Southwest Airlines: Navigating Liquidity Challenges with Operational Momentum and Brand Strength

Southwest Airlines leverages its distinctive operational model and brand moat to balance liquidity tensions amid evolving industry dynamics.

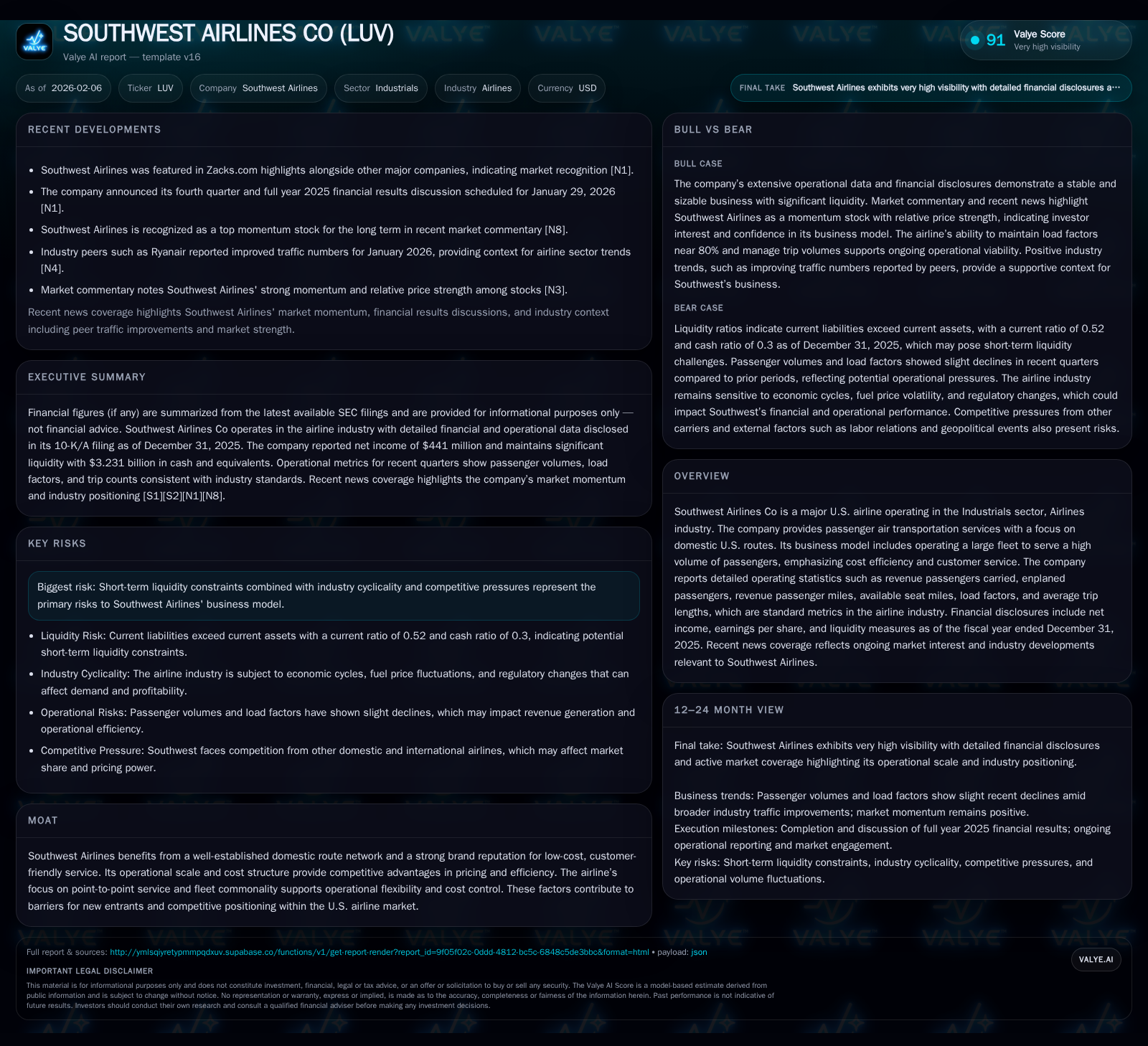

As of the fiscal year ending 2025, Southwest Airlines demonstrates solid profitability and operational efficiency underpinning its position as a domestic low-cost leader. However, significant liquidity tensions arise from a low current ratio driven by current liabilities far exceeding current assets. Despite these financial headwinds, recent analyst upgrades and market momentum highlight investor confidence in Southwest's resilient brand and cost leadership. The airline's strategic focus on fleet commonality and point-to-point network enables flexibility that may insulate it amid industry cyclicality and competitive pressures.

Southwest’s Unique Market Position: The Backbone of a Low-Cost Giant

Southwest Airlines has long been recognized for its foundational role within the U.S. domestic airline industry. Operating primarily within the broad Industrials sector under the airlines industry classification, Southwest focuses on passenger air transportation across an extensive domestic network. This is no accident; the airline has cultivated a strong brand identity synonymous with low fares, customer-friendly policies such as no change fees, and reliable point-to-point service model rather than traditional hub-and-spoke structures. This route philosophy enables more direct flights between secondary airports, reducing layover times and optimizing aircraft utilization.

The company's moat is multidimensional. From a structural standpoint, its extensive domestic coverage creates significant entry barriers for newcomers aiming to replicate its network density efficiently. At the same time, consistent execution on cost discipline furthers pricing advantage capabilities. As highlighted in their filings [F1][S1], operational metrics such as load factors — reflecting overall passenger volume relative to available seating capacity — consistently outperform many peers, showcasing effective demand capture amidst a saturated market.

Additionally, Southwest's brand reputation contributes to customer loyalty that buffers against price wars or competitive incursions. Combined with scale advantages stemming from serving high passenger volumes on standardized equipment, these elements collectively reinforce its positioning as a low-cost giant within the U.S. air travel landscape.

Fleet and Operational Efficiency: The Heart of Cost Leadership

Digging into fleet composition reveals the mechanics behind Southwest’s cost leadership edge. Unlike carriers that operate multiple aircraft types requiring diverse pilot training regimes, maintenance infrastructure, and inventory parts complexity, Southwest maintains an almost exclusive fleet of Boeing 737 aircraft variants [S2][F1]. This commonality simplifies both operational logistics and maintenance scheduling while enabling crew flexibility across routes.

Moreover, Southwest's point-to-point routing model diverges from conventional hub-centric airlines by minimizing passenger connection dependencies that often add complexity and potential delays. This setup allows for higher aircraft utilization rates—a critical metric translating into lower per-seat costs—and improved schedule reliability.

Together, these strategic operational decisions sustain momentum in managing input cost pressures prevalent in the airline industry, including fluctuating fuel prices and labor expenses. Operational data corroborates this positioning: steady increases in revenue passenger miles accompanied by controlled available seat miles suggest efficient capacity management even during variable demand periods.

2025 Financial Deep Dive: Cash Flows, Profitability, and Liquidity Tensions

Financially, Southwest’s most recent annual report for calendar year 2025 reveals intriguing contrasts underscoring its liquidity dynamics [F1][S1]. The company posted a positive net income of $441 million, affirming profitability after years layered with pandemic disruption recovery phases.

The cash and cash equivalents balance stands at approximately $3.23 billion as of December 31, 2025; however, this liquidity cushion appears outmatched when considered against current liabilities totaling roughly $10.9 billion. This disparity yields a current ratio near 0.52—significantly below typical thresholds signaling comfortable short-term debt coverage capability.

This "liquidity tension" indicates that while underlying earnings support business continuity, the immediate balance sheet obligations demand vigilant working capital management. Such tension could influence strategic decisions around capital expenditures or financing activities moving forward.

The company's disclosures emphasize awareness of this risk cluster alongside cyclicality inherent in air travel demand patterns and evolving competition pressures [valye_report_excerpt]. This dual recognition highlights how critical it is for management to maintain disciplined financial controls without stifling investments that sustain operational momentum.

Industry Momentum Meets Company Reality: Insights from Recent Upgrades and Market Buzz

Despite internal liquidity challenges, Southwest garners notable external confidence reflected through recent analyst activity and media sentiment [N3][N10][N11][N4]. BMO Capital’s upgrade underscores renewed faith in Southwest’s growth narrative anchored in operational robustness combined with improving macro conditions supporting leisure and business travel segments.

Nasdaq articles frame Southwest as a strong momentum stock showing positive relative price strength against broader sector volatility [N3][N10]. This sentiment captures investors' excitement around its scalable operating platform but tempers expectations considering persistent pressures surrounding near-term balance sheet health.

As such, while Southwest aligns with momentum investor portfolios seeking exposure to cyclical rebound beneficiaries with proven track records, cautious undertones persist given the complex interplay between robust earnings performance versus looming liquidity needs.

Navigating Risks: Cyclicality, Competition, and Southwest’s Defensive Moat

Operating within an airline industry historically characterized by sharp ebbs and flows due to economic cycles adds layers of complexity when interpreting Southwest’s financial positioning [valye_report_excerpt][S1]. Demand sensitivity to macroeconomic shifts—including fuel price shocks or geopolitical disruptions—can induce volatility impacting revenues unpredictably.

Additionally, competitive intensity remains high as legacy carriers continue capacity optimizations while low-cost rivals compete aggressively on overlapping routes. Yet Southwest’s moat provides partial insulation: the brand promise paired with manageable cost structures limits downside scope relative to less efficient operators who face margin erosions more acutely during downturns.

Recognizing these risks explicitly connected to measurable metrics—like liquidity ratios—enables clearer visibility into how the company might weather cyclical shocks without compromising fundamental competitiveness.

Investor Sentiment and Momentum Stocks: Unpacking Analyst Perspectives

Examining trading patterns alongside options activity reveals nuanced buyer interest reflecting balanced perspectives [N5][N13][N8]. Solid U.S. manufacturing news bolstering economic optimism has coincided with notable option volume surges on LUV shares suggesting speculative plays betting on sustained appreciation anchored by improved travel demand forecasts.

Media commentary highlights why certain investor cohorts gravitate toward Southwest given its historic resilience combined with visible traction post-pandemic recovery cycles [N5][N8]. Such trades often factor in potential multiple expansions attributable to steady operational leverage benefits despite cyclical uncertainties.

This mosaic of bullish momentum tempered by foundational caution illustrates strongly how Southwest occupies a unique space becoming both a defensive proxy due to its moat strategy yet an aggressive growth catch given scaling opportunities underpinned by strong domestic airfare demand.

Future Outlook: Balancing Growth Opportunities With Fiscal Discipline

Looking ahead toward forthcoming quarterly earnings releases scheduled for late January 2026 [N1], stakeholders will scrutinize management’s roadmap to balancing reinvestment for market expansion against addressing pressing liquidity bottlenecks.

Emerging themes likely include further efforts optimizing working capital cycles complemented by targeted capital allocation prioritizing technology or network enhancements designed to sustain customer experience advantage without exacerbating financial strain [S1][F1][N1].

If successful, this approach could convert existing challenges into strategic inflection points catalyzing new phases of operational momentum reinforcing Southwest’s stature among U.S. airlines via sustained profitability aligned with prudent fiscal stewardship.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice or recommendations regarding any securities or companies discussed herein.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments