Southern Missouri Bancorp’s Strength in Physical Assets and Cybersecurity Leadership Amid Regional Banking Challenges

Southern Missouri Bancorp leverages its owned branch network and advanced cybersecurity governance to navigate regulatory and credit risks in a regional banking environment.

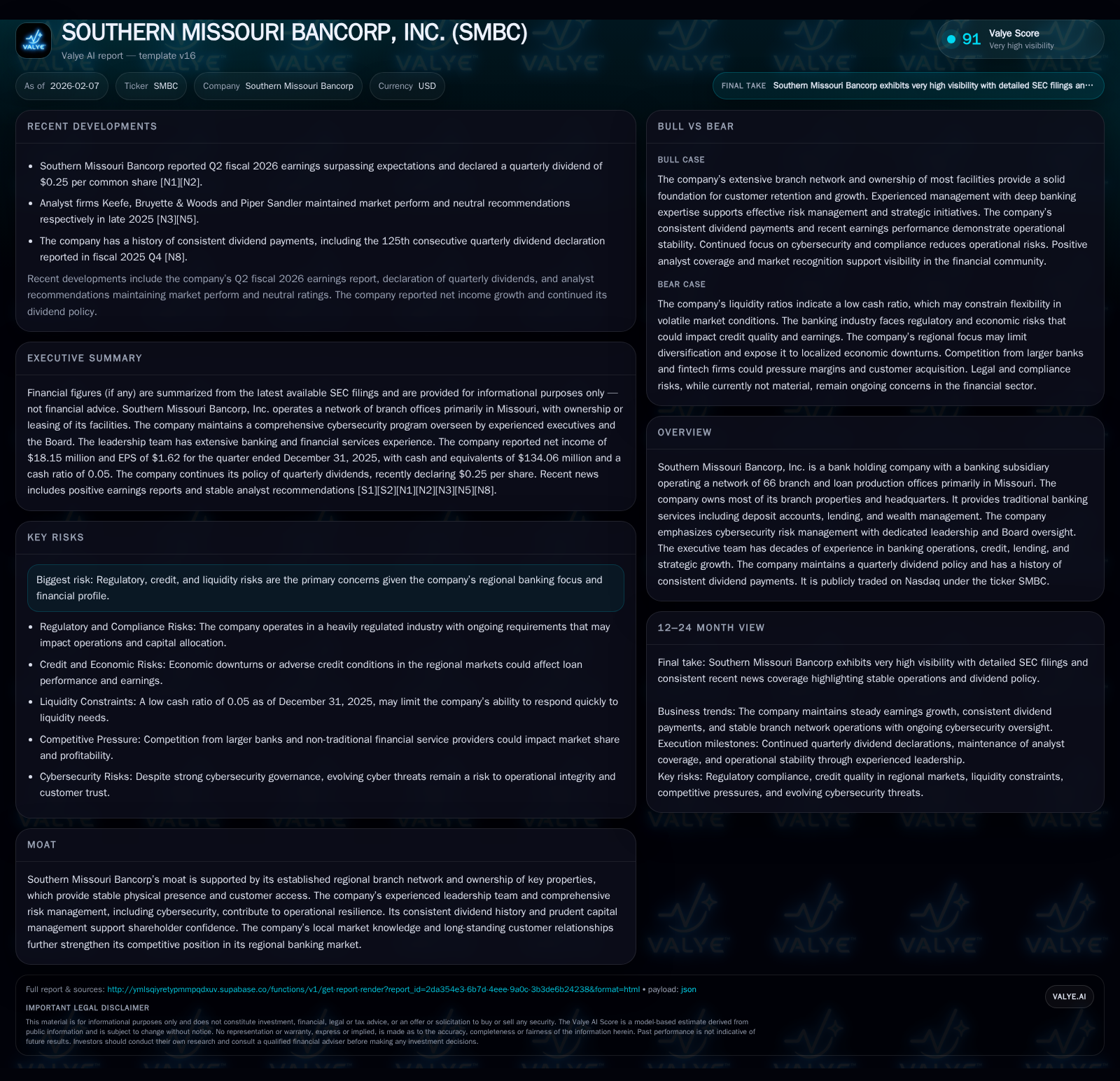

Southern Missouri Bancorp, Inc., operating primarily in Missouri with a network of 66 branches, distinguishes itself by owning the overwhelming majority of its physical facilities, anchoring stable customer relationships and local presence. Leadership with decades-long industry experience guides strategic growth while an experienced Information Security Officer and board-level oversight elevate cybersecurity risk management as a firm competitive edge. Financially, SMBC maintains resilience marked by solid net income and consistent quarterly dividends, though it remains vigilant of regulatory, credit, and liquidity headwinds inherent to its regional banking focus. The recent Q2 fiscal 2026 earnings beat underscores effective execution underlying cautious optimism about future growth opportunities.

A Robust Physical Footprint: Branch Ownership and Regional Presence

Southern Missouri Bancorp (SMBC) operates a well-established network of 66 branches primarily located throughout Missouri. Notably, SMBC owns the real estate for 59 of these locations as well as its corporate headquarters — a significant foundation for its competitive moat. This ownership model offers tangible benefits: stable cost structures free from unpredictable lease expenses, enhanced customer familiarity with longstanding physical locations, and direct control over facility upgrades or expansions according to strategic needs. The company believes its current facilities sufficiently support present operations but commits to ongoing evaluation aligned with customer growth patterns [S1][valye_report_excerpt.moat].

This proprietary property approach contrasts favorably against many regional peers who rely more heavily on leased space or digital-only presence. By anchoring itself in physical communities across Missouri, SMBC fosters durable relationships reinforced by accessible service locations — key in an era where trust oscillates amid fluctuating economic conditions.

Experienced Leadership Steering Strategic Growth

Guiding SMBC is Chairman and CEO Greg Steffens, whose tenure spans since joining in 1998 initially as CFO before assuming top leadership roles starting in 1999. Mr. Steffens brings over 34 years of experience including prior supervision at Sho-Me Financial Corp and federal regulatory expertise as an examiner with the Office of Thrift Supervision. His deep institutional knowledge enhances financial stewardship and regulatory navigation capabilities [S1].

Alongside him is President Matthew T. Funke, appointed internal auditor upon joining the company in 2003 and now Chief Administrative Officer with over 25 years in banking and finance. Mr. Funke's background underpins strong operational controls and growth initiatives.

The extensive combined experience of this executive team anchors the bank’s strategic direction — balancing steady expansion with risk-aware management critical for regional operators facing economic volatility.

Cybersecurity as a Competitive Differentiator

Amid escalating cyber threats confronting the financial services sector, Southern Missouri Bancorp distinguishes itself through a comprehensive cybersecurity framework featuring leadership accountability at multiple levels [S1][valye_report_excerpt.moat]. The company’s Information Security Officer (ISO) oversees enterprise-wide cybersecurity strategy with over four decades of pertinent experience in financial services information security domains.

Significantly, the ISO reports directly to the IT Committee and the Board of Directors’ risk committees regularly provide updates on preventive controls alongside incident detection and remediation efforts. This governance structure ensures cybersecurity is not delegated to IT alone but integrated into overarching operational risk assessment — fostering resilience.

Such proactive risk mitigation supports customer trust essential for maintaining deposits and loan activity given today’s sophisticated threat environment. The focus on cyber risk contrasts with traditional metrics often highlighted by regional banks, positioning SMBC ahead regarding digital safety considerations [S1][valye_report_excerpt.risks].

Financial Health Indicators and Dividend Consistency

As of year-end December 31, 2025, Southern Missouri Bancorp reported net income totaling $18.15 million complemented by strong liquidity holding $134 million in cash and cash equivalents — indicators underpinning ongoing operational stability [F1].

Current liabilities were last reported at approximately $2.46 billion (as of March 31, 2021), consistent with normal banking balance sheet profiles recognizing deposits and other obligations [F1]. Importantly for shareholders, SMBC maintains a quarterly dividend policy evidenced by the recent declaration of $0.25 per common share for Q2 fiscal year 2026 which reflects consistent distributions supporting investor confidence [N2][valye_report_excerpt.overview].

This steady dividend track record stems from disciplined capital management paired with sound earnings generation—a delicate balance that remains pivotal amid tightening economic conditions affecting credit demand.

Navigating Regulatory, Credit, and Liquidity Risks

Operating primarily within Missouri’s regional banking landscape exposes SMBC to typical sector vulnerabilities such as regulatory compliance pressures, credit risk from local economic fluctuations, and liquidity constraints particularly in stressed market scenarios [valye_report_excerpt.risks][S1]. However,

the company has demonstrated proactive risk governance through transparent disclosures noting absence of any material outstanding legal proceedings that might threaten financial health—a notable indicator amidst frequent litigation environments intersecting banking operations.

Regulatory oversight further benefits from executive teams’ prior regulator experience ensuring responsiveness to evolving compliance requirements [S1]. Credit quality remains carefully monitored leveraging localized market insights enabling targeted loan origination while avoiding excessive concentration risks.

Collectively these measures mitigate some downside potential typical for peer institutions without compromising growth agility.

Quarterly Performance Beats Expectations: Insights from Q2 Fiscal 2026

On January 21, 2026, Southern Missouri Bancorp publicly released preliminary Q2 fiscal year 2026 results exceeding analyst estimates underscoring effective operational execution against broader sector headwinds [N1][N2]. Although specific line items were not detailed within available excerpts beyond overall net income affirmations,

the earnings beat signals sustained momentum validating management’s strategic pathways encompassing physical expansion moderation alongside cybersecurity vigilance.

Such positive quarterly outcomes contribute to reinforcing investor sentiment particularly important for regional banks navigating uncertain macroeconomic environments characterized by interest rate fluctuations and deposit behavior shifts.

Future Outlook: Expansion Plans and Market Positioning

Looking ahead SMBC balances cautious optimism with operational discipline concerning branch footprint dynamics [S1]. Management currently assesses existing facilities as adequate for immediate foreseeable needs but commits to vigilant monitoring driven by customer demand trends that may warrant incremental network augmentation.

This stance reveals deliberate capital allocation priorities—preserving resources for maintenance or technology investment rather than aggressive geographical expansions that could introduce unnecessary fixed costs or dilution of service quality.

Moreover, the combination of locally owned properties plus rich managerial acumen equips Southern Missouri Bancorp to adapt nimbly relative to competitors overly reliant on leased space or limited physical touchpoints [valye_report_excerpt.overview].

Synthesis: Why Southern Missouri Bancorp Stands Out among Regional Banks

Southern Missouri Bancorp encapsulates a distinctive blend of traditional regional bank strengths coupled with forward-looking risk management that affords it a differentiated posture within its marketplace:

- Ownership of nearly all branch properties mitigates occupancy cost fluctuations while cementing community roots crucial for long-term customer relationships.

- Veteran leadership expertise steers prudent strategic growth blending operational efficiency with compliance sensitivity.

- Advanced cybersecurity governance integrated at Board level preempts digital threats which pose increasing systemic risk punctuating modern banking sectors.

- Solid financial footing reflected in double-digit million-dollar net incomes alongside robust cash holdings fuels reliable dividend returns fortifying investor trust.

- Transparent risk disclosures coupled with absence of material litigation reflect sound institutional health leaving room for measured optimistic expansion should demand justify it.

Ultimately SMBC’s synthesis of tangible asset control augmented by intangible operational competencies delivers a multifaceted moat rarely matched fully by peers constrained either by rental dependencies or nascent cyber preparedness standards. As regional banks confront myriad pressures—from evolving regulations to digital disruptions—Southern Missouri Bancorp exemplifies how embedding resilience through both brick-and-mortar stewardship and cybersecurity sophistication constitutes an enduring strategy aligned with stakeholder value preservation amidst uncertainty.

This analysis is based solely on publicly available information including SEC filings dated September 11, 2025 (10-K), February 6, 2026 (10-Q), recent news releases as cited, and aggregated company facts data ending December 31, 2025. It does not constitute investment advice or recommendations.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments