Super Micro Computer's AI Pivot and Nvidia Partnership Amid Tech Sector Volatility

SMCI’s Q2 earnings surge underscores its strategic role in AI server hardware alongside Nvidia, with solid financials supporting resilience.

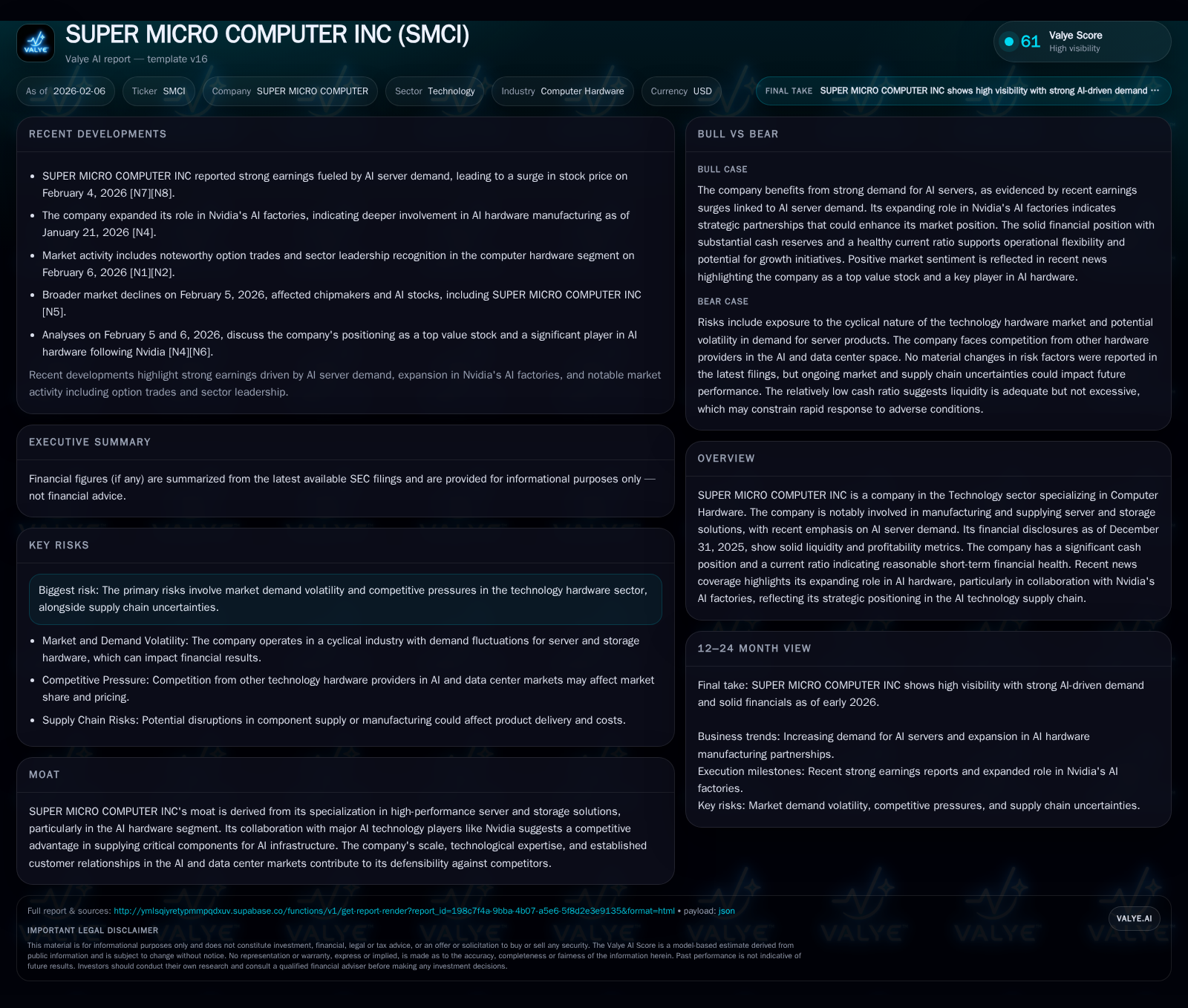

Super Micro Computer Inc. (SMCI) has accelerated on the back of booming AI server demand, delivering a Q2 earnings beat that caught market attention. Its expanding collaboration with Nvidia underscores a growing architectural footprint in AI infrastructure, reinforcing its competitive moat. Despite this momentum, sector volatility and cyclical risks remain formidable challenges, making the sustainability of its rally an open question tied to execution and broader market conditions.

Riding the AI Wave: SMCI’s Earnings Breakout

Early February 2026 saw Super Micro Computer’s share price surge in response to its blowout second-quarter earnings report. The tech market buzzed as SMCI reported revenue figures that surpassed analyst expectations with a notable year-over-year rise—fuelled predominantly by surging demand for servers optimized for artificial intelligence workloads. This breakout quarter was more than a one-off spike; it signaled SMCI’s deeper integration into the AI hardware boom rippling across data centers worldwide [N1][N5][N6].

Investor enthusiasm was palpable yet tempered, reflecting an acute awareness that gains tied to evolving AI demands must prove sustainable beyond headline results. Still, this earnings missive positioned SMCI at the forefront of beneficiaries from rapidly proliferating AI applications—which require specialized high-performance compute infrastructure that few providers can deliver at scale.

Inside Super Micro’s AI Hardware Edge and Nvidia Partnership

Central to SMCI's recent ascent is its expanding footprint within Nvidia's 'AI factories'—a term describing Nvidia’s ecosystem for custom AI server manufacturing partnerships. This collaboration is pragmatically transformative for Super Micro. It leverages both firms’ strengths: Nvidia contributes cutting-edge GPU architectures driving AI model training, while SMCI supplies complementary server platforms designed for seamless integration and high reliability [N9].

This partnership differentiates Super Micro from commodity server providers by embedding it directly within next-generation AI infrastructure rollouts. It underscores a product pipeline innovation cycle keyed into one of technology’s fastest growth segments. Market narratives casting SMCI alongside Nvidia position it not just as a hardware vendor but as a strategic participant in shaping future compute environments essential to an evolving digital economy [N7].

Financial Fortitude: Liquidity and Profitability Under the Microscope

Beyond exciting operational headlines lie the financial fundamentals that anchor SMCI's ability to sustain its growth trajectory amid sector uncertainties. As of December 31, 2025, the company reported an enviable cash and cash equivalents balance exceeding $4 billion—a considerable war chest providing a buffer amid capital-intensive demands typical for hardware innovation cycles [F1].

Coupled with this is SMCI’s current ratio of approximately 1.7, indicating ample short-term liquidity relative to immediate liabilities—reflecting sound working capital management. The firm's net income reported at over $400 million suggests healthy profitability supporting reinvestment capabilities [F1]. These metrics jointly offer reassurance that SMCI is financially equipped to capitalize on long-term AI-driven opportunities while weathering episodic market disruptions documented by technology vendors broadly [S2].

Navigating Market Volatility: Addressing Sector Risks Head-On

Yet no analysis would be complete without confronting intrinsic risks inherent to a niche technology hardware provider operating amidst volatile macro trends. Super Micro explicitly acknowledges fluctuations in customer demand sensitivity—a reflection of how rapidly evolving enterprise IT budgets adapt to shifting economic conditions [S2].

Supply chain complexities add layers of uncertainty as component shortages or logistical bottlenecks can pressure margins or lead times. Competitive intensity also remains fierce given numerous global players aiming to carve their own space within the lucrative AI server segment—necessitating constant innovation and cost discipline from SMCI [valye_report_excerpt].

These factors underscore why vigilance remains paramount for stakeholders observing whether growth waves can translate into durable competitive advantage rather than transient spikes.

Competitive Moat: Scale, Tech, and Relationships in AI Server Space

Super Micro’s moated position arises from multiple reinforcing vectors: proprietary engineering expertise tailored toward high-performance computing; scale efficiencies allowing agility in production volumes; and trusted long-standing customer relationships particularly within hyperscale data center operators—all pivotal in anchoring recurring revenue streams around mission-critical applications [valye_report_excerpt].

Embedding into Nvidia’s supply chain grants additional leverage—creating barriers to entry for competitors who may struggle to match ecosystem intimacy coupled with blended software-hardware optimizations unique to such collaborations [N7]. This synergy blends product excellence with strategic positioning—a blend rare among peers mostly competing on commoditized specs alone.

Stock Sentiment vs. Fundamentals: Is the Rally Justified?

While analysts and investors celebrated the post-earnings price pop enthusiastically, some voices urge circumspection. The broader tech sector experienced sell-offs soon after SMCI’s rally, particularly impacting chipmakers and related suppliers—a reminder of how quickly sentiment can shift under rising interest rate environments and geopolitical uncertainties affecting supply chains globally [N4][N8].

Such dynamics underscore an essential truth: valuation moves driven heavily by hype may overshoot fundamentals if underlying operational improvements falter or if competitive responses erode margins. Yet a contrasting view highlights SMCI as a compelling value proposition given solid earnings growth supported by real technology leadership traits rather than mere speculative exuberance [N14].

Balancing these perspectives offers investors a framework appreciating the dual nature of momentum stocks within cyclical industries—where timing entry points around confirmed fundamental progress rather than headline euphoria is key.

The Road Ahead: Growth Catalysts and Potential Pitfalls

Looking forward, Super Micro stands at a promising though challenging inflection point. The secular tailwinds powering demand for specialized AI infrastructure are unlikely to abate soon—especially with exponential growth forecasted across machine learning models requiring scalable compute resources [valye_report_excerpt].

Success will depend on winning deeper engagements across both hyperscaler ecosystems and emerging vertical use cases while maintaining disciplined execution amid intensifying competition that could compress pricing power or escalate R&D spending needs. Supply chain resilience strategies will also be tested given ongoing global uncertainties documented broadly across semiconductor-reliant hardware sectors [S2].

Ultimately, Super Micro’s journey exemplifies today’s complex technology landscape where innovative partnerships paired with solid financial footing create pathways for value creation—but do not eliminate inherent cyclicality nor strategic risks inherent to cutting-edge industrial ecosystems.

Disclaimer: This report is for informational purposes only and does not constitute investment advice or recommendations. Readers should conduct their own research or consult professional advisors before making any financial decisions.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments