Atlassian Corp: Steering Cloud and AI Innovation Through Intense Competitive Currents

Atlassian’s recent earnings beat highlights growth resilience amid subscription headwinds and ambitious AI investments.

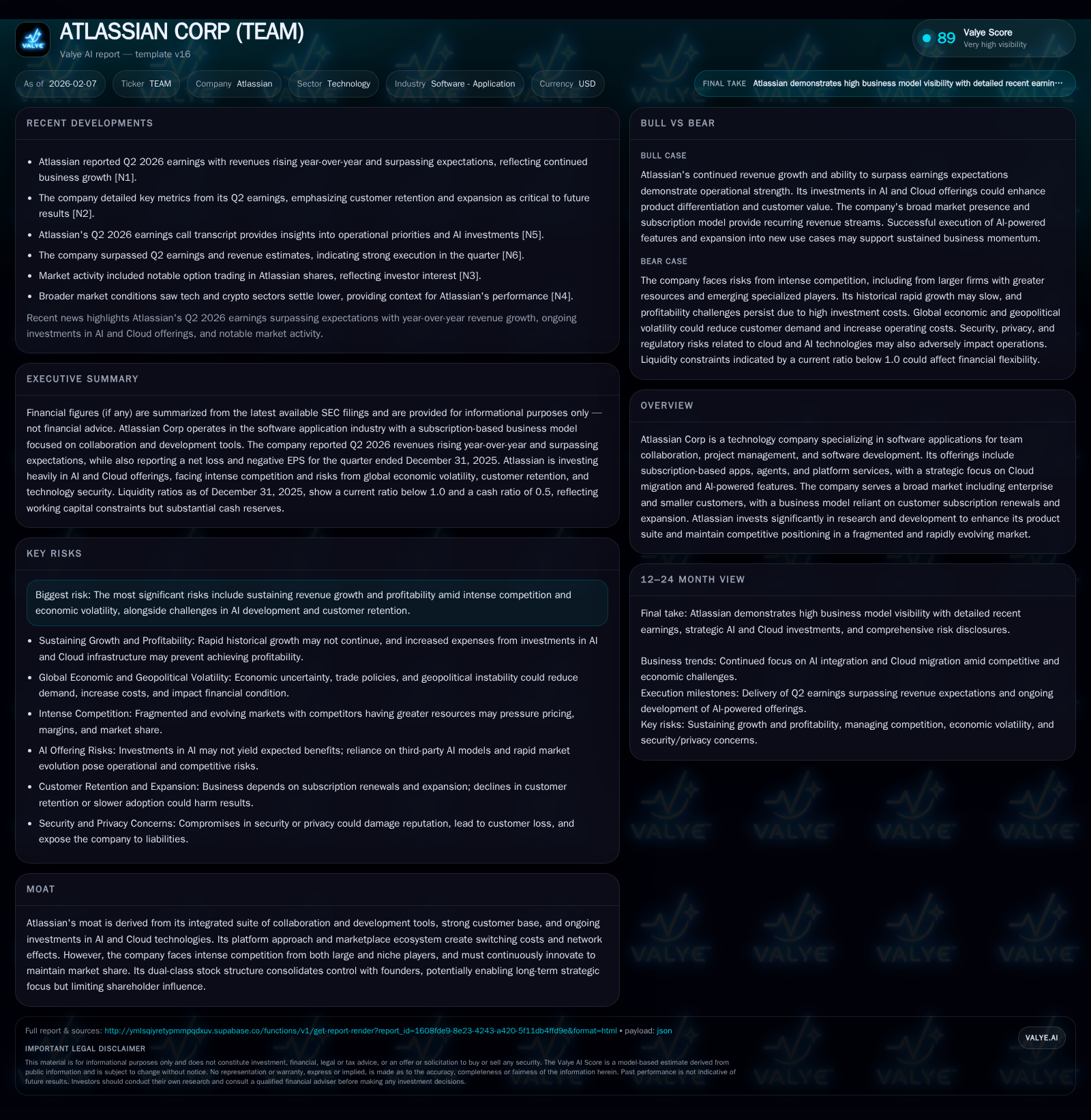

Atlassian Corp (TEAM) posted a robust Q2 2026 earnings beat, underscoring ongoing revenue growth driven by its expanding cloud and collaboration product suite. Yet beneath the surface, subscription renewals show strain, and the costs of accelerating AI innovation are pressuring profitability. The company’s strategic pivot toward cloud offerings remains essential but fraught with execution risk. Competing against both tech giants and specialized rivals, Atlassian must balance its substantial cash reserves with the need for continued R&D to safeguard its moat and sustain long-term growth.

Robust Q2 Results: Beyond the Numbers

What does Atlassian's latest earnings beat really tell us? On February 5-6, 2026, the company reported Q2 results that exceeded analyst expectations on revenue growth with total revenues comfortably rising year-over-year [N1][N4][F1]. This topline momentum reflects sustained demand for Atlassian’s collaborative and developer-centric applications which remain central to organizational workflows. However, this upbeat headline masks an underlying profit tension — net losses persist, largely driven by elevated investment spending and margin compression amidst strategic shifts [F1]. The company’s ability to grow while grappling with negative income underscores how execution on transformation fronts will shape its near-term financial health.

Subscription Dynamics: The Backbone and the Bottleneck

Subscription renewals and expansion underpin Atlassian's business model; these recurring revenues fuel both stability and growth. Nonetheless, recent data hint at emerging tension: renewal rates have softened somewhat relative to historical highs, with organic expansion becoming less certain [S2][N2][N6]. As smaller customers weather economic volatility and larger enterprises reassess IT spend priorities, retaining these subscribers takes on heightened importance. The high-volume transactional nature of low-touch customer segments implies that even modest attrition rates can disproportionately impact aggregated growth trajectories. Hence, vigilance around subscription KPIs continues as a strategic imperative.

Cloud Migration: From Strategic Imperative to Execution Challenge

Helping customers transition from on-premise deployments to Atlassian's cloud platform is not merely tactical—it is existential for future competitiveness. The shift promises scalable delivery models, richer integrations, and improved user experience aligned with SaaS industry norms. Yet navigating this migration "orchestration" is complex—both technologically and operationally—which could slow anticipated adoption curves or introduce service disruptions discouraging renewals [S2][valye_report_excerpt]. Balancing speed with reliability requires deft ecosystem weaving between engineering teams and customer success functions. Failure to execute seamlessly could stall growth objectives tied to cloud-driven revenue streams.

Investing in AI: Promise Meets Competitive Reality

Atlassian’s significant R&D allocation into embedding AI-powered capabilities within its product suite reflects an ambition to differentiate in a crowded market via intelligent automation and enhanced productivity tools [valye_report_excerpt][S2]. This artificial intelligence pivot potentially extends the company's moat by creating sticky product features that improve workflow orchestration organically. However, AI development harbors inherent uncertainties—technological complexity, adoption hurdles, potential misalignment with user needs—that could dampen expected returns or delay time-to-market benefits. As such, these investments carry dual roles as both upside catalysts and execution hazards woven tightly into future outcomes.

Competitive Terrain: Giants and Niches Converging

Atlassian’s marketplace approach intertwines multiple offerings into a cohesive ecosystem generating network effects that heighten switching costs for customers [valye_report_excerpt]. This integrated orchestration differentiates it from stand-alone tools but also places it squarely against large-scale tech juggernauts like Microsoft or Google who compete across multiple collaboration vectors while nurturing aggressive innovation pipelines. Similarly, nimble niche players target specific gaps that could undercut Atlassian’s share if it falters in responsiveness or customization. Ultimately, sustaining leadership demands continuous evolution of platform capabilities coupled with keen competitive surveillance [S2].

Financial Health Snapshot: Balancing Growth with Profitability

Behind the growth story lies a delicate financial balancing act. Latest filings show Atlassian carrying robust liquidity reserves exceeding $1.15 billion in cash equivalents—a significant buffer enabling ongoing investment flexibility [F1]. However, current liabilities outstrip current assets resulting in a current ratio below 1 (0.89), signaling potential short-term liquidity strain that management must carefully monitor given operational requirements [F1]. Meanwhile, the persistent negative net income despite revenue advances highlights margin pressure likely stemming from elevated R&D spend related to AI initiatives and cloud transition efforts [F1][S2]. These contrasts illustrate a scenario where cash flow management is pivotal to maintaining runway without sacrificing innovation velocity.

Governance Dynamics: Founder Control and Long-Term Strategy

Atlassian’s governance structure centers control within its founders through dual-class shares—a common design in tech firms aiming to shield visionary strategy from transient shareholder pressures [valye_report_excerpt]. This facilitates bold long-term bets such as intensive R&D spending or transformational pivots like cloud migration without imperative for immediate profitability swings demanded by open markets. Yet this concentration risks limiting shareholder influence over risk oversight or executive compensation practices which could affect perceptions among institutional investors seeking accountability frameworks alongside growth ambitions. The governance dynamics thus play a subtle yet crucial role in shaping the company’s strategic journey.

Risk Radar: What Could Trip Up Atlassian?

The company faces an array of intertwined risks that could materially derail progress if not actively managed. Foremost are challenges sustaining steep revenue growth amid heightened global economic uncertainty that impairs enterprise IT budgets while impacting smaller customers differently [S2]. Cloud migration complexities present operational risks given dependency on successful customer onboarding onto newer architectures—missteps here jeopardize retention gains. Similarly, failure to translate AI investments into meaningful customer value could erode competitive positioning especially as rivals accelerate comparable initiatives [S2]. Other concerns range from potential security breaches affecting product trustworthiness to scaling sales strategies efficiently amid evolving market conditions. This risk mosaic demands integrated mitigation across corporate functions.

Outlook and Market Sentiment ahead of Next Earnings

Investor sentiment entering upcoming earnings cycles exhibits cautious engagement colored by broader tech sector rotations and notable option market activity signaling hedging or speculative positioning around TEAM shares [N7][N8][N9][N12][N13][N14]. Analyst forecasts have adjusted metrics slightly downward reflecting subscription retention uncertainties but still anticipate steady top-line progression anchored by cloud upsell potential [N5][N6]. As market participants watch closely how Atlassian maneuvers through these operational narratives combined with macroeconomic headwinds—the upcoming earnings reports will be critical inflection points influencing medium-term momentum.

Final Thoughts: Sustaining the Moat in a Fragmented Market

In the multi-threaded software collaboration landscape—marked by diverse customer demands and escalating innovation pace—Atlassian’s integrated platform approach remains a cornerstone of its competitive defense [valye_report_excerpt][S2]. Maintaining this moat will depend on amplifying unique network effects inherent in its expansive product ecosystem while continuously innovating through AI enhancements aligned tightly with user workflows. Simultaneously, ensuring subscription health amidst migration journeys coupled with adept financial stewardship amid investment-heavy phases comprises an intricate orchestration challenge for leadership. Success will hinge on blending strategic vision with disciplined execution as competitive pressures mount steadily.

This analysis is provided solely for informational purposes based on publicly available data as of early February 2026. It does not constitute investment advice or recommendations.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments