Raymond James Financial Inc: Strategic Resilience in a Shifting Financial Landscape

A comprehensive analysis explores Raymond James Financial’s multi-segment model, innovation strategies, and risk navigation amid market volatility.

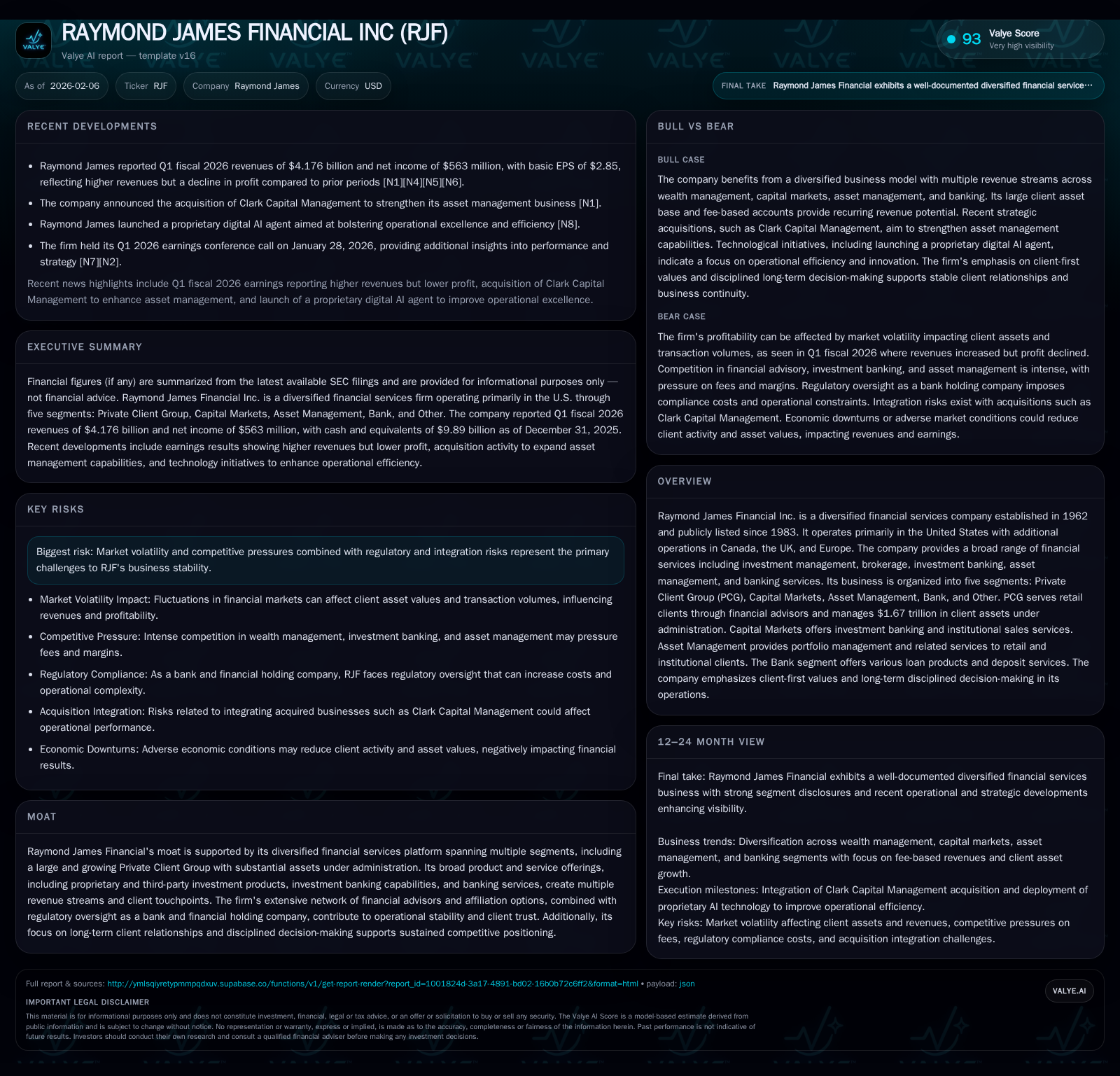

Raymond James Financial Inc. reported a robust Q1 2026 revenue beat driven by its diversified financial services platform despite notable investment banking softness. The Private Client Group remains the cornerstone of stability with $1.67 trillion in assets under administration, while recent strategic moves like acquiring Clark Capital Management and launching proprietary AI initiatives highlight a growth-oriented approach. Regulatory complexities and market fluctuations loom as challenges, but the firm's strong balance sheet and diversified moat underscore its operational resilience and long-term positioning.

Quarterly Results: Beyond the Surface of Q1 Earnings Success

Raymond James Financial (RJF) kicked off fiscal year 2026 on solid footing, reporting quarterly revenues of approximately $4.18 billion—a figure that surpassed consensus estimates and reflects steady momentum across its diversified financial services offerings [N1][N3][N4][F1]. Yet beneath this topline strength lies a nuanced story: while the firm benefited from increased client engagement and asset retention, profitability was constrained by softness within its investment banking operations [N13]. This divergence between revenue growth and profit pressures underscores the complex dynamics at play in RJF’s capital markets arm.

Investment banking revenue headwinds—attributed to broader sector headwinds including reduced deal flow—tempered overall earnings results despite strong trading and advisory fee contributions [N7][N13]. This quarter's earnings transcript reveals management’s cautious tone on near-term IB prospects but highlights confidence rooted in core recurring revenues [N2]. Thus, while headline numbers commend RJF’s adaptability, they also prompt a deeper dive into segment-level performance drivers.

Takeaway: RJF’s Q1 results demonstrate robust topline growth buoyed by stable client assets yet underscore underlying capital markets volatility impacting profit margins.

Private Client Group: The Bedrock of AUA-Driven Stability

The Private Client Group (PCG) segment remains indisputably central to Raymond James’ business architecture. As of late 2025, PCG managed $1.67 trillion in assets under administration (AUA), with fee-based accounts constituting over $1 trillion—a signifier of recurring revenue quality that cushions earnings against episodic market swings [S1][F1]. PCG’s vast network of nearly 9,000 financial advisors serves as both a distribution engine and a strategic differentiator, leveraging AdvisorChoice® affiliation options spanning employees, independent contractors, and third-party RIAs.

Notably, RJF emphasizes a fee-based account growth strategy which enhances recurring revenue predictability while curbing reliance on transactional commissions [S1]. This shift aligns with broader industry trends toward advisory models favoring long-term alignment over sales-driven incentives. Moreover, the AdviserChoice® platform allows flexible affiliation modes facilitating talent retention and new advisor recruitment—an important competitive lever amid evolving advisor demographics.

Takeaway: PCG’s expansive AUA base and diversified affiliation framework make it the backbone of sustainable revenue generation for Raymond James.

Capital Markets Segment: Navigating Investment Banking Headwinds

Raymond James’ capital markets segment encountered turbulence this quarter due to weakening investment banking fees. Factors contributing include overall subdued M&A activity, deal execution delays, and tightening regulatory constraints affecting deal flow—themes common across peer institutions during periods of macroeconomic uncertainty [N1][N7]. This cyclical softness presents near-term revenue volatility risks within one of RJF’s traditionally growth-oriented segments.

Management commentary suggests disciplined focus on cost control measures alongside selective pursuit of resilient advisory mandates [N2][S1]. Despite softness, trading volumes remained robust; however, underwriting fees declined year-over-year, pointing to a bifurcated picture within capital markets operations that will require vigilant strategy recalibration going forward.

Takeaway: Investment banking slowdowns depress Capital Markets profitability temporarily but are met with tactical cost management preserving segment viability.

Asset Management Expansion: The Clark Capital Acquisition and Its Implications

In a strategic leap to bolster its asset management footprint, RJF announced the acquisition of Clark Capital Management earlier this year [N10][N11][N14]. This move amplifies RJF’s portfolio management capabilities while diversifying product suites beyond traditional brokerage offerings. Clark Capital brings complementary institutional and wealth management expertise that is expected to generate synergies through cross-selling opportunities and scale efficiencies.

This acquisition aligns with RJF’s broader thematic push towards expanding steady-fee-based revenue sources beyond the fluctuating capital markets environment [S1]. The anticipated impact extends not just to top-line asset inflows but also to enhancing RJF’s appeal among institutional clients demanding specialized strategies—a growing segment amid evolving investor preferences.

Takeaway: The Clark Capital acquisition signifies a deliberate pivot towards scaling Asset Management as a durable driver for diversified earnings streams.

Digital Transformation at RJF: AI Innovations Fueling Operational Excellence

Raymond James is advancing its technological edge with the launch of a proprietary AI-powered digital agent intended to enhance operational workflows across client service touchpoints [N12][S1]. This innovation exemplifies how RJF seeks productivity gains via automation while maintaining personalized advisory support—a dichotomy critical in wealth management sectors.

The AI agent’s deployment addresses both front-office efficiency for advisors and back-office process streamlining. Expected benefits include faster client onboarding, improved data insights enabling tailored advice, and reduced operational bottlenecks. However, embedding such technology also requires ongoing cultural shifts among advisors accustomed to traditional methods.

Takeaway: RJF’s AI initiative enhances competitive positioning through tech-enabled operational excellence without compromising client engagement quality.

Regulatory and Reputation Risk: Safeguarding Trust in a Digital Age

Operating as both a bank holding company and a financial holding company places Raymond James under extensive regulatory scrutiny by entities such as the Federal Reserve [S1]. This environment mandates rigorous compliance frameworks encompassing securities regulations, banking laws, anti-money laundering statutes, and cybersecurity protocols.

Reputation stands paramount; any failure in treating clients fairly or safeguarding sensitive information could trigger material reputational damage with downstream financial consequences [S1]. Of particular concern is cybersecurity risk—RJF actively confronts daily hostile cyber activity including AI-enhanced phishing attempts targeting clients and staff alike. Failures here could magnify through rapid social media dissemination exacerbating fallout severity.

Management prioritizes investments in security infrastructure alongside ongoing employee training programs designed to identify evolving threats [S1]. Overall, balancing innovation adoption with vigilant compliance emerges as an ongoing challenge requiring sustained executive attention.

Takeaway: Regulatory complexity coupled with rising cybersecurity threats necessitates continued vigilance to protect RJF’s hard-earned client trust.

Financial Fortitude: Balance Sheet Strength and Liquidity Position

Raymond James’ financial statements reveal a sturdy liquidity profile marked by nearly $10 billion held in cash and cash equivalents as of year-end 2025 [F1], underpinning its capacity to absorb shocks or fund opportunistic deals. Net income exceeded $560 million for the quarter evidencing ongoing profitability despite sectoral headwinds [F1].

This strong cash position grants flexibility amid uncertain markets—allowing RJF to sustain client capital requirements reliably while supporting strategic acquisitions without undue leverage strain [S2]. Such balance sheet robustness is essential given volatile interest rate environments that can pressure net interest margins within banking operations.

Takeaway: RJF’s ample liquidity fortifies its ability to manage risk proactively while investing for growth without overextending balance sheet leverage.

The Multi-Segment Moat: Diversification as Competitive Defense

At the heart of Raymond James’ enduring appeal lies its diversified model encompassing Private Client Group advisory services; Capital Markets investment banking; Asset Management portfolio solutions; plus traditional Banking products [S1]. This mosaic reduces dependency on any single economic vector volatile by nature—thereby smoothing earnings swings across cycles.

Revenue streams from fee-based accounts in PCG blend with episodic capital markets fees, recurring asset management fees post-Clark acquisition, plus interest income from bank lending activities—a structure delivering resilience against cyclical downturns. Additionally, multiple client touchpoints across these segments foster deep relationships harder for competitors to disrupt [S1].

Takeaway: Revenue diversity across business lines functions as an effective buffer against singular market shocks enhancing RJF’s competitive moat.

Challenges Ahead: Market Volatility and Integration Risks

Despite strengths, Raymond James confronts palpable risks—chiefly sustained market volatility impacting capital markets revenues alongside execution risks integrating newly acquired businesses such as Clark Capital [S1]. Competitive intensity for talent within financial advisor ranks also demands constant innovation in compensation structures (e.g., AdvisorChoice® flexibility).

Regulatory changes remain fluid; adapting compliance practices entails ongoing costs that strain resources especially when paired with technology investments. Cybersecurity threats evolve rapidly requiring constant updates to defense mechanisms [S1]. These factors collectively constitute compounded challenges demanding agile management responses grounded in sound risk controls.

Takeaway: Navigating external headwinds coupled with internal integration complexities will test but ultimately shape RJF's future trajectory.

Taking Stock: Valuation Context and Strategic Outlook

Considering Raymond James' recent quarterly outperformance alongside proactive expansion efforts—including enhanced digital tools and key acquisitions—the firm stands poised for sustained relevance though not without bumps driven by macroeconomic uncertainty [N2][N8][N9][F1][S1].

The strategic emphasis on fee-based revenue growth within PCG and Asset Management complements defensive operating principles evident during Capital Markets softness. Strong liquidity buffers against downside scenarios while innovation elevates differentiation potential versus larger bulge bracket peers increasingly reliant on scale alone.

Looking forward demands balancing patience through volatile investment banking cycles with skeptically optimistic commitment to long-term execution fundamentals reinforced by disciplined decision-making culture highlighted in annual disclosures [S1].

Takeaway: RJF maintains sound positioning blending stability with growth catalysts; prudent vigilance over risks will be crucial going forward.

This report is for informational purposes only and does not constitute investment advice or recommendations. Readers should conduct their own due diligence before making any financial decisions.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments