VIASAT Surges with Q3 Earnings Beat and Expands In-Flight Wi-Fi Moat Amid Industry Pressures

Strong quarterly results underscore VIASAT's robust satellite infrastructure and strategic commercial partnerships despite capital-intensive risks.

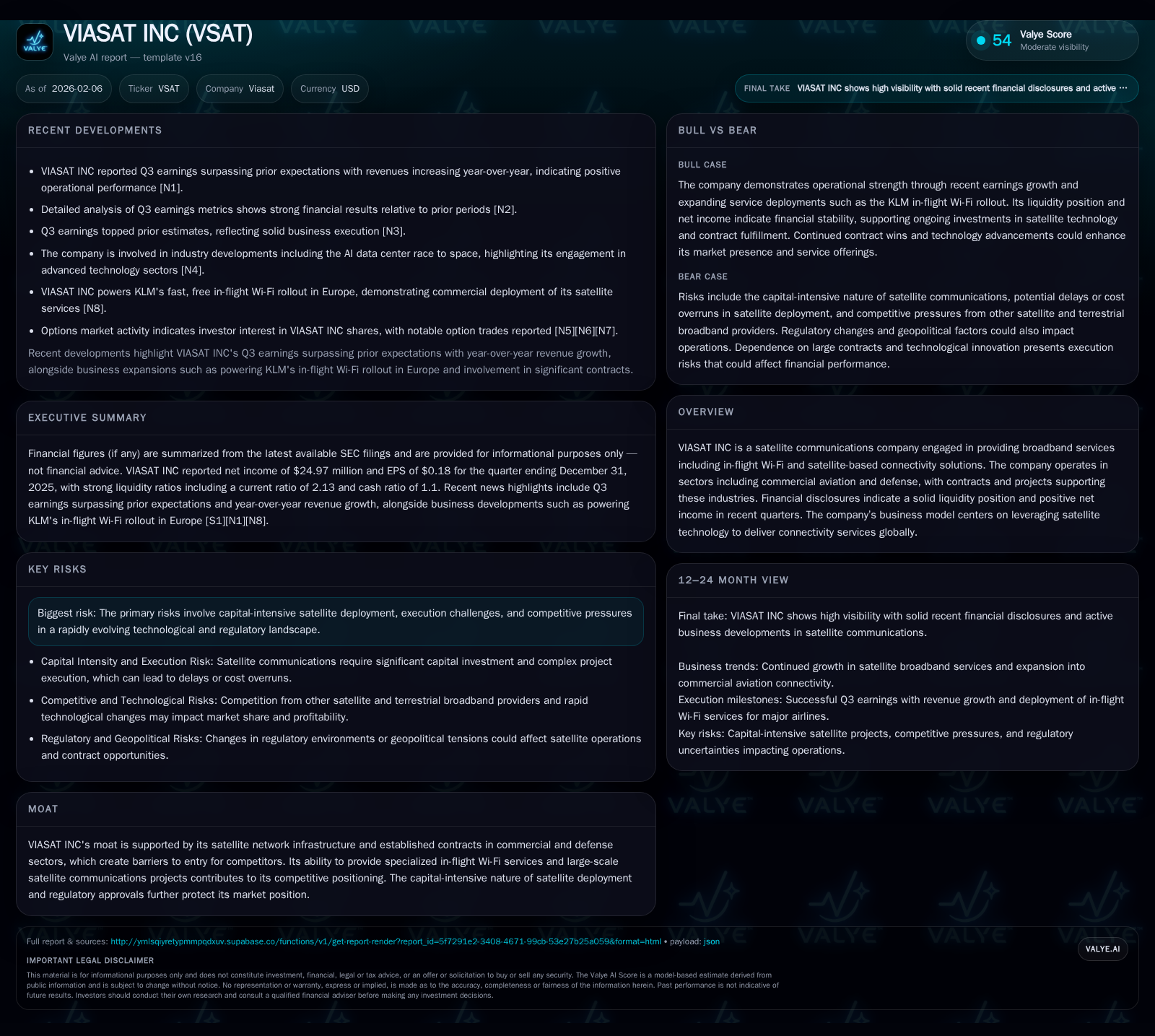

VIASAT INC’s latest Q3 earnings surpassed expectations, driven by sustained revenue growth and solid net income performance. The company’s strategic investments in satellite network infrastructure and a pivotal role in commercial aviation in-flight Wi-Fi deployments, such as KLM’s rollout, reinforce its competitive moat. However, challenges persist from the capital-heavy satellite launch demands and evolving competitive pressures in the dynamic satellite communications industry.

Breaking Down VIASAT's Latest Earnings Surge

VIASAT INC reported Q3 results that handily beat market expectations, underscoring the company’s continued operational execution despite a challenging aerospace environment [N1][N2][N3]. Total revenues showed a year-over-year increase reinforcing positive top-line momentum. The company posted notable net income gains as well, reporting figures consistent with advancing profitability trends by fiscal year-end [F1][S2]. A current ratio north of 2.0 signals solid short-term financial health, indicating that VIASAT maintains sufficient liquidity to meet near-term obligations while funding its growth initiatives.

The earnings beat serves as evidence that VIASAT’s business model—anchored on scalable satellite broadband solutions and niche markets like in-flight connectivity—is gaining traction. This financially robust quarter reflects disciplined cost management aligned with expanding service contracts and increasing adoption of satellite-based broadband offerings.

Financial Fortresses: Liquidity and Profitability at a Glance

A deeper dive into VIASAT's balance sheet reveals a resilient foundation supporting its capital-intensive operations. Cash and cash equivalents stood at approximately $1.35 billion at the latest reporting period end [F1], complemented by $2.65 billion in current assets against $1.25 billion in liabilities, yielding a strong current ratio of 2.13 [F1].

This liquidity buffer is crucial given the steep costs associated with satellite design, manufacturing, launching, and ongoing maintenance—a hallmark challenge in the satellite communications sector. Such financial stoutness enables VIASAT to sustain multi-year satellite projects without jeopardizing operational continuity or flexibility. Profitability improvements alongside this liquidity further suggest the company is navigating capital demands efficiently.

The Moat: Satellite Infrastructure Meets In-Flight Connectivity

VIASAT's moat resides primarily in its expansive proprietary satellite network infrastructure coupled with exclusive contracts across commercial aviation and defense spheres [valye_report_excerpt.moat][N10]. Crucially, the company commands a significant position in providing specialized in-flight Wi-Fi services—a niche yet high-value segment.

The partnership powering KLM’s fast, free European in-flight Wi-Fi rollout epitomizes VIASAT’s ability to embed itself into airline operations as an essential technology provider [N10]. This deployment not only drives recurring revenues but erects barriers against potential entrants via complex integration requirements and longstanding contractual relationships.

Moreover, established ties with defense customers bolster VIASAT's competitive insulation by anchoring dependable revenue streams less susceptible to commercial market volatility. These dual-sector engagements create layered protective moats hard for rivals lacking comparable technical infrastructure or client trust to overcome.

Navigating Challenges: Capital Intensity and Execution Risks

Despite these strengths, VIASAT confronts inherent risks tied to the capital intensity of satellite launches and network expansions. Upfront costs remain significant hurdles, often compounded by complex regulatory approval processes that can delay project timelines or inflate budgets [valye_report_excerpt.risks][S2].

Execution missteps—whether from technological setbacks or supply chain disruptions—pose additional threats given the high stakes involved. Intensifying competition from next-generation satellite operators pushing low earth orbit (LEO) constellations also pressures pricing models and innovation cycles.

Regulatory landscapes continue evolving globally around spectrum allocation and space traffic management, requiring proactive compliance efforts to avoid punitive impacts or deployment constraints.

Spotlight on Commercial Aviation: Powering KLM’s Wi-Fi Rollout

Highlighting VIASAT’s commercial prowess is its pivotal role providing KLM’s fleet with high-speed inflight connectivity—a service increasingly demanded by passengers expecting seamless digital access [N10]. This partnership signifies not just a revenue stream but a validation of VIASAT’s sophisticated data transmission capabilities across large geographies.

Such commercial aviation contracts are transformative for VIASAT's profile because they embed the company within airline ecosystems at multiple touchpoints—hardware installation, ongoing service delivery, customer support—thereby cementing long-term relationships that are less price-sensitive due to quality dependency.

The KLM rollout serves as an archetype case showcasing how tailored applications of satellite broadband can drive differentiated value propositions beyond mere commodity internet access.

Defense Contracts: Anchoring Stability in a Competitive Space

While commercial aviation garners headlines, defense contracts form another critical pillar for VIASAT’s balanced portfolio [valye_report_excerpt.overview]. Government projects typically involve multiyear engagements with stringent performance criteria but often provide steady funding streams insulated from fluctuating consumer trends.

This bifurcated sector approach enhances revenue stability; when commercial demand softens or faces disruption due to macroeconomic factors or alternative technologies, defense programs offer resilience through predictable procurement cycles.

Exploiting this dual-sector strategy necessitates maintaining rigorous compliance standards and delivering cutting-edge solutions meeting both military-grade security requirements and technical performance benchmarks.

Investor Moves and Market Sentiment: Insider Sales and Options Activity

Investor behavior presents a nuanced picture for VIASAT’s outlook. Notably, recent insider sales by CEO-level executives saw shares worth around $4 million liquidated [N6], which some interpret cautiously given typical insider sales precede risk recalibrations or personal portfolio rebalancing.

Contrasting this are vigorous options market activities signaling bullish bets on VSAT shares at strike prices around $15 with potential double-digit returns cited by strategists using options-based approaches [N7][N8][N9][N11]. This divergence illustrates how institutional players may anticipate upside contingent on successful execution of upcoming initiatives while insiders possibly tilt towards liquidity extraction amid lingering uncertainties.

Parsing these signals requires considering context—insider sales do not inherently imply negative views if motivated by personal financial strategies; meanwhile sophisticated options flows can be speculative or hedging rather than unequivocal directional bets.

Future Horizons: Navigating the Evolving Satellite Landscape

Looking ahead, VIASAT operates against a backdrop of rapid technological evolution reshaping industry dynamics. One emerging trend from adjacent space ventures like SpaceX involves relocating AI data center capabilities into orbit for latency reduction and energy efficiency gains [N5]. Such innovations could recalibrate competitive positioning or open new market segments needing scalable satellite bandwidth.

However, these advances also bring sharper competition—both from incumbent giants expanding capacity and nimble startups leveraging novel architectures—intensifying pressure on legacy operators like VIASAT to keep innovating.

Regulatory vigilance remains paramount as governments worldwide deliberate more comprehensive frameworks addressing orbital congestion risks and spectrum usage rights [valye_report_excerpt.risks]. Successfully navigating this confluence demands flexibility in capital allocation, strategic partnerships, and technological investments if VIASAT aims to maintain its moated status amidst escalating challengers.

Disclaimer: This document is a factual analysis intended solely for informational purposes based on public disclosures and industry context as of early 2026. It does not constitute investment advice or recommendations regarding any securities mentioned herein.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments