Strategic Resilience Through Capital Recycling and Development at American Assets Trust

Despite Q4 revenue headwinds, American Assets Trust leverages its high-barrier portfolio and active redevelopment to sustain growth.

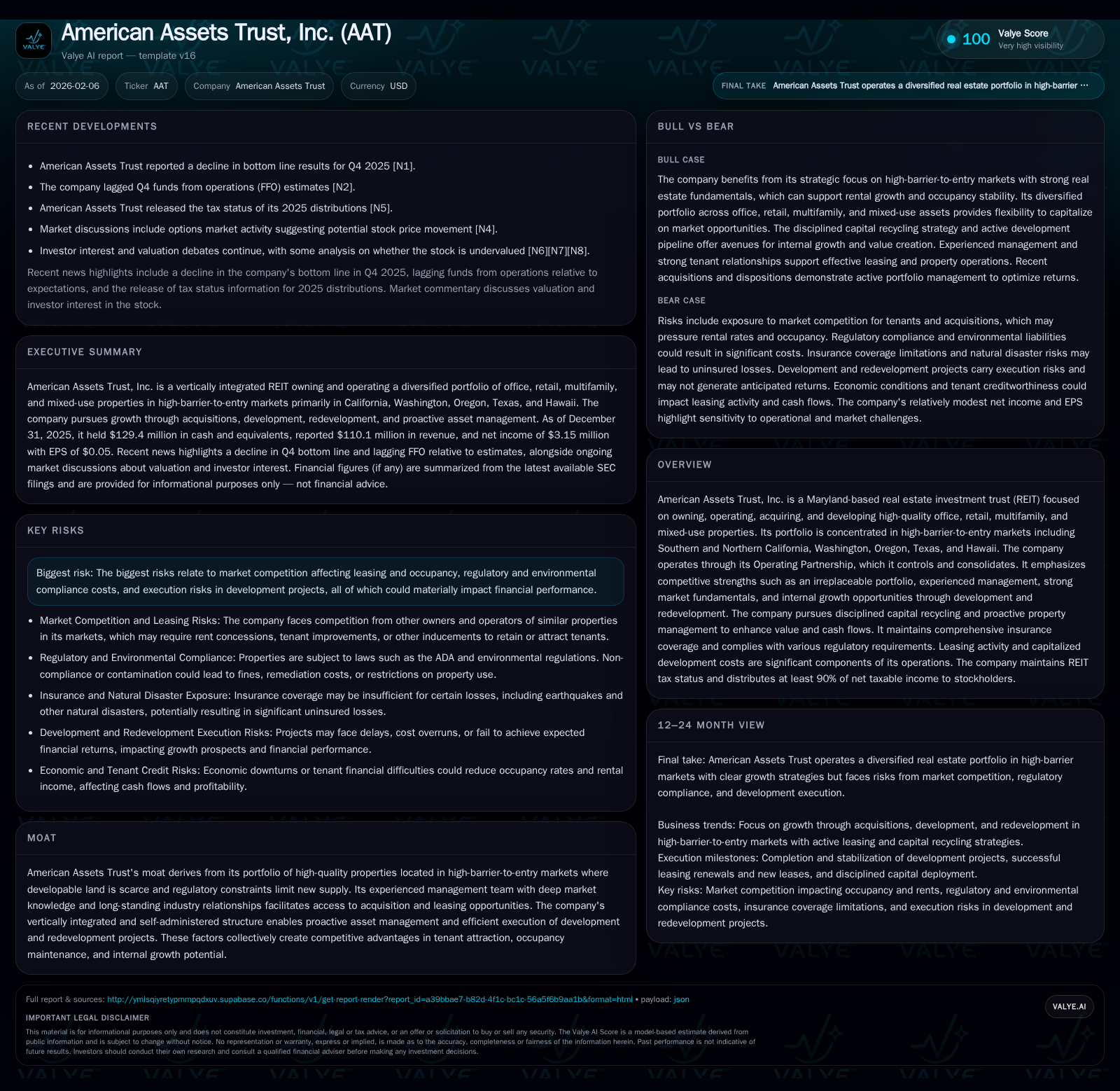

American Assets Trust's recent earnings reflect pressures common in commercial real estate, including a modest 3% rental revenue decline driven by office occupancy slips and the sale of a key retail asset. However, its concentrated portfolio in difficult-to-develop West Coast and Texas markets, combined with disciplined capital recycling—selling Del Monte Center to acquire Genesee Park—and an internal development pipeline exemplified by La Jolla Commons III, underpin durable competitive advantages. Management’s vertically integrated approach enhances execution agility, while risks around leasing competition and regulatory costs warrant monitoring. The firm’s strong liquidity and focused growth initiatives position it well amid a complex macro backdrop.

AAT’s Portfolio Footprint: High-Quality Real Assets in Tough Markets

American Assets Trust (AAT) controls a well-curated mix of commercial real estate assets whose value hinges substantially on their location within some of the nation’s most high-demand yet supply-constrained markets. As of year-end 2025, the company owned and operated a portfolio comprising 31 properties that include office buildings, retail centers, multifamily communities, and mixed-use developments. These assets collectively offer almost 6.8 million rentable square feet of office and retail space along with more than 2,300 residential units plus a hotel component.

Geographically, AAT focuses on Southern and Northern California markets such as San Diego and the Bay Area; Pacific Northwest hubs like Bellevue and Portland; select Texas cities; and Hawaii’s Oahu island. These regions are notable for their rigorous land use regulations and limited developable parcels — factors which erect significant barriers to new supply creation [S1]. The company's deliberate concentration here engenders a durable competitive moat built on scarcity.

Navigating the Recent Earnings Slip: Dissecting Q4 Performance

In its full-year 2025 earnings release filed February 6, AAT disclosed a notable compression in total property revenues—down roughly $21.7 million or 5% relative to prior-year results—driven primarily by a $13.1 million drop (-3%) in rental income [S1][N1]. Office segment revenues fell modestly due to lowered occupancy particularly at specific properties like Coastal Collection at Torrey Reserve and First & Main; however, certain offices such as City Center Bellevue demonstrated rent uplift reflecting selective market strength.

Retail rental revenue contracted chiefly due to the strategic sale of Del Monte Center earlier in the year but showed same-store increases thanks to rent escalations at assets like Carmel Mountain Plaza [S1][S2]. Multifamily metrics feature a nuanced picture: while total multifamily rental income increased materially through acquisition contributions (Genesee Park), same-store-based figures dipped slightly owing to marginal occupancy decreases partially offset by higher rents.

General & administrative expenses edged higher by seven percent alongside rising net interest costs (+5%), squeezing net income down about two percent year-over-year despite a significant gain on real estate sales [S1][N2]. This mix underscores short-term operational pressures associated with capital reallocation activities.

Capital Recycling in Action: From Del Monte Center to Genesee Park

A defining theme for AAT is its disciplined capital recycling—refining the portfolio through sales that fund strategic acquisitions bolstering both asset quality and growth vectors. In early 2025, the sale of Del Monte Center generated approximately $117.8 million net proceeds representing high execution acumen given the substantial recorded $44.5 million gain [S2].

Proceeds were redeployed immediately into acquiring Genesee Park in San Diego for about $67.9 million—a recent addition that enhances AAT's multifamily footprint targeting sustained demand amid constrained new supply [S2]. This transaction exemplifies how AAT reshapes its holdings aligned with prevailing market fundamentals without sacrificing liquidity or increasing leverage excessively.

Leasing Dynamics Across Property Types: Office, Retail, Multifamily, and Mixed-Use

Leasing performance reveals differentiated trajectories across segments illuminating broader industry trends influencing revenue outcomes through late 2025. Office space remains challenged by moderate occupancy erosion from prior years’ peaks though baseline rents are stabilizing where tenancy renewal activity thrives [S1].

Retail stands out positively with percentage leased climbing above 97%, reflecting successful tenant retention strategies amidst evolving consumer patterns post-pandemic [S1]. Mixed-use properties similarly maintain solid lease-up rates near mid-90s percentages.

Multifamily presents tighter bandwidth with slight occupancy declines (~0.7%) but offsetting rent escalations contributing volume stability [S1]. Collectively these patterns suggest nuanced but manageable leasing cycles demanding tailored asset-level management.

Management’s Development and Redevelopment Edge: Building Internal Growth Engines

Beyond acquisition-led growth, AAT leverages its vertically integrated platform wherein development capabilities form core strategic pillars underpinning internal growth potential. Notably, the transition of La Jolla Commons III—from land held for development into operational phase as of April 2025—highlights adept project delivery enhancing net operating income streams [S1][valye_report_excerpt].

This self-administered structure confers advantages enabling rapid decision-making on redevelopment initiatives improving existing properties’ economic value proposition without outsized external dependencies.

Assessing Risk Factors: Leasing Competition, Regulatory Pressures, and Execution Challenges

Management acknowledges sizable risk exposures inherent to their business model that warrant ongoing vigilance. Leasing competition particularly affects office assets facing new supply dynamics or shifting workplace demands impacting tenant behaviors [S2].[valye_report_excerpt]

Environmental regulations impose compliance expenditures that may evolve unpredictably affecting operating margins. Additionally, development execution risks—including permitting delays or cost overruns—pose material uncertainty that can impair planned return profiles if not managed tightly [S1][S2].

The company mitigates these through proactive market monitoring combined with conservative capitalization strategies allowing for nimbleness amidst cycling conditions.

Financial Health Snapshot: Liquidity, Cash Flow, and Income Trends

AAT closed FY25 with robust liquidity—boasting over $129 million in cash & equivalents—which provides a buffer supporting ongoing investment flexibility despite reported net income softening to around $55.6 million attributable to shareholders [F1][S1].

Operating cash flows remain healthy but somewhat pressured by incremental corporate overheads alongside rising interest expenses linked to financing activities supporting development endeavors [S1]. These metrics portray a balance between cautious optimism regarding financial endurance versus near-term margin compression.

Competitive Moat Under the Microscope: Scarcity, Integration, and Market Relationships

The overarching competitive moat revolves around combining geographically scarce high-quality assets with ownership control enabling efficient operational stewardship. The limited availability of developable land enforced by regulatory strictures amplifies pricing power that conventional market participants cannot readily replicate [valye_report_excerpt].

Furthermore, AAT's vertical integration—notably managing both acquisitions/developments alongside day-to-day property operations under one umbrella—enables swift responses maximizing leasing velocity while minimizing downtime during renovation phases.

Experienced management teams possess deep local market knowledge backed by longstanding tenant relationships fostering resilient occupancy metrics amidst cyclical headwinds.

Looking Forward: Catalysts and Potential Market Reactions

Options market indicators have recently suggested elevated volatility potential surrounding AAT equity signaling investor anticipation for either upside catalysts or corrective moves depending on emerging operational data points [N4]. Moreover, tax status disclosures on distributions for fiscal year 2025 emphasize management's commitment to shareholder communication relevance particularly amid evolving tax landscapes affecting REIT investors [N5].

Going forward monitoring execution progress on pipeline developments alongside leasing trends across segments will be pivotal signals influencing market sentiment towards American Assets Trust’s evolving narrative.

Disclaimer: This analysis is provided solely for informational purposes based on publicly available data as of February 2026. It does not constitute investment advice or recommendations regarding any securities holdings or transactions.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments