Ventas, Inc. FY2025 Performance and Strategic Positioning Amid Market Challenges

An in-depth analysis of Ventas’ strong financial results, segment dynamics, liquidity profile, and risk disclosures highlights both resilience and complexities.

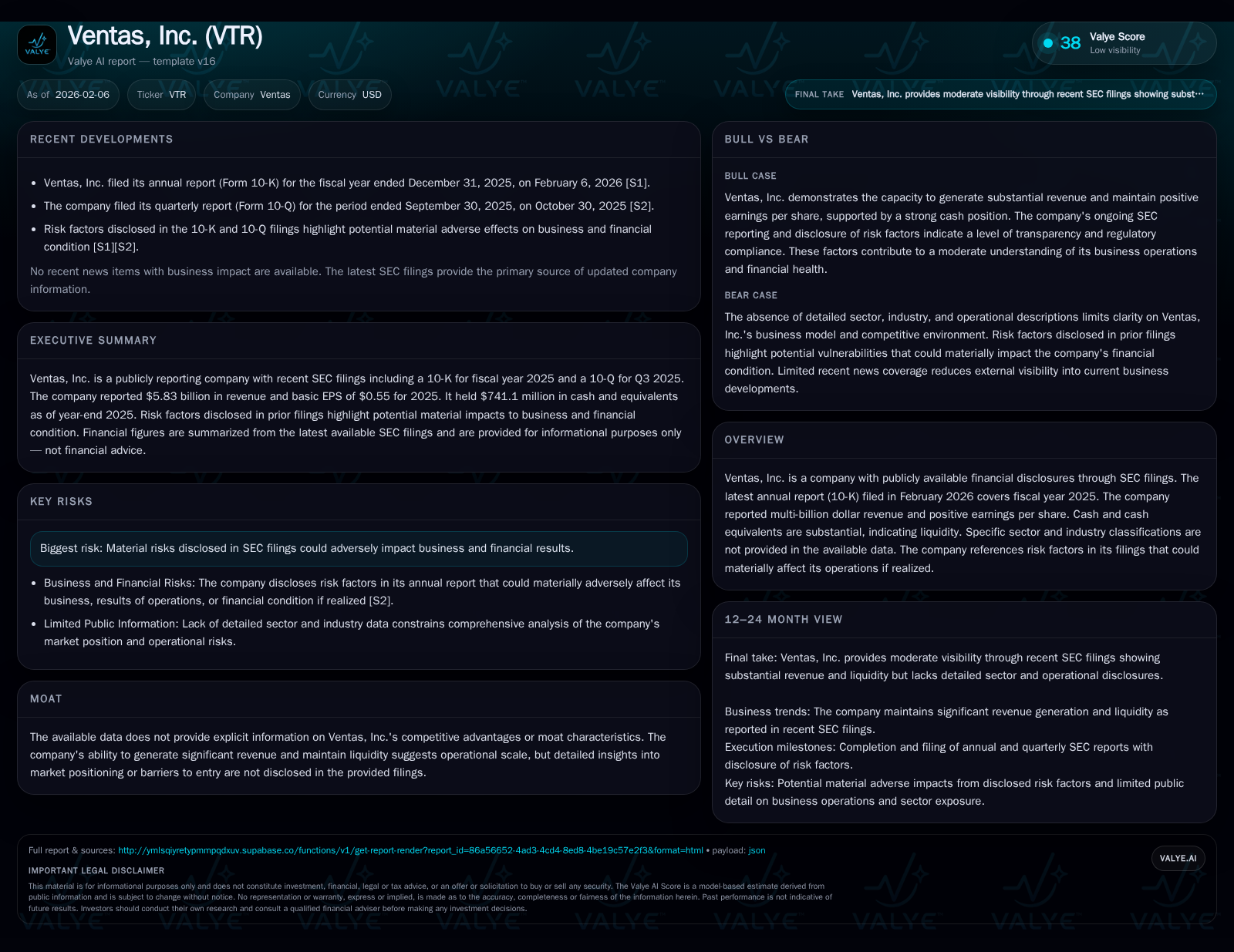

Ventas, Inc. closed fiscal 2025 with robust revenue of $5.83 billion and sustained liquidity of $741 million in cash equivalents, underpinning operational stability amid sector uncertainties. The company’s diverse segment portfolio—including triple net leased properties, outpatient medical facilities, senior living operations, and third-party capital management—reflects evolving strategy though explicit moat characteristics remain undisclosed. Risk factors outlined in SEC filings emphasize macroeconomic and regulatory headwinds that could materially impact future results. Market response post-Q4 earnings signals positive investor sentiment tempered by cautious positioning given the absence of clear moat advantages.

A Closer Look at Ventas’ FY2025 Financial Milestones

Ventas wrapped fiscal year 2025 with a commendable revenue performance totaling approximately $5.83 billion [S1][F1]. This achievement aligns with its reported Funds from Operations (FFO), which met Wall Street estimates as echoed in multiple post-earnings analyses [N1][N6]. Such metrics underscore the company's ability to generate significant top-line cash flow amid evolving economic conditions. The company also reports positive earnings per share contextually supporting a baseline of profitability, albeit the focal metric remains its operational cash flow proxies. Underpinning these financials is a notable cash position—$741 million in readily available cash and equivalents—signaling robust liquidity that equips Ventas to navigate capital needs or unexpected market disruptions [F1].

While these headline figures illustrate broad financial health, they mask a complexity within its segmental influences and risk exposures that merit granular examination.

Breaking Down Segment Contributions: Senior Living to Capital Management

Ventas delineates its operations across three primary reportable segments: triple net leased properties; outpatient medical and research portfolios; and resident fees and service revenues associated with senior living operations [S1]. Additionally, a third-party capital management segment extends the company's footprint into asset management services.

The triple net lease segment represents traditional REIT rental income streams predominantly grounded in long-term lease agreements. Concurrently, the outpatient medical portfolio reflects strategic positioning within healthcare real estate—a sector experiencing structural change due to demographic shifts and technological integration. Resident fees and services comprise variable revenue tied directly to senior living operations; this segment often contends with occupancy cycles and regulatory scrutiny influencing performance variability.

The capital management function broadens operational scope by managing external funds which may provide fee-based income diversification but also introduces exposure to third-party investors' appetite and market conditions.

Analyzing the latest report reveals potential subtle strategic shifts: increased emphasis on outpatient medical properties suggests adaptation toward emerging healthcare trends while maintaining core leased-assets stability. However, detailed segment-level contribution figures are not explicitly provided here to quantify weightings or growth trajectories precisely.

Liquidity & Capital Structure: A Buffer in Uncertain Markets

Liquidity remains paramount for real estate investment trusts navigating fluctuating interest rate environments and credit markets. Ventas' $741 million in cash and cash equivalents at year-end 2025 represents a sizeable immediate cushion [F1]. While this bolsters short-term solvency confidence, comprehensive evaluation necessitates insight into outstanding debt maturities, leverage ratios, covenant obligations, and refinancing risks—which the current dataset does not fully disclose [S1].

Nonetheless, maintaining such cash reserves during an era marked by macroeconomic challenges indicates prudent treasury management aimed at preserving optionality.

This liquidity allows Ventas to exploit prospective acquisition opportunities or absorb operational shocks originating from tenant defaults or adverse regulatory developments within its healthcare-adjacent portfolios.

Analyzing Risk Factors from the Latest SEC Disclosures

The company’s 2025 filings enumerate several material risk factors consistent with REIT industry norms [S2][S1]. Foremost among these are macroeconomic headwinds including inflationary pressures impacting operating costs and tenant solvency; fluctuations in interest rates potentially elevating debt servicing costs; evolving healthcare regulations that can alter reimbursement rates or compliance burdens; plus uncertainties related to public health events affecting senior living occupancy trends.

Additional risks cited involve dependency on key tenants within leased asset classes—default scenarios could materially impair rental income streams—and liquidity constraints that may limit flexibility under stressed market conditions.

Importantly, the language employed is cautious yet non-speculative—highlighting that realized risks could materially affect financial outcomes but stopping short of forecasting their occurrence.

Investors monitoring Ventas should weigh these risk disclosures heavily when contextualizing recent strong FFO results.

Market Sentiment and Stock Dynamics Post-Q4 Earnings

Following its Q4 FY2025 reporting period, Ventas’ shares experienced notable appreciation trending approximately +10.9% over a recent three-month span [N8]. Analysts attribute this uplift partly to earnings that met or slightly exceeded expectations alongside improvements in same-store cash Net Operating Income (NOI) signaling operational momentum [N1][N2].

Investor engagement manifests increasingly sophisticated strategies such as options-driven "yield boost" approaches amplifying effective dividend returns—shifting nominal yields from ~2.5% up to more aggressive ~8.3% brackets [N9]. This suggests heightened demand for income alternatives in a low-rate yet volatile environment.

Additionally, technical indicators identified periods where the stock entered oversold territory before stabilizing gains [N10], illustrating a dynamic interplay of fundamental strength supporting price resilience.

Market behavior thus reflects both confidence in underlying business performance tempered by ongoing caution given sector exposures.

What the Absence of Clear Moat Insights Implies for Investors

A striking aspect discerned from Ventas’ 10-K disclosures is the absence of explicit articulation regarding durable competitive advantages or moat characteristics [S1][valye_report_excerpt]. Unlike some peers who emphasize barriers such as proprietary operating platforms or entrenched market positions, Ventas offers limited direct commentary on such defenses.

While reporting robust revenues and liquidity imply scale economies and operational efficacy, the lack of definitive moat delineation invites closer scrutiny about potential vulnerability to competitive pressures or cyclical downturns.

For buy-side analysts aiming beyond headline metrics, this gap suggests tempering conviction with guardrails against complacency—future moats may emerge through strategic initiatives or market repositioning but currently remain ambiguous.

This observation opens analytical avenues exploring whether operational scale alone suffices amid intensifying competition within specialized healthcare real estate sectors.

Strategic Outlook: Navigating Growth Amid Shifting Industry Currents

Integrating Ventas’ financial robustness with its nuanced segment exposure reveals a company endeavoring to balance legacy income streams from triple net leases with growth-oriented investments in outpatient medical facilities and senior living services [S1][N4][N5][valye_report_excerpt]. This blend exposes it simultaneously to stable rental contracts yet cyclical healthcare demand patterns complicated by regulatory flux.

Going forward, vigilant monitoring of macroeconomic indicators alongside policy developments affecting healthcare funding will be essential. Capital allocation moves—including potential acquisitions funded by existing liquidity—could signal management’s confidence trajectory.

Additionally, progress within third-party capital management may diversify revenue sources but warrants careful appraisal concerning external fund flows sensitivity amid broader economic volatility.

Given these intersecting factors, stakeholders should maintain a balanced view recognizing strong FY2025 accomplishments while acknowledging layered risks inherent in complex REIT business models reliant on sector-specific trends.

This analysis is based solely on publicly available information as of February 2026 including SEC filings and relevant Nasdaq news sources. It is intended for informational purposes without offering investment recommendations or advice.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments