Diginex Ltd’s ESG AI Ambitions Amid Leadership Change and Complex Capital Dynamics

Diginex propels its AI-powered ESG compliance vision through aggressive acquisitions and strategic funding, facing execution and dilution challenges.

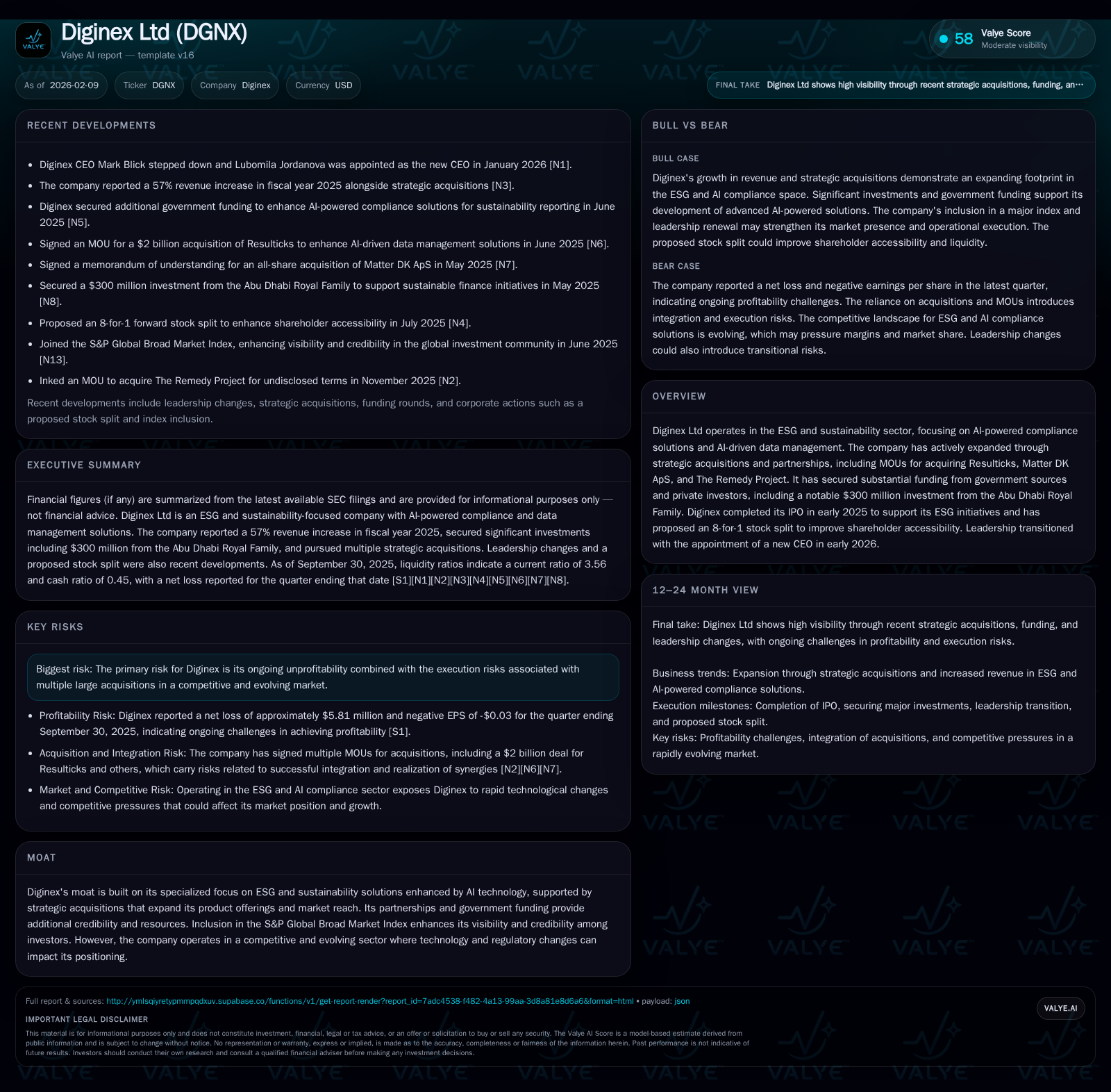

Diginex Ltd has quickly carved a niche as a sustainability-focused AI provider following its early 2025 IPO. Bolstered by substantial capital infusions, including a $300 million investment from the Abu Dhabi Royal Family, it pursues growth through key acquisitions and partnerships. However, the recent CEO transition and potential shareholder dilution due to large warrants linked to chairman-owned Rhino Ventures introduces new complexities. While Diginex’s strategic positioning leverages regulatory tailwinds in ESG AI compliance, integrating acquisitions and achieving profitability remain significant hurdles.

The Rise of Diginex: From IPO to ESG AI Pioneer

Diginex Ltd emerged publicly via an early 2025 IPO with a clear ambition: to pioneer AI-powered compliance solutions centered on environmental, social, and governance (ESG) criteria. This move was not merely about accessing public markets but strategically positioning itself at the confluence of burgeoning investor demand for ESG accountability and rapid advancements in artificial intelligence capabilities.

By embedding AI at the core of its compliance and data management platform, Diginex addresses a critical pain point for corporations navigating complex sustainability regulations worldwide. Its timely public offering laid the groundwork for funding innovation, scaling operations, and pursuing growth through both organic development and targeted acquisitions. This foundational step set a tone for aggressive expansion but also exposed Diginex to the pressures accompanying rapid scale-up efforts.

Leadership at a Crossroads: CEO Transition and Its Implications

In late January 2026, Diginex signaled a pivotal shift when founder and CEO Mark Blick stepped down after guiding the company through its formative IPO phase [N1]. His successor, Lubomila Jordanova, stepped into leadership at a juncture where strategic focus pivots from market entry towards consolidation and execution excellence.

This leadership change invites questions about continuity versus change within the company’s trajectory. Jordanova inherits a complex integration agenda following multiple acquisitions alongside intense capital management demands. Her ability to balance operational rigor with visionary growth will be critical in transforming Diginex’s promising technology stack into sustainable commercial success.

Timing-wise, this transition occurs after Diginex secured substantial funding and completed several MOUs for acquisitions—a potentially volatile moment demanding stable command to manage both internal culture shifts and external stakeholder confidence.

Strategic Acquisitions Fueling Market Reach and Moat Expansion

Diginex’s growth narrative heavily features its recent MOUs targeting acquisitions of Resulticks, Matter DK ApS, and The Remedy Project [valye_report_excerpt]. Each targets a specific facet of the ESG ecosystem or data analytics capabilities essential for robust compliance solutions.

Resulticks brings advanced customer engagement technology adaptable for regulatory reporting frameworks; Matter DK enhances renewable energy analytics expertise; The Remedy Project introduces specialized sustainability impact assessment tools. Together these assets deepen Diginex's AI-driven solution stack, serving as both moat enhancers—improving competitive differentiation—and catalysts for expanding client reach.

However, such aggressive dealmaking also raises inherent integration risks. Successfully melding diverse cultures, systems, and product lines without diluting focus or delaying delivery will test Diginex’s operational maturity.

Financial Snapshot: Hypergrowth vs. Persistent Unprofitability

Reviewing the latest available financials sheds light on the tension between rapid expansion ambitions and financial discipline [F1]. For the fiscal year ending September 2025:

- Revenue stood around $2 million.

- Net losses totaled approximately $5.8 million.

- Cash on hand was roughly $1.85 million.

- Current assets outpaced current liabilities by over threefold (current ratio around 3.56).

While liquidity metrics suggest sufficient short-term runway to fund operations, ongoing losses highlight the challenge of translating ambitious top-line growth into profitability. This pattern is common among high-growth tech firms but places pressure on management to demonstrate credible paths toward sustainable margins before capital exhaustion becomes urgent.

Warrants and Ownership Dilution: Decoding the Rhino Ventures Episode

One complexity accentuating shareholder scrutiny involves warrants granted to Rhino Ventures Limited (RVL), an entity controlled by Diginex Chairman Miles Pelham [S2]. The corrected issuance dated July 15, 2024 grants RVL 4.17 million warrants exercisable until mid-2027 at $6.13 per share.

Crucially, if all warrants are exercised, this could lead to RVL holding nearly 51% of outstanding shares—effectively creating a potential control pivot point that dilutes existing ownership considerably. These dynamics raise governance questions given overlapping executive influence and may temper investor enthusiasm until clarity emerges on warrant exercise likelihood or buyback strategies.

Such warrant structures are often utilized as incentives or restructuring tools but carry risk of unexpected shifts in control balance that must be closely monitored by stakeholders.

Government & Private Capital: The Abu Dhabi Royal Family’s Game-Changer

A transformative pillar supporting Diginex’s capital structure is the sizable $300 million investment orchestrated by members of the Abu Dhabi Royal Family [valye_report_excerpt]. This infusion not only cushions financial risks but lends considerable prestige amid competitive ESG AI arenas increasingly crowded by startups backed by traditional VC funds.

Government-linked funding signals confidence in Diginex’s technology roadmap while helping defray costs related to ambitious research efforts and acquisition integration. Moreover, this partnership unlocks strategic access to Middle Eastern markets where sustainability mandates are gaining traction rapidly.

This backing mitigates typical scale-up risks yet amplifies expectations that deployed capital will translate efficiently into differentiated product offerings with tangible client outcomes.

Navigating the ESG AI Landscape: Opportunities Amidst Competition

Globally tightening climate-related disclosure rules coupled with rising social governance awareness create fertile ground for specialized technology providers like Diginex [valye_report_excerpt]. Enterprises striving for compliance face escalating complexity requiring sophisticated analytics platforms embedded with AI automation — precisely where Diginex seeks advantage.

Nonetheless, competition is intense from established software companies expanding into ESG modules alongside pure-play innovators solving niche problems. Moreover, regulatory flux can rapidly alter compliance requirements forcing agility in product development roadmaps.

For Diginex, success depends on leveraging its expanded acquisition-derived capabilities while continuously innovating its AI core to maintain relevance against evolving mandates — a nontrivial challenge demanding sustained investment.

Risks on the Radar: Integration Challenges and Market Volatility

Despite promising prospects, significant risks shadow Diginex’s trajectory [valye_report_excerpt]. Integrating multiple recently acquired businesses without distracting from organic product development threatens execution timelines. Persistent net losses underscore capital consumption patterns that must be reversed long term.

Warrant-induced possible ownership dilution compounds uncertainty regarding future governance dynamics impacting stock valuation sentiment. Proposals such as an 8-for-1 stock split aim at improving liquidity but reveal underlying concerns around share price accessibility amidst complex capitalization structure.

Finally, operating within a volatile market eager yet cautious about emerging ESG technologies means shifts in regulatory environments or macroeconomic conditions could influence short-to-medium term performance unpredictably.

Looking Ahead: Can Diginex Deliver on its Promises?

As Diginex stands today—a still-young public company energized by cutting-edge AI sustainability tools backed by influential sovereign investment—its path forward blends promise with caution. Leadership change situates new stewardship atop challenging integration demands; expansive equity instruments introduce dilution friction; financials reflect growth pains familiar yet intense in this sector.

However, if execution discipline matches visionary ambition—harnessing government/private capital effectively while scaling client adoption—the company could carve durable differentiation in an accelerating global push towards transparent ESG accountability. Investors should watch closely how operational focus sharpens under Ms. Jordanova’s leadership amid an industry landscape where technological innovation is swiftly rewarded but flawed execution penalized heavily.

This analysis aims solely to provide detailed context about Diginex Ltd without prescribing any investment actions.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments