Power Integrations: Strategic Resilience in High-Voltage Power Conversion Amid Global Uncertainties

An in-depth analysis of Power Integrations Inc’s operational strength, technological moat, and risk navigation in a rapidly evolving power electronics landscape.

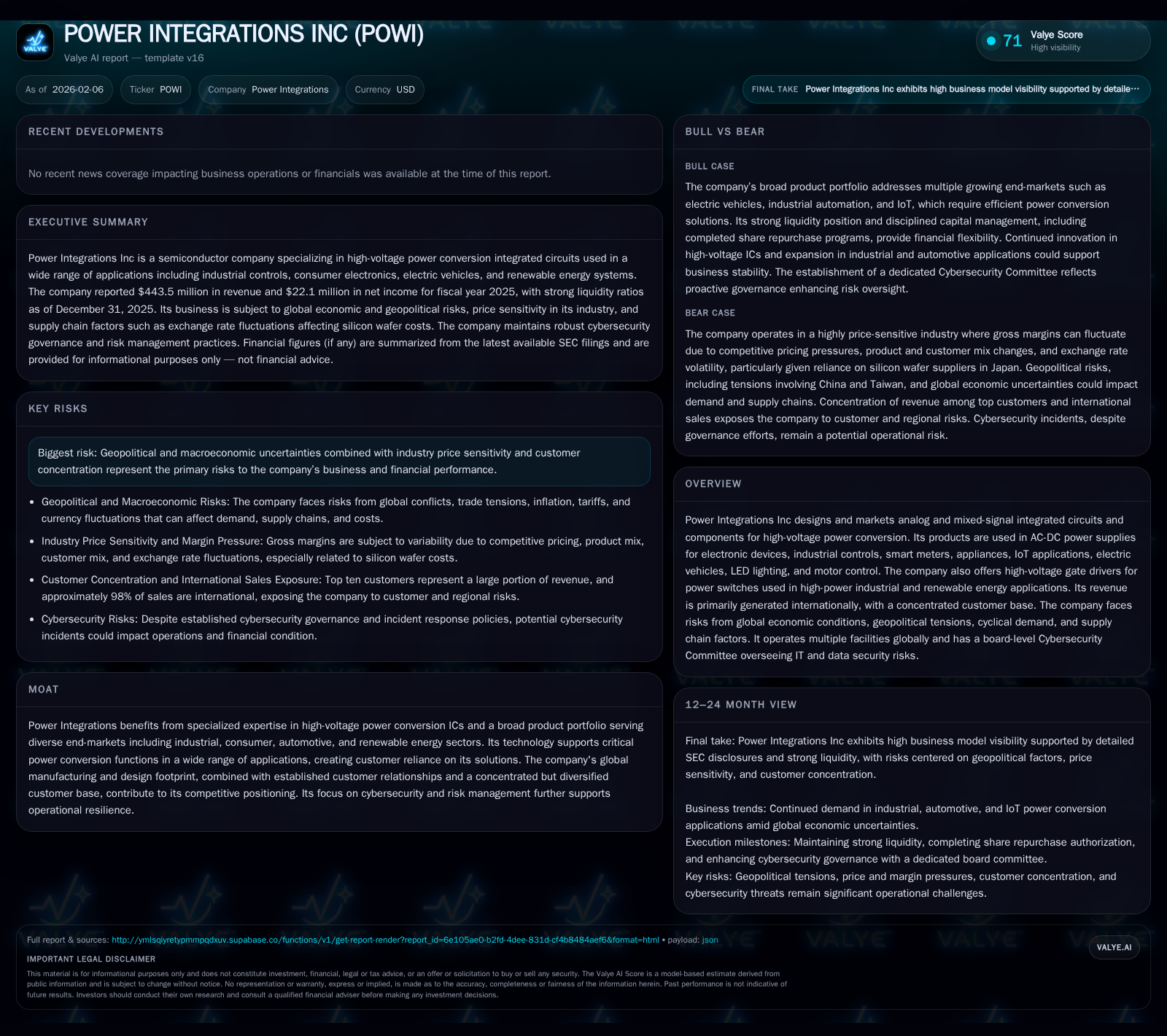

Power Integrations (POWI) stands at the forefront of high-voltage power conversion ICs, powering a diverse array of applications from consumer electronics to renewable energy. The company’s latest earnings surpassed expectations, driven by robust international demand and margin management despite persistent global risks. Its strategic governance focus on cybersecurity and operational resilience coupled with a strong balance sheet positions POWI to navigate geopolitical, macroeconomic, and supply chain pressures while capitalizing on growth opportunities in electrification and IoT domains.

Power Integrations: Enabling the Pulse of Modern Power Conversion

At the heart of today’s digital ecosystem lies an unseen but vital pulse — the flow of power efficiently converted to drive billions of devices worldwide. Power Integrations Inc., ticker POWI, anchors this pulse by designing and marketing specialized analog and mixed-signal integrated circuits tailored for high-voltage power conversion tasks. Their products predominantly enable AC-DC power supplies crucial to electronic devices spanning consumer gadgets to industrial machinery. This expansive portfolio extends into smart meters enhancing grid intelligence, appliances optimizing home energy use, IoT devices unlocking new data frontiers, electric vehicles (EVs) accelerating transportation evolution, LED lighting redefining illumination efficiency, and motor control systems orchestrating precision operations.

Operating globally with owned manufacturing and design facilities across the United States (San Jose headquarters), Europe (Germany R&D center), and Asia (Singapore sales offices among others), POWI balances its engineering excellence with geographical breadth. This dispersed footprint not only facilitates responsiveness to local market demands but buffers some geopolitical uncertainties influencing international trade flows [S1][F1].

Dissecting the Latest Earnings Beat: What Drives Revenue and Profit?

The fiscal year ending December 31, 2025, marked a noteworthy milestone for Power Integrations as revenue reached approximately $443.5 million with net income tallying $22.1 million — figures that comfortably outpaced Wall Street estimates. Management commentary during the Q4 earnings release highlighted strength derived from sustained demand in industrial controls and consumer electronics powering incremental unit shipments. Moreover, product mix optimization along with cost controls supported profit margin expansion despite raw material volatility cited across the semiconductor sector.

Key drivers included ramp-ups in EV-related components and ongoing adoption of smart grid technologies where POWI's ICs play indispensable roles converting high voltages safely and efficiently. These contributors reveal not just transient sales upticks but affirm underlying structural growth backed by resilient end-market expansion patterns [N1][N2][F1].

Global Footprint and Customer Dynamics: Balancing Diversification and Concentration

While Power Integrations’ revenue is predominantly international — reflecting its deep integration in global supply chains — its customer base exhibits notable concentration risks common among semiconductor firms reliant on OEM partnerships. Nonetheless, this concentration is somewhat mitigated by diversification across discrete vertical markets such as automotive electrification components, residential appliances, renewable energy systems, and industrial automation.

This multi-industry exposure helps moderate vulnerability to cyclical downturns in any single segment or region yet still demands vigilance given unpredictable geopolitical headwinds affecting cross-border commerce particularly involving China-Europe-US trade dynamics. SEC disclosures prominently outline these macro uncertainties as potential disruptors to order volumes and component pricing structures that form part of POWI's risk landscape [S1][F1].

Technological Moat Rooted in High-Voltage Innovation and Customer Reliance

Power Integrations' competitive edge lies not simply in producing standard power ICs but mastering high-voltage analog circuits integral to power conversion efficiency. This expertise represents an entrenched moat fortified by years of intellectual property accumulation covering device architectures optimized for safety certifications, thermal management, and electromagnetic interference mitigation.

Such technological sophistication fosters customer reliance since substituting established designs involves lengthy qualification cycles with potential performance trade-offs posing unacceptable risks for end-device manufacturers. The company’s broad portfolio serving mission-critical power functions entraps clients within POWI’s ecosystem — a compelling barrier against commoditization pressures prevalent elsewhere in semiconductors [valye_report_excerpt.moat][S1].

Governance Spotlight: Cybersecurity Leadership as a Competitive Edge

In today's interconnected hardware landscape where digital threats increasingly target operational technology layers alongside IT networks, POWI’s governance stance offers distinct differentiation. Since 2018, the Chief Information Security Officer (CISO) has brought over 25 years of executive-level expertise managing complex IT infrastructures at leading tech firms to steer company-wide cybersecurity strategy.

The establishment of a dedicated board-level Cybersecurity Committee underscores management’s prioritization of proactively addressing cyber risk exposures that could interrupt production or compromise sensitive design data. The committee receives comprehensive quarterly updates covering threat assessments, incident response readiness procedures involving cross-functional teams including legal and finance arms, security training initiatives for personnel awareness enhancement, vendor risk evaluations ensuring supplier ecosystem integrity, as well as regulatory compliance surveillance.

This governance framework converts abstract cyber threat landscapes into quantifiable operational risk metrics informing strategic decision-making — reinforcing POWI’s reputation for robust operational resilience beyond mere product innovation [S1].

Navigating Headwinds: Geopolitical, Macroeconomic, and Supply Chain Pressures

Amid growth optimism lie tangible challenges posed primarily by geopolitical tensions constraining semiconductor trade flows alongside macroeconomic slowdown fears that can suppress capital expenditure budgets among industrial clients. Commodity pricing sensitivity exacerbates margin pressures while lingering global supply chain fragilities threaten timely component deliveries essential for maintaining assembly schedules.

Management acknowledges these headwinds candidly within SEC disclosures enumerating risks tied to economic cyclicality and price competition characteristic of the industry. Nonetheless, evidence from recent earnings suggests agile inventory management practices combined with diversified sourcing strategies have helped soften immediate impacts.

This pragmatic approach transforms potential circuit breakers into managed voltage regulators maintaining steady operational output without catastrophic outages [valye_report_excerpt.risks][S1].

Financial Health Check: Liquidity, Leverage, and Operational Efficiency

Scrutinizing Power Integrations' balance sheet reinforces confidence in its financial robustness underpinning strategic flexibility. The company closed fiscal 2025 carrying approximately $58.7 million cash and equivalents set against current liabilities near $70.4 million yielding an exceptionally healthy current ratio near 6.51 — signaling ample short-term liquidity coverage.

Current assets approximating $458 million further augment this cushion while limiting financial leverage empowers sustainable investments in R&D focused on emerging power architectures without compromising solvency amid external shocks.

Such liquidity strength serves as a buffer akin to an oversized capacitor bank smoothing volatile cash flow currents typical within semiconductor cycles maintaining stable voltage for innovation initiatives [F1].

Market Momentum: Technical Trends and Yield Storytelling

From a market technical perspective, recent trading activity reveals bullish undertones as POWI's stock price ascended above critical moving averages — a development often interpreted by technicians as confirmation of upward momentum signaling improving investor sentiment.

Simultaneously crossing the dividend yield threshold beyond 2% enhances attractiveness for income-oriented shareholders seeking stable payout streams reinforced by fundamental performance consistency.

Together these signals articulate a positive narrative about market confidence aligning with the company’s fundamental strides suggesting that undercurrents supporting POWI’s valuation profile are strengthening [N4][N5].

Strategic Outlook: Positioning Amid Emerging Technologies and Market Shifts

Looking ahead through a strategic prism reveals a company poised to capitalize on megatrends reshaping power electronics content globally. While generative AI itself may not directly consume high-voltage ICs extensively yet ([N3]), the explosion of connected intelligent devices within IoT ecosystems intrinsically depends on efficient power converters integrating POWI’s chips.

Electrification momentum especially within EVs continues requiring robust gate driver technologies enabling reliable switching for traction motors highlighting further synergy with POWI’s product roadmap.

Nevertheless, sustaining footholds amid evolving market dynamics mandates vigilant navigation of external risks coupled with relentless innovation effort — ensuring that Power Integrations remains both the pulse producer powering tomorrow's devices and the guardrail maintaining consistent delivery amid stormy macroeconomic climates [valye_report_excerpt.overview][N3].

This analysis is based solely on publicly available information including recent SEC filings and verified news sources as detailed in citations. It does not constitute investment advice or recommendations.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments