Navigating Recovery and Competitive Pressures: An In-Depth Look at Las Vegas Sands Corp in 2025-26

Las Vegas Sands Corp posts robust Q4 earnings beating expectations amid market volatility and intensifying industry competition.

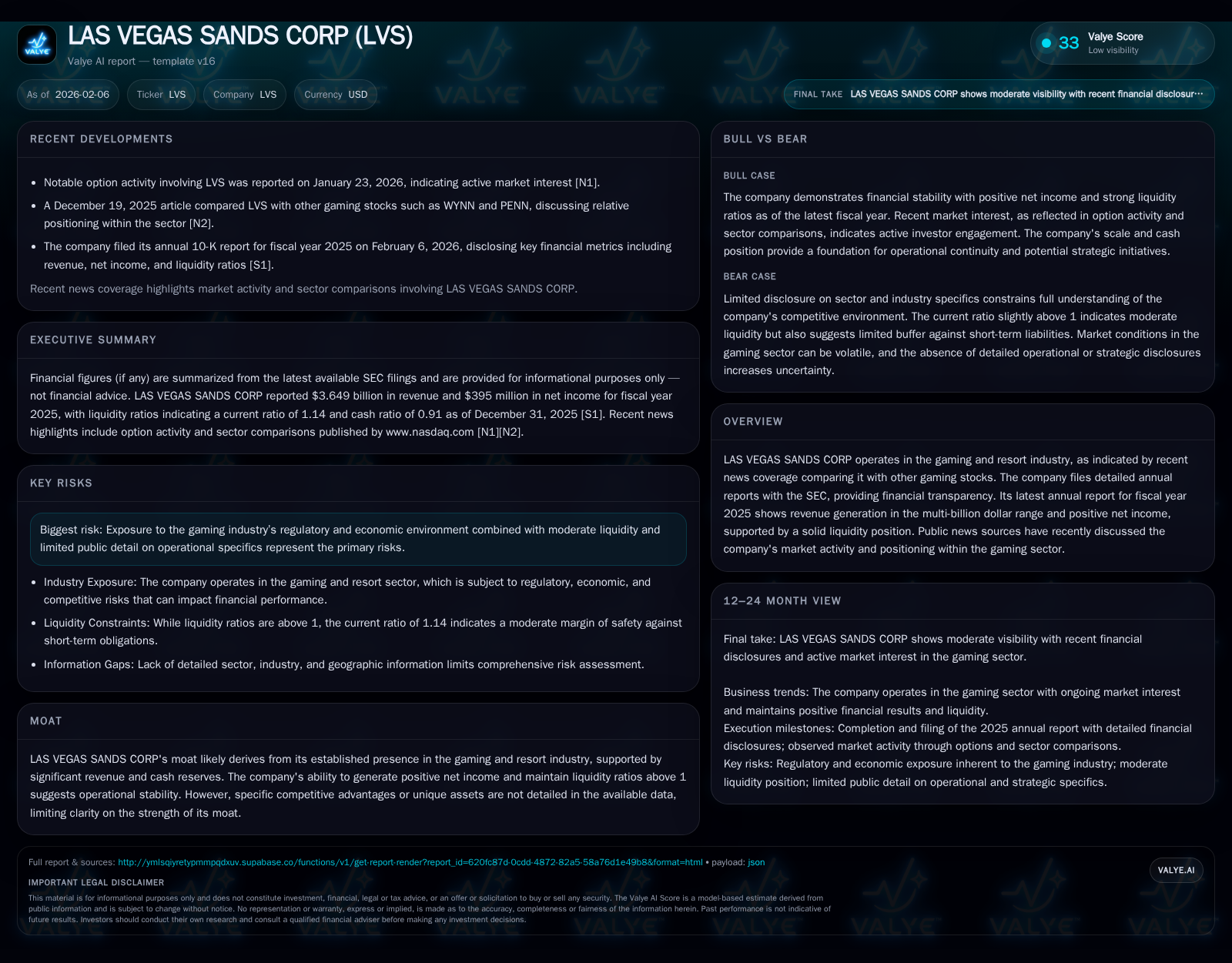

Las Vegas Sands Corp (LVS) has demonstrated a strong post-pandemic rebound with Q4 2025 earnings and revenues surpassing analyst estimates, signaling renewed operational momentum. The company’s solid financial foundation is underscored by $3.65 billion in revenue and $395 million in net income for the full year 2025, supported by ample cash reserves of $3.84 billion and a current ratio above 1. Despite these positive results, LVS faces industry-wide regulatory risks and macroeconomic headwinds which contributed to notable stock price volatility early in 2026. Strategic strength in geographic diversification—especially the profitable Singapore segment—provides some competitive insulation, while ongoing dividend distributions reflect management’s confidence in cash flow sustainability.

Navigating the Recovery: LVS’s Q4 Earnings Beat Expectations

Las Vegas Sands Corp closed out 2025 on a notably strong note as reported Q4 earnings surprised to the upside relative to consensus forecasts. Multiple Nasdaq sources confirm that LVS not only surpassed revenue estimates for the quarter but also posted year-over-year gains signaling a clear traction recovery following pandemic-induced disruptions [N2][N3][N4][N5][N6]. Against a backdrop where broader market volatility has been heightened by mixed earnings reports from major technology names [N1][N12], LVS’s performance stands out as an emblem of sector resilience.

This rebound narrative is further enriched by management’s remarks during earnings calls emphasizing operational durability and improved customer engagement across key resorts. These developments resonate with renewed investor optimism as LVS capitalizes on pent-up demand in gaming and hospitality sectors while navigating macro uncertainties.

Dissecting the Financial Pillars: Revenue, Profitability, and Liquidity

Turning to the foundational indicators of corporate health reflected in SEC filings, LVS reported full-year 2025 revenues of approximately $3.65 billion with net income tallying $395 million [S1][F1]. This profitability underscores effective cost management alongside incremental topline expansion amid evolving consumer patterns.

Liquidity metrics reinforce operational sustainability; cash and cash equivalents remained comfortably elevated at about $3.84 billion heading into 2026. When combined with current assets of $4.83 billion against current liabilities near $4.22 billion, this yields a current ratio of roughly 1.14—a level suggesting sound short-term financial flexibility to meet obligations without strain.

These figures collectively illustrate LVS's capacity not only to generate positive earnings but also to maintain robust cash buffers which can underwrite investment or weather episodic shocks intrinsic to gaming enterprises.

Geographic Footprint Spotlight: Strength in Singapore and Beyond

One critical dimension often overlooked is geographical segmentation within LVS’s portfolio. Insights reveal that the Singapore operations have been prominent contributors to EBITDA flow-through enhancement [N11], serving as a key driver of consolidated profitability.

This regional strength points to diversified revenue streams mitigating concentration risk tied solely to U.S.-based gaming hubs such as Las Vegas or Macau properties. Such geographic dispersion affords LVS more stable earnings trajectories despite localized regulatory or economic fluctuations.

An understanding of this multi-jurisdictional presence complements appreciation for how LVS leverages its global footprint strategically while potentially exploiting favorable market dynamics outside North America.

Decoding the Moat: What Shields LVS in a Competitive Industry?

Assessing what constitutes LVS’s moat is challenging due to limited public disclosure on distinct competitive barriers or intellectual property assets specifically outlined in filings or news reports. However, its scale—manifested through multi-billion dollar revenue generation—and impressive liquidity profile suggest practical advantages in brand recognition and capital access [valye_report_excerpt.moat][S1][F1].

Moreover, consistent positive net income reveals operational execution capabilities that afford resilience within a competitive landscape marked by intense rivalry for consumer spend among luxury resort operators globally.

Absent granular details on proprietary technologies or exclusive licenses, one infers LVS’s protective moat centers on longstanding market presence combined with financial resource depth enabling swift response to external challenges.

Risks at Play: Regulatory, Economic Cycles, and Market Dynamics

Nevertheless, embedded risks merit sober appraisal. Regulatory scrutiny inherent in gaming jurisdictions poses continual compliance demands with potential for adverse actions affecting license statuses or operating conditions. Economic cyclicality further exposes fluctuations in discretionary travel and leisure spending impacting visitation patterns.

News examined contextualizes these vulnerabilities amid today’s market anxieties—particularly concerns regarding AI-related corporate spending reductions spilling over into consumer sectors—adding pressure on stocks including LVS [valye_report_excerpt.risks][N7][N13]. This multifaceted risk environment constrains unalloyed optimism despite fundamental strength.

Investor Sentiment and Market Reaction: Stock Price Volatility Explored

Market behavior patterns underscore the tension between optimism on fundamentals versus external headwinds. Notably, LVS stock dropped nearly 14% on January 30, coinciding with broad tech-driven equity pullbacks alongside company-specific factors [N13]. Additionally, crossing below the pivotal two-hundred-day moving average indicated technical weakness prompting further selling interest among traders [N14].

Option markets registered heightened activity suggesting divergent views on future directional moves reflecting uncertainty surrounding near-term catalysts.

Such volatility episodes amplify the need for nuanced interpretation rather than simplistic directional conclusions about company trajectories.

Dividend Policy: Signaling Confidence or Managing Cash?

Administrative signals such as ex-dividend announcements punctuate narrative themes of cash discipline paired with shareholder value consideration [N9]. Maintenance of dividend flows amid cyclical industry pressures intimates management confidence in sustainable free cash flow generation supported by healthy liquidity reserves.

Dividends thus function as both a tangible return mechanism for investors desirous of yield exposure in consumer discretionary domains and an implicit statement about underlying business robustness.

Outlook and Strategic Considerations for Stakeholders

Synthesizing available information yields a cautiously optimistic forward stance whereby LVS’s sturdy financial footing—anchored by multi-billion revenue scale, profitability persistence, and ample cash holdings—constitutes an asset against prevailing uncertainties [S1].

Recent analyses highlighting investor timing considerations intimate potential reward avenues conditioned on navigating sectoral risks sensibly [N10]. Strategic agility exploiting geographic strengths such as Singapore operations alongside vigilant regulatory risk management will be key determinants shaping endurance.

In conclusion, while Las Vegas Sands faces no shortage of external tests characteristic of global gaming enterprises today, its demonstrated recovery trajectory coupled with disciplined liquidity stewardship provide substantive reasons for stakeholders to monitor developments closely amidst an evolving market landscape.

Disclaimer: This analysis is based solely on publicly available information including SEC filings and recent news coverage as of early February 2026. It does not constitute investment advice or recommendations to buy or sell any securities.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments