the fiscal quarter ending December 2025 [F1][N2][N3]. This upward trajectory is complemented by a strong liquidity position—with cash on hand near $175 million—providing ample runway to fund continued R&D initiatives without compromising operational flexibility.

Such fiscal health allows the company to strategically invest in product development cycles addressing emerging AI fraud phenomena while sustaining global sales efforts [N3]. The current ratio standing at roughly 1.18 reflects solid short-term balance sheet management amid ongoing technology investments [F1].

Navigating Cybersecurity and Intellectual Property Risks

No techno-security leader is immune to risks inherent with protecting sensitive client credentials from targeted cyberattacks or managing intellectual property exposure given industry fragmentation. Mitek acknowledges these challenges explicitly within its governance framework: the Board receives routine updates on cybersecurity postures while senior management—including an experienced VP of Technology Operations—oversees rigorous defense architectures incorporating external audits and third-party consultants [S1].

Legal proceedings related to IP claims are monitored closely with contingency planning designed to mitigate disruptions ranging from injunctions to royalty negotiations—a vital precaution as patent portfolios intersect fierce rivalries within the identity verification landscape [S1]. Quarterly reports confirm ongoing vigilance though no material changes in risk profiles recently [S2], reflecting mature risk management commensurate with industry standards.

Market Sentiment and Analyst Outlook: The Road Ahead

Investor discourse reveals a cautiously optimistic environment around MITK stock performance. Technical analysis notes recent bullish patterns such as a golden cross indicator signaling potential momentum gains [N8]. Meanwhile, value investors debate underlying valuation metrics vis-à-vis reported fundamentals highlighting dips during previous years yet recent earnings beats offer renewed confidence [N5][N6].

Wall Street analyst consensus suggests upside potential of approximately 30%, driven mainly by accelerating adoption curves for advanced biometrics authentication broadly applicable amid rising regulatory demands worldwide [N7]. However, volatility associated with evolving AI threat landscapes tempers exuberance introducing execution risks tied to continued innovation pace.

R&D and Patent Strategies: Sustaining Competitive Advantage

At the heart of Mitek’s moat lies relentless innovation amplified through an extensive patent portfolio encompassing techniques from image forensics to biometric liveness algorithms [valye_report_excerpt][S1]. These intellectual property assets not only barricade direct competition but also permit premium product positioning supported by proprietary methods difficult to replicate rapidly.

The company openly communicates forward-looking initiatives focused on countering emerging AI-generated fraud modalities such as synthetic identities or deepfake attacks using layered detection frameworks built upon decades of specialized pattern recognition expertise [valye_report_excerpt]. This ongoing pipeline investment ensures customers receive state-of-the-art safeguards aligned with shifting threat vectors.

Global Footprint and Operational Infrastructure

Mitek operates from its headquarters in San Diego augmented by satellite offices across major financial centers including Paris, Amsterdam, New York City, Barcelona, Leeds, and London [S1]. This geographically distributed presence facilitates close proximity engagement with regulated clients subject to differing jurisdictional compliance requirements.

Physical infrastructure coupled with dedicated regional teams enhances responsiveness in onboarding new customers while scaling support capacity—a critical factor given high stakes associated with identity verification failures. Such operational breadth reflects strategic foresight ensuring service reliability throughout geographic expansions.

Investor Considerations: Balancing Risk & Reward

For stakeholders assessing Mitek Systems’ investment profile absent explicit recommendations, there is clear alignment between technology leadership proven by scale and innovation velocity juxtaposed against persistent cybersecurity exposures plus intellectual property litigation possibilities [valye_report_excerpt][S2][N5].

The company presents a fundamentally sound balance sheet that funds growth without excessive leverage while governance mechanisms mitigate downside risks rationally rather than reactively. Nonetheless, rapid shifts in fraud methodologies driven by generative AI innovations demand constant vigilance from management to maintain differentiation over agile competitors.

Evaluations benefit from contextualizing financial stability alongside qualitative factors such as patent strength, global client entrenchment across sensitive sectors, integration success from acquisitions enriching product breadth, and transparent risk disclosures. This blend portrays Mitek not just as a vendor but as an indispensable partner in securing trusted digital interactions now critical worldwide.

This analysis was compiled using publicly available information including company filings (SEC Forms 10-K & 10-Q), earnings call transcripts, recent market articles on Nasdaq.com dated up to February 2026, alongside Valye News proprietary research summaries dated February 7th, 2026. It does not constitute investment advice or endorsement of any securities.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments