BioVie Inc.: Navigating Clinical Challenges in Neurodegenerative and Liver Disease Therapeutics

BioVie Inc. focuses on developing novel therapies for neurological disorders and advanced liver disease amid clinical and regulatory complexities.

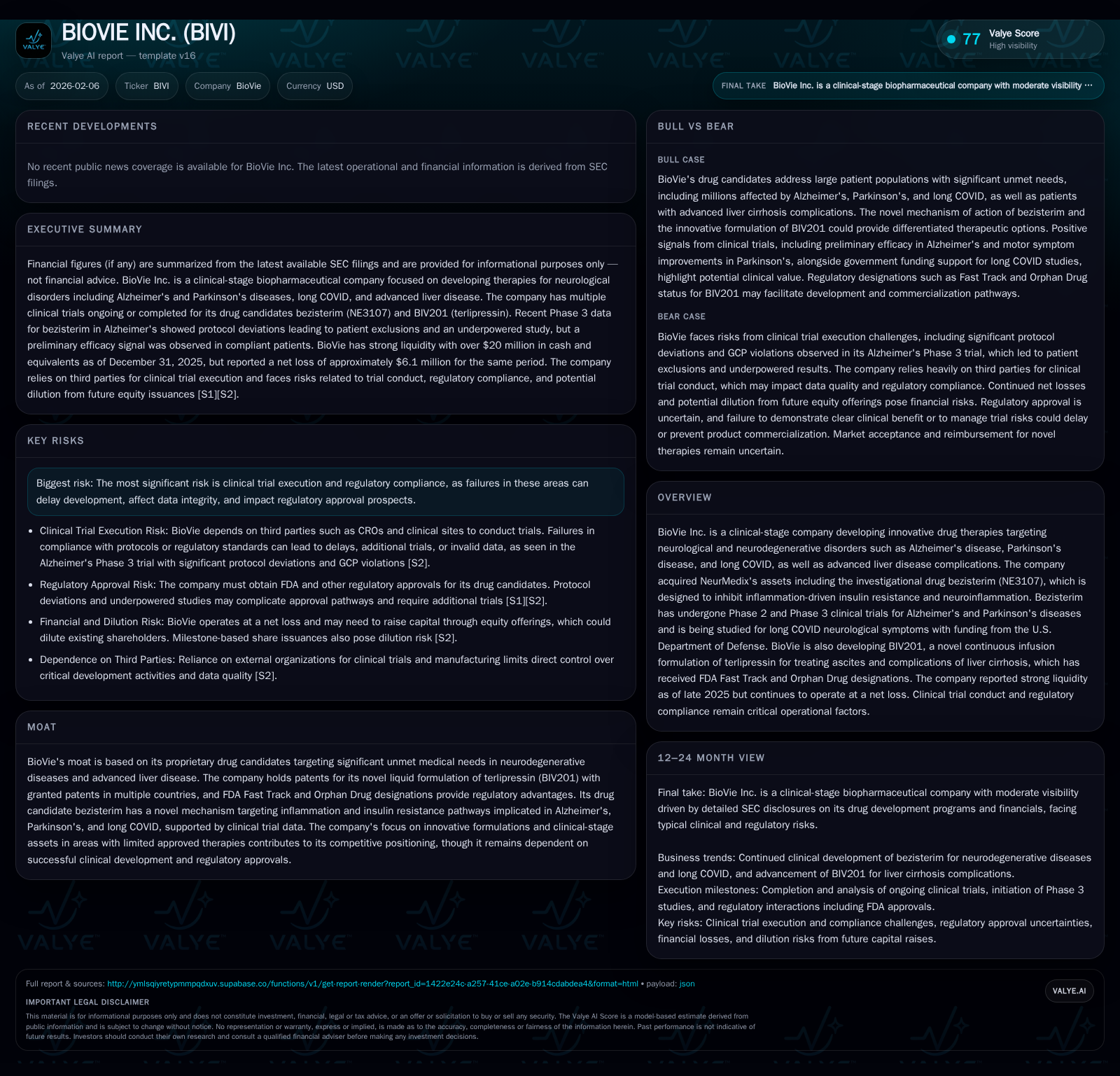

BioVie Inc. is a clinical-stage biopharmaceutical company advancing drug candidates targeting neurodegenerative diseases such as Alzheimer's and Parkinson's, long COVID neurological symptoms, and complications arising from advanced liver disease. Its lead compounds include bezisterim (NE3107), an anti-inflammatory oral agent with Phase 2 and 3 clinical data, and BIV201, a novel formulation of terlipressin with FDA Fast Track and Orphan Drug designations. Despite promising therapeutic rationales supported by emerging science, BioVie faces significant operational risks, including clinical trial execution issues exemplified by recent protocol deviations affecting the robustness of Phase 3 Alzheimer's data. The company maintains a strong liquidity position but remains dependent on successful trial outcomes and regulatory approvals to advance its pipeline.

Company Overview

BioVie Inc. is a clinical-stage biopharmaceutical company focused on innovative drug development for devastating neurological disorders—including Alzheimer’s disease (AD), Parkinson’s disease (PD), and long COVID neurological sequelae—as well as advanced liver disease complications like ascites associated with cirrhosis. The company's pipeline centers primarily on two candidates: bezisterim (also known as NE3107), an investigational orally administered anti-inflammatory agent targeting insulin resistance pathways implicated in neurodegeneration; and BIV201, a continuous-infusion terlipressin formulation designed to improve outcomes for patients suffering from severe liver-related fluid accumulation.

Originally acquiring key assets from NeurMedix in mid-2021, BioVie inherited a promising but still early-stage therapeutic platform that leans heavily on modulation of neuroinflammation—a growing evidence-supported mechanism increasingly recognized as central to the pathogenesis of diseases like AD and PD. Simultaneously, BIV201 represents a strategic diversification into acute complications arising from end-stage liver disease where treatment options remain limited.

Therapeutic Candidates and Mechanisms

Bezisterim (NE3107)

Bezisterim stands out mechanistically due to its dual role: it inhibits inflammation-driven insulin resistance while modulating key inflammatory signaling cascades such as extracellular regulated kinase (ERK) and nuclear factor kappa-light-chain-enhancer of activated B cells (NFκB). Crucially, bezisterim does so without broadly suppressing immune function or causing major drug-drug interactions—a notable advantage given the typically elderly patient population likely to receive these therapies.

This novel approach addresses pathological drivers considered fundamental in neurodegenerative diseases. Insulin resistance within the brain can exacerbate amyloid beta accumulation and tau pathology characteristic of AD. Likewise, neuroinflammation fuels dopaminergic neuron degeneration in PD. Preliminary Phase 2 trials demonstrated improved cognitive function in AD patients treated with bezisterim relative to controls. Similarly encouraging results emerged from PD studies where the drug combined with levodopa yielded improvements in "morning on" symptoms indicative of better motor control.

Beyond traditional neurodegeneration indications, bezisterim is being evaluated under funding from the U.S. Department of Defense for long COVID neurological symptoms where persistent neuroinflammation post-infection drives fatigue and cognitive dysfunction—symptoms lacking effective treatments.

BIV201: Continuous Infusion Terlipressin

BIV201 represents BioVie’s push into addressing advanced liver disease complications specifically ascites due to cirrhosis—conditions that significantly burden healthcare systems globally with high morbidity.

Terlipressin traditionally is given intermittently; BioVie’s novel liquid formulation allows continuous infusion which may enhance hemodynamic stability while minimizing side effects related to peak doses. This candidate recently secured both Fast Track status and Orphan Drug designation from FDA—a testament to its potential to address an unmet need in a difficult-to-treat patient population.

Clinical Development Progress

Bezisterim Trials

BioVie conducted a large Phase 3 randomized, double-blind placebo-controlled study (NCT04669028) evaluating bezisterim for mild-to-moderate AD that began enrollment in August 2021 with topline results announced November 2023. Unfortunately, this trial encountered substantial hurdles related to protocol noncompliance—specifically pervasive violations at fifteen study sites predominantly clustered geographically. These breaches necessitated exclusion of all affected patient data to preserve integrity.

This exclusion reduced statistical power below necessary thresholds to definitively meet primary endpoints despite a retained preliminary efficacy signal within remaining compliant site data. The company publicly acknowledged this setback while maintaining plans for further analyses and potential additional studies pending regulatory feedback.

Prior Phase 2 trials have offered promising biomarker improvements correlating with cognitive gains, suggesting biological activity consistent with the hypothesized mechanism.

Parkinson’s Disease Trial Data

A Phase 2 study in PD patients showed clinically meaningful motor improvements when bezisterim was added to standard levodopa therapy versus levodopa alone—with no related adverse events recorded.

Long COVID Neurological Symptoms Research

Supported by Department of Defense funding given increased recognition of long COVID as a public health issue particularly among veterans and military personnel—the drug candidate is being explored for mitigating chronic neuroinflammation believed driven by TLR-4/NFκB pathway activation triggered by residual viral proteins.

BIV201 Development Status

While specifics on trial progression are less publicly detailed compared to bezisterim programs, Fast Track designation usually implies ongoing or planned pivotal development intended to expedite eventual approval processes based on available preliminary data suggesting clinical benefit.

Regulatory Environment & Intellectual Property Positioning

BioVie benefits from granted patents covering its proprietary liquid terlipressin formulation across multiple jurisdictions—providing exclusivity beyond patent term extensions potentially conferred by orphan status. Orphan Drug designation also conveys market exclusivity incentives upon approval which can be pivotal in rare or underserved conditions like advanced ascites treatment.

Fast Track recognition by FDA reflects the agency's acknowledgement of serious diseases addressed by BIV201 coupled with the potential for addressing unmet needs enabling accelerated review timelines contingent on data quality.

Concurrently, BioVie's reliance on rigorous adherence to current Good Clinical Practice (cGCP) standards remains critical considering prior trial deviations exposed vulnerabilities that could delay approval or require additional costly studies.

Financial Overview & Operational Considerations

As of year-end 2025 (10-Q filing dated February 2026), BioVie reported $20.5 million in cash and equivalents alongside approximately $21.8 million in total current assets against $3 million current liabilities yielding a robust current ratio exceeding 7. This liquidity profile supports ongoing research expenditures but must be contextualized within continued net losses exceeding $6 million for the fiscal year reflecting intensive investment into R&D without commercial revenues yet generated.

The absence of any marketed products leaves BioVie wholly dependent on capital markets or partnership/licensing arrangements for sustained funding across what remain high risk phases involving scale-up manufacturing validation alongside expensive pivotal trials.

Notably, management acknowledges challenges inherent in outsourcing critical components such as clinical trial conduct and manufacturing—which are especially material given recent site-level compliance failures—and emphasizes oversight responsibilities notwithstanding third-party delegation.

Furthermore, the company faces intellectual property risks if generics are approved prematurely or exclusivity windows narrowed by regulatory authorities.

Risks Summary & Industry Contextualization

BioVie exemplifies many typical biotech early-stage risks: developing first-in-class therapeutics tackling complex multi-factorial diseases requires rigorous clinical proof often complicated by slow enrollment or data integrity challenges. Neurodegeneration therapy development is notoriously fraught given heterogeneous patient populations complicating endpoint assessments and biomarker validation.

Liver disease therapeutics like terlipressin formulations operate within an established but highly competitive arena where delivery innovations may confer advantages but require clear demonstration of incremental benefit.

Clinical trial execution remains an existential challenge—failures or irregularities invoke costly delays impacting valuation and raising investor uncertainty. Regulatory navigation remains complicated by evolving guidance around post-COVID symptomatology intersecting neurology/macrophysiology fields where standard endpoints remain ill-defined.

The company’s current staffing limitations regarding sales/marketing also highlight future commercialization hurdles post-approval requiring strategic partnerships or expansion at substantial incremental cost.

Conclusion: A High-Risk Biotech Developing Promising Candidates Facing Executional Roadblocks

BioVie Inc.’s pursuit of innovative pharmacological approaches targeting inflammation-mediated pathways underlying neurodegenerative diseases aligns well with contemporary scientific paradigms highlighting immune-metabolic contributors beyond classical amyloid/tau-centric models. Concurrently advancing treatments addressing advanced liver disease complications further diversify risk/return profiles albeit still within clinical developmental uncertainty frameworks typical of emerging biopharma firms without approved products or revenues.

The recent cannabis-shaped setbacks in their flagship Phase 3 Alzheimer’s trial exemplify how operational rigor is paramount; however promising preliminary signals suggest retained potential warranting continued observation pending resolution through further analyses or new trials. Strong financial resources provide near-term runway but do not mitigate inherent developmental risks intrinsic to this sector.

Investors and stakeholders should view BioVie through lenses appreciating both scientific innovation opportunities alongside classic biotech risk factors including dependence on third-party compliance quality controls, capital needs fungibility, regulatory pathways uncertainties, intellectual property protections' durability,and nascent commercial capabilities—all critical variables shaping ultimate success trajectories.

Disclaimer: This analysis is intended solely for informational purposes reflecting publicly available data supplemented with general industry context as of early 2026 and does not constitute investment advice.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments