Crane Harbor Acquisition Corp.: Navigating SPAC Origins to Quantum Tech Merger Prospects

From its inception as a purpose-built Cayman Islands SPAC, CHAC embarks on a transformative path via a quantum tech merger underpinned by experienced management amid execution risks.

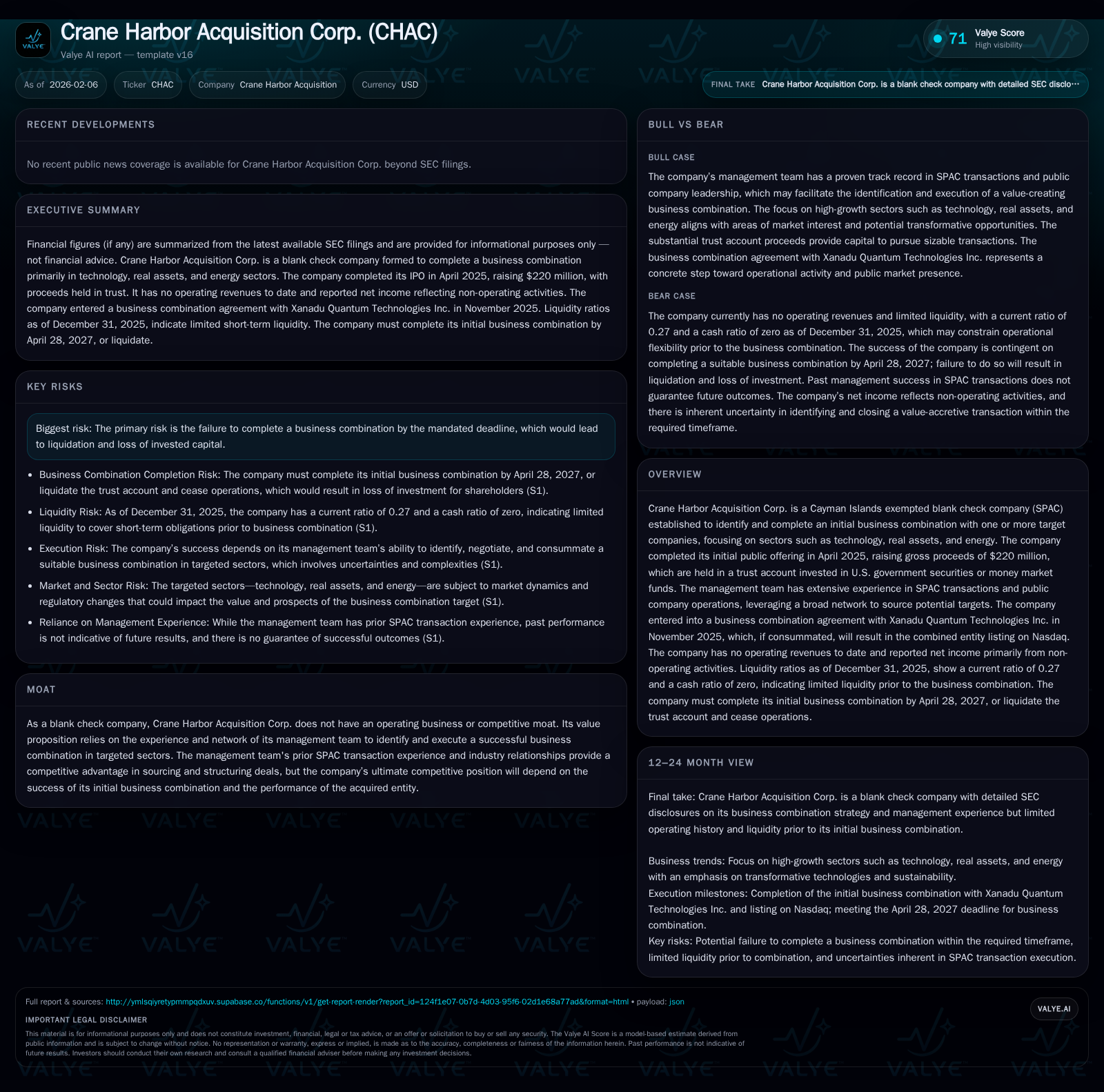

Crane Harbor Acquisition Corp. (CHAC) launched in early 2025 as a blank check company targeting technology, real assets, and energy sectors with an IPO that raised $220 million. It secured a pivotal business combination agreement with Xanadu Quantum Technologies in November 2025, aiming to list the merged entity on Nasdaq. While CHAC maintains no operating revenues yet, its financial position reflects trust-held IPO proceeds generating interest income offset by administrative expenses. The company faces critical execution risk tied to completing the merger by April 2027, which will determine its transition from a shell to an operational public company in the emerging quantum technology space.

Origin Story of a Purpose-Built Blank Check Vehicle

Crane Harbor Acquisition Corp. emerged on January 2, 2025 as a Cayman Islands exempted company specifically chartered to pursue one or more transformative business combinations. It operates under the blank check company framework—an entity that holds no active operations or revenues and exists primarily to identify and merge with a promising target.

Unlike traditional corporations building product lines organically, CHAC’s raison d’être is transactional: to serve as a vehicle facilitating the public listing of dynamic firms in select sectors identified by management’s expertise. The company's explicit interest lies in technology innovation, real assets including infrastructure-related investments, and energy domains where disruption aligns with broader global megatrends.

This focused mandate reflects strategic intent: targeting companies at inflection points capable of leveraging capital infusion and operational guidance to accelerate maturation. To date, CHAC has seen no revenue generation — a hallmark of its developmental state — channeling efforts instead into deal origination and regulatory compliance preparations [S1][F1].

Capital Deployment and Structural Foundations Post-IPO

The foundational capital to fuel CHAC’s strategic ambitions was secured through an initial public offering executed on April 28, 2025. It raised $220 million gross through issuance of 22 million units priced at $10 each. Alongside this came $6.4 million from private placement units sold to insiders including sponsors, further augmenting resources.

Critically, all proceeds except underwriting fees were placed into an independently managed trust account invested in U.S. government securities or equivalent money market funds—ensuring capital preservation while enabling accretion through nominal interest income.

This structural design provides dual benefit: preserving investor principal during search phase while generating non-operational earnings evident in reported net income from trust interest totaling approximately $3.58 million by year end 2025. However, operationally CHAC remains dormant; expenses incurred are predominantly administrative — legal fees, financial reporting costs, due diligence expenditures — reflecting ongoing readiness rather than commercial activity [S1][F1].

Notably, the current ratio at December 31, 2025 stands near 0.27 (current assets $404k vs. current liabilities $1.51M), indicative of typical liquidity profiles for nascent SPACs where liabilities include accrued costs exceeding immediate liquid assets [F1]. This underlines the company’s reliance on long-term capital commitments beyond short-term asset base.

The Management Team: Experience Crafting Opportunities in Technology, Real Assets, and Energy

A cornerstone of CHAC's value proposition resides in its management team—a cadre seasoned in structuring SPAC transactions coupled with substantive operating expertise across targeted industries.

Management's ecosystem encompasses access channels ranging from private equity firms to sovereign wealth funds and pension investors as well as deep connections among corporate founders and domain professionals across investment banking and legal fields. These relationships constitute pipelines for deal flow not readily available to generic capital pools.

Their combined acumen blends financial engineering capabilities with hands-on governance experience serving both pre-IPO companies and public entities post-merger. This experience governs rigorous target evaluation metrics emphasizing disruptive technological solutions aligned with sustainability, infrastructure development, and advanced energy innovations.

Such a mosaic approach aims beyond simple capital deployment; it strives to vault selected portfolio companies into accelerated growth trajectories through strategic oversight and scalable operational frameworks [S1].

The Xanadu Quantum Technologies Pact: A Defining Business Combination

In November 2025, the company crystallized its initial business combination strategy by entering into an agreement with Xanadu Quantum Technologies Inc., anchoring its future fortunes to the evolving quantum computing sector.

The deal structure involves CHAC continuing its corporate existence under Canadian jurisdiction (Ontario's Business Corporations Act) while merging outstanding shares of Xanadu with those of CHAC into a successor pubco whose securities will be Nasdaq-listed post-closing.

This step not only transitions CHAC from an empty shell towards operational status but also represents validation of management’s sector focus — quantum computing being among the most complex innovations poised for broad industrial impact.

The transaction ensures that both entities become subsidiaries of the newly formed public company with shared synergies expected from combined capital markets access and governance structures optimized for scaling disruptive technology development [S1].

Quantifying Financial Health and Operational Silence

With zero operating revenues reported throughout inception through December 2025, Crane Harbor Acquisition Corp.'s financial footprint is marked by its passive income streams generated entirely through interest earned on trust-held IPO proceeds.

Net income recorded stood at approximately $3.58 million—a function of $6.09 million in trust account interest partially offset by administrative expenses totaling roughly $2.51 million during the same period.

The limited current assets ($404k) juxtaposed against current liabilities ($1.51M) reflect accrued operational costs connected primarily to preparatory work for proposed combination activities including legal fees and due diligence expenditures.

This early lifecycle balance sheet profile is emblematic of blank check entities where tangible assets remain minimal but prospective value springs from deal completion potential rather than existing cash flow infrastructure [S1][F1].

Risk Factors: Navigating the Deadline to Deliver Returns or Liquidate

Embedded within CHAC’s journey is acute execution risk inherent to all blank check companies hinging entirely upon consummation of an initial business combination prior to a regulatory deadline – April 28, 2027.

Failure to complete this strategic milestone obligates liquidation of trust accounts less permitted expenses resulting inevitably in return of original investments minus accrued losses—an unattractive outcome for shareholders betting on transformational deals.

Risk disclosures maintain transparent acknowledgment that success is neither guaranteed nor assured by historical performance or management intent alone; myriad factors could delay or derail negotiations including target valuation misalignment or adverse market conditions impacting financing structures.

Investor exposure consequently straddles dual possibilities: realizing upside attached to quantum computing’s emergent growth or enduring downside tied tightly to timing pressures and competitive bidding for attractive targets within constrained windows [S1][S2].

Future Outlook: From Cayman Paper to Nasdaq Reality

Assuming successful closing with Xanadu Quantum Technologies Inc., CHAC anticipates substantive shifts from its embryonic form into a publicly traded entity actively engaged in research commercialization within quantum technologies — an arena attracting significant venture capital attention given its potential exponential impact across industries such as pharmaceuticals, cryptography, materials science, and logistics optimization.

Post-merger operational plans are likely oriented around scaling technology development pipelines, expanding intellectual property portfolios, attracting top-tier talent, and forging strategic alliances within the growing quantum ecosystem globally.

Transitioning from a Cayman Islands shell entity steeped in static trust-held cash towards an innovation-driven NASDAQ listed firm symbolizes reopening narratives about how purpose-oriented blank check vehicles can birth cutting-edge public companies in frontier technologies [S1].

Investor Implications and Valuation Drivers Post-Combination

Following consummation of the business combination transaction—and subsequent delisting closure formalities—the complexion of investor returns will pivot substantially onto fundamentals tied directly to Xanadu’s commercial success trajectory within quantum hardware/software convergence domains.

Valuation drivers will include demonstrated capability milestones such as prototype breakthroughs, partnerships with enterprise clients or governments seeking quantum advantages, intellectual property expansion cadence alongside scalable manufacturing or cloud delivery models where applicable.

Conversely downside remains anchored in execution hurdles: integration risks post-merger; capital market volatility affecting follow-on funding; regulatory uncertainties surrounding nascent technologies; competitive displacement threats; plus macroeconomic headwinds influencing discretionary R&D budgets globally.

Management stewardship will emerge as pivotal moving forward—balancing aggressive growth ambitions against prudent resource management required for sustained value creation within highly technical innovation cycles [S1][F1].

This analysis is based exclusively on publicly available information including Crane Harbor Acquisition Corp.’s filings with the SEC up to February 6th, 2026. It does not constitute investment advice nor recommendations regarding any securities mentioned herein but aims to provide an informed perspective on the company's formation history, strategic transaction developments, financial posture prior to merger completion, associated risks inherent in SPAC transactions, and anticipated future operational trajectory contingent upon business combination finalization.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments