Rithm Acquisition Corp.: Navigating SPAC Challenges Amid Regulatory Hurdles and Market Evolution

Rithm Acquisition Corp. faces a critical juncture as it grapples with NYSE noncompliance amidst its ongoing quest for a viable business combination.

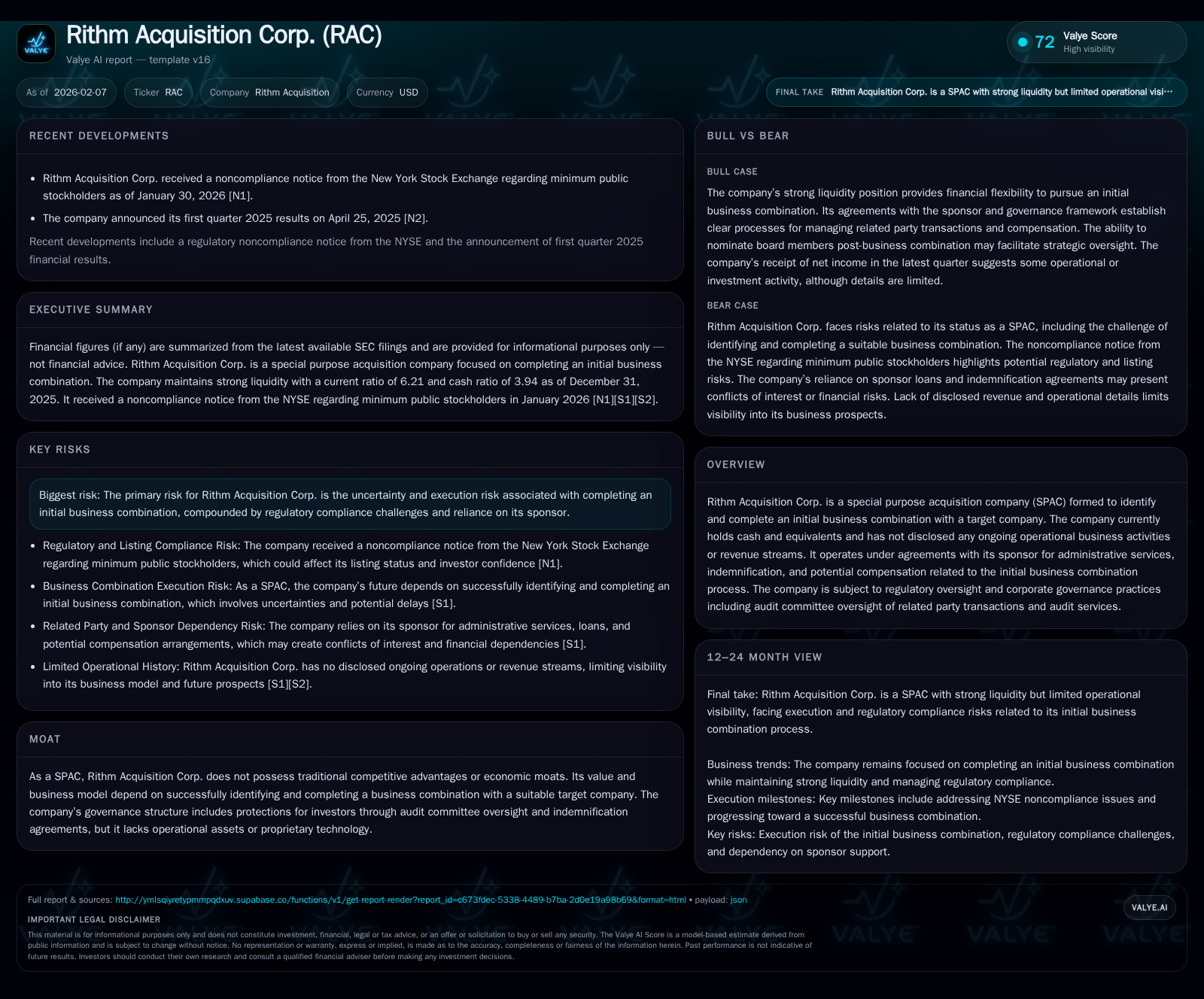

Rithm Acquisition Corp. (RAC), a special purpose acquisition company (SPAC), finds itself at an inflection point marked by an NYSE noncompliance notice concerning minimum public stockholders. Despite holding a strong liquidity position and steady governance oversight, RAC’s value proposition remains tethered to successfully completing an initial business combination—a process fraught with execution and regulatory risks. The company’s reliance on its sponsor for administrative services and indemnifications adds layers of governance complexity, while broader SPAC market dynamics underscore the pressures confronting RAC's path forward.

The Elusive Quest: RAC’s Search for a Suitable Business Combination

Rithm Acquisition Corp. began life as a traditional blank-check vehicle with the singular goal of consummating an initial business combination. Unlike operating companies, RAC possesses no core business nor revenue-generating assets; it simply holds funds raised through its initial public offering, earmarked exclusively for an acquisition or merger target [valye_report_excerpt]. Notably, company officers and directors hold fiduciary or contractual allegiances that may at times supersede their duties to RAC itself—an important structural limitation highlighting potential conflicts when identifying suitable targets [S1]. This underscores RAC’s dependency on navigating these interwoven obligations carefully to secure a transaction aligned with shareholder interests.

As of now, RAC has not publicly disclosed ongoing operational activities beyond the search process itself. This absence reflects the standard SPAC lifecycle where operational momentum hinges entirely on deal origination success. Without profitable operations or proprietary assets, RAC’s valuation remains essentially a function of perceived merger prospects.

Governance and Sponsor Dynamics: Navigating Fiduciary Duties and Indemnifications

Governance at RAC closely revolves around its sponsor relationship. The sponsor provides essential administrative support encapsulated in a fixed monthly fee of $20,000 covering office space and other services located at 799 Broadway in New York [S1]. While this fee remains steady until merger completion or liquidation, additional reimbursable expenses incurred by the sponsor related to deal sourcing or due diligence lack any spending caps but are subject to quarterly audit committee reviews.

Further complicating dynamics are indemnification agreements wherein RAC agrees to shield its sponsor and affiliates—including Rithm entities—from liabilities connected to IPO activities or operational conduct [S1]. These protections preclude sponsors from drawing against trust account funds in indemnification contexts, erecting barriers that may insulate sponsors even if shareholder claims emerge post-merger discussions.

Moreover, there's scope for finder’s fees or consulting compensation tied explicitly to the identification and consummation of the eventual target business [S1]. Such arrangements introduce potential agency conflicts between sponsor incentives and shareholder interests—a nuanced risk that merits scrutiny given the tight interdependence shaping RAC’s operational structure.

Regulatory Under Scrutiny: Implications of the NYSE Noncompliance Notice

On January 30, 2026, Rithm Acquisition Corp. received a noncompliance notice from the New York Stock Exchange regarding failure to meet minimum thresholds for public stockholders [N1]. This event signals a critical regulatory inflection tying directly into listing standards aimed at safeguarding market liquidity and broad investor participation.

The notice introduces procedural challenges for RAC’s share liquidity profile. Lack of adequate public float not only threatens continued listing status but pressures management timelines for remedying deficiencies either through stockholder base expansion or accelerated transaction execution. The enforcement environment surrounding SPACs has grown increasingly rigorous post-peak issuance cycles, underscoring how regulatory compliance is now both prerequisite and pressure point [valye_report_excerpt].

Investor confidence often hinges on such compliance milestones; continual nonconformance risks reputational dilution that could impair capital formation efforts or merger negotiations downstream.

Financial Snapshot: Cash Position, Expenses, and Performance Signals in Absence of Operating Revenue

Financial disclosures highlight RAC’s characteristically unique balance sheet profile reflective of pure-play SPAC traits [F1]. As of December 31, 2025, cash and cash equivalents totaled approximately $401K—a modest sum in absolute terms but sufficient relative to the company’s minimal liabilities.

Current assets stand at $633K against current liabilities near $102K yielding an exceptionally strong current ratio estimated at 6.21—indicative of robust near-term liquidity buffers atypical for most operating entities but standard among SPACs focused solely on transactional pursuits.

Interestingly, RAC reported net income of roughly $2.18 million over this period [F1], likely driven by non-operating items such as interest income or other gains rather than operational profit streams absent any active business units. This financial posture underscores the company's storage-of-liquidity model pending successful capital deployment via merger.

Risk Landscape: Execution and Regulatory Risks Confronting RAC

Central among RAC's hurdles is the existential risk inherent in failing to identify and close an initial business combination within prescribed regulatory timeframes [valye_report_excerpt][S1]. Execution uncertainty extends beyond typical deal risk; it encompasses challenges related to competitive tension among investors, sponsor alignment complexities, fiduciary constraints on officers/directors due to other obligations, and market receptivity shifts.

Regulatory burdens compound these difficulties—manifest in stringent NYSE requirements recently spotlighted by the noncompliance notice—and evolving SEC oversight paradigms targeting transparency and investor protections for SPAC structures.

The dependence on sponsors compounds governance risk since they uniquely control significant administrative functions and funding avenues such as loans that can be extended pre-transaction yet must be repaid from trust proceeds upon consummation [S1]. Any misalignment here could distort incentive profiles during critical phases of deal negotiation.

The aggregate risk picture thus blends legal-compliance dimensions with transaction execution uncertainty—heightened by marketplace skepticism stemming from renewed scrutiny following years of SPAC market volatility.

SPAC Market Context: How RAC Fits Into Broader Industry Trends

While not explicitly chronicled in filings or news citations regarding RAC specifically, analysis must acknowledge broader industry realities shaping SPAC trajectories today [N1][valye_report_excerpt]. The SPAC boom of recent years has markedly tempered amid rising regulatory clampdowns, tightened disclosure mandates, and heightened investor wariness due to spotty post-deal performance across some cohorts.

In this environment characterized by declining new issuances and longer timelines for transaction closure relative to prior cycles, vehicles like RAC face amplified pressures—both from financial market expectations demanding clear value creation paths and regulators tightening listing compliance thresholds. These factors collectively raise entry barriers that dilute once-easy funding paths prevalent during frothier markets.

RAC's struggle to maintain minimum public stockholder levels echoes sector-wide phenomena where shareholder dispersion issues complicate capital markets access—reinforcing the necessity for sharp strategic navigation in closing deals expeditiously.

Potential Pathways Forward: Scenarios for Business Combination or Liquidation

Looking ahead, RAC confronts bifurcated scenarios hinged largely on whether it can surmount execution challenges before regulatory deadlines loom.

A successful initial business combination will unlock access to trust funds designated for transaction consummation costs while transitioning RAC toward operational status symbolized by revenue generation prospects indirectly implied yet undefined currently [S1][valye_report_excerpt]. Such outcome would validate governance mechanisms in place while potentially recalibrating sponsor relationships toward active enterprise stewardship rather than passive service provision.

Conversely, failure to conclude a qualifying merger within stipulated timeframes—or inability to resolve NYSE listing deficiencies—likely condemns RAC toward liquidation under customary SPAC dissolution protocols. This outcome would trigger return of remaining trust balances minus permitted expenses back to shareholders but effectively terminate sponsor involvement aside from residual indemnity obligations [S1][N1].

Each pathway carries distinct implications regarding shareholder value realization timelines as well as reputational ramifications within an industry segment striving for rehabilitation after notable attrition over recent years.

Disclaimer: This report is intended solely for informational purposes and does not constitute investment advice or recommendations regarding securities mentioned herein. All information is derived from publicly available sources including SEC filings and news releases as cited. Readers should conduct their own due diligence before making any financial decisions related to Rithm Acquisition Corp. or similar entities.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments