Longduoduo Co Ltd: Navigating Complex Corporate Structures and Single-Partner Dependency Amid Regulatory Risks

Longduoduo’s business hinges on a labyrinthine offshore structure and dominant reliance on Inner Mongolia Honghai, exposing it to multifaceted risks.

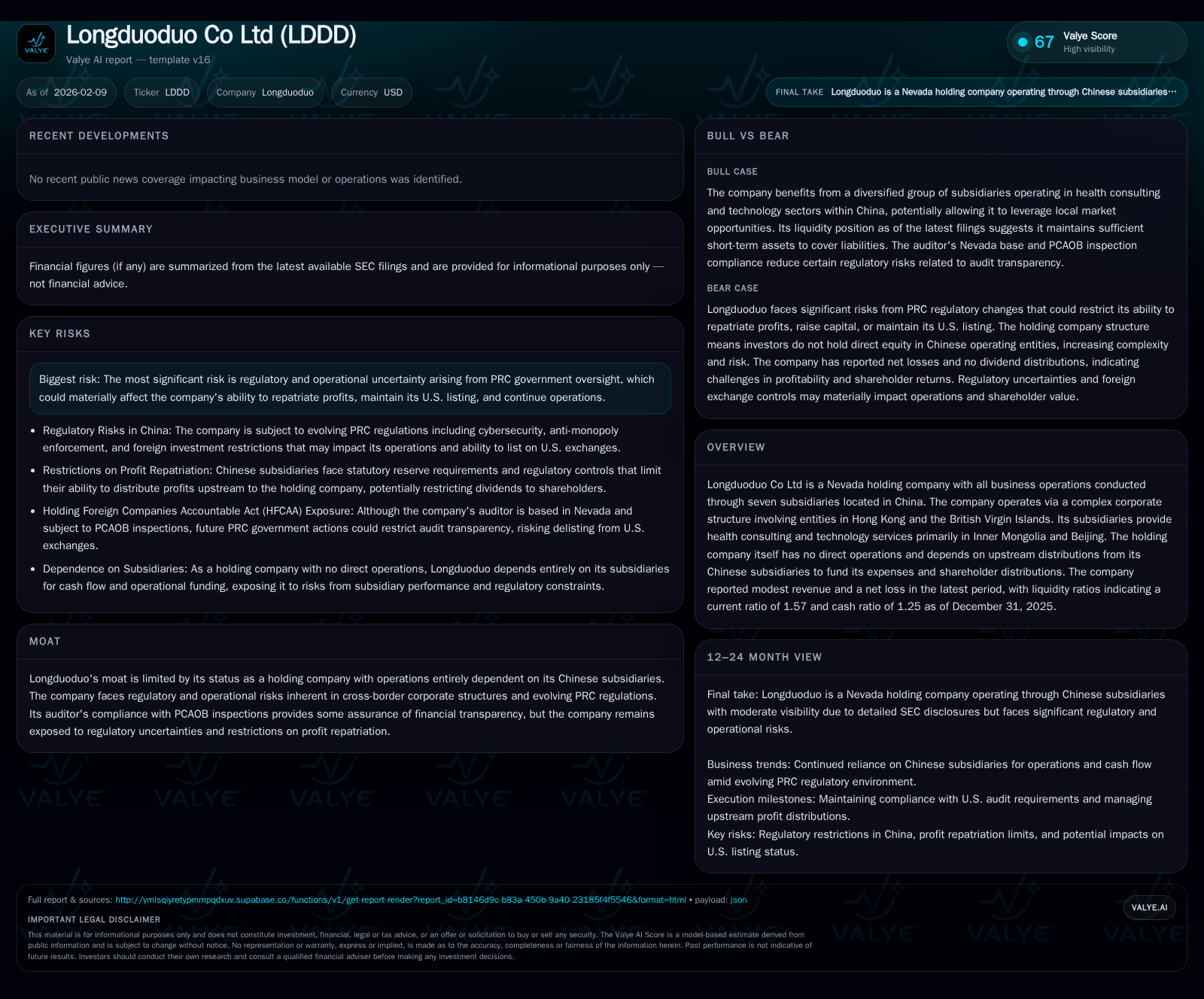

Longduoduo Co Ltd operates through a layered corporate web spanning Nevada, Hong Kong, the British Virgin Islands, and China, with all revenue stemming almost exclusively from a single partner, Inner Mongolia Honghai Health Management Co. Ltd. This outsized dependence, combined with regulatory uncertainties tied to cross-border operations and reliance on third-party healthcare providers, underpins its fragile financial position. While modest revenue and limited liquidity provide some operational runway, the looming expiration of key contracts in mid-2026 and PRC regulatory scrutiny signal caution for the company’s strategic outlook.

Navigating Longduoduo’s Corporate Labyrinth

Longduoduo Co Ltd anchors itself as a holding company incorporated in Nevada but conducts all operating activities through seven subsidiaries based in China. The company’s ownership cascade flows from Longduoduo in Nevada into Longduoduo Company Limited (Hong Kong), then through LDD Technology Limited based in the British Virgin Islands, further down to LDDJK Hong Kong Limited and ultimately to four Chinese limited companies including Longduoduo Health Technology Company Limited operating mainly in Inner Mongolia and Beijing [S1]. This intricate corporate architecture is not merely legal formality; it opens the company to multiple layers of regulatory scrutiny both from U.S. securities authorities monitoring offshore structures and from evolving People's Republic of China (PRC) regulations targeting overseas listings and profit repatriations.

Such complexity arguably introduces operational opacity that complicates transparent financial disclosures and may hinder responsive governance. Moreover, managing compliance across jurisdictions requires sustained resources and expertise which exert pressure on a holding entity devoid of direct income-generating operations — reliant instead on distribution upstream from its Chinese subsidiaries [S1]. The indirect nature of operations embeds currency exchange risk alongside geopolitical tensions affecting Sino-U.S. economic ties.

The Inner Mongolia Honghai Reliance: Double-Edged Sword

A defining characteristic of Longduoduo’s revenue model is its overwhelming dependency on Inner Mongolia Honghai Health Management Co., Ltd., which accounted for over 97% of the company's revenues during fiscal year ending June 30, 2025 [S1][F1]. This concentration stems from Sales Agency Agreements executed in June 2023 under which Longduoduo’s Chinese subsidiaries act as sales agents for Honghai services in exchange for commissions.

While lucrative to date, this dependency is fraught with downside risks. Crucially, these agreements terminate in June 2026 with no assurance of renewal or alternative partnerships. Should Inner Mongolia Honghai scale back engagements due to adverse regulatory developments, competitive displacement by other sales agents, or business difficulties, Longduoduo's revenue base could collapse precipitously [S1]. The lack of contractual diversification leaves the company vulnerable to a single counterparty's operational health and regulatory standing — a precarious position especially given the opaque PRC healthcare market regulation environment.

Financial Snapshot: Signs of Strain Amid Modesty

Recent financial disclosures paint a picture of limited scale coupled with ongoing losses reflective of operational fragility. For the six months ended December 31, 2025, Longduoduo reported revenues totaling approximately $345,265 USD while incurring a net loss of around $258,495 USD [F1]. On a balance sheet basis, current assets stood at about $1.76 million against current liabilities near $1.12 million yielding a current ratio of roughly 1.57 — providing modest liquidity sufficiency [F1].

Despite this, cash ratio dynamics are more constrained given working capital needs predominantly funded by creditor support or upstream transfers from profitable subsidiaries. The holding entity itself lacks direct earnings capacity and depends heavily upon consistent upstream distributions—a mechanism susceptible to disruption if subsidiary cash flow falters or parent-level costs increase unexpectedly [S1]. These financial metrics underscore a thin margin cushion compounded by uncertainty surrounding the continuation of the dominant Honghai partnership.

Regulatory Shadows Looming Over Cross-Border Operations

Longduoduo operates within a shifting regulatory landscape shaped by tightening PRC oversight on overseas-listed Chinese companies. Government efforts to regulate data privacy, cross-border capital flows including dividends repatriation, export controls on medical technologies and telecommunications infrastructure inject layers of uncertainty that threaten ongoing compliance [S1].[S2]

The company’s auditor being subject to Public Company Accounting Oversight Board (PCAOB) inspections offers some reassurance on financial transparency; yet regulatory compliance can't be assured solely through independent audits. Restrictions imposed by PRC authorities could curtail dividend remittances required by Nevada holding entity operations or cause forced delisting from U.S exchanges if transparency standards falter [S1]. Persistent geopolitical tensions between China and the U.S. exacerbate this risk dynamic making operational continuity contingent upon adept navigation of dual jurisdictional demands.

Quality Control and Third-Party Service Risks in Healthcare

Operationally, Longduoduo's model relies extensively on third-party healthcare service providers who deliver services under cooperative arrangements [S1]. While contractual stipulations require these partners to hold necessary licenses and fulfill quality standards, Longduoduo does not exercise direct control over their performance or compliance status.

This creates significant exposure: licensed lapses or substandard medical care could result in customer dissatisfaction or litigation risks including medical malpractice claims. Additionally, mishandling sensitive personal healthcare information by third parties poses confidentiality breaches that can damage reputation irreversibly [S1]. Such vulnerabilities place Longduoduo within an ecosystem where peripheral failures may cascade into material adverse effects threatening both financial outcomes and brand equity.

Technology at Risk: Cybersecurity and System Vulnerabilities

Given its digital-dependent health consulting services architecture, Longduoduo confronts inherent cybersecurity challenges encompassing data privacy obligations as well as protection of proprietary clinical data streams [S1]. Its business relies heavily on uninterrupted computer networks connecting customers, partners and internal systems facilitating sensitive healthcare transactions.

Threat vectors include external cyber-attacks exploiting public network vulnerabilities alongside insider risks stemming from human error or inadequate automation controls resulting in accidental data exposure. Further complicating security posture is dependence on third-party IT systems—each possibly possessing distinct security weaknesses outside Longduoduo's immediate control—multiplying potential breach points [S1]. Such incidents could provoke operational disruptions while precipitating regulatory investigations or litigation expenses detrimental to financial health.

Strategic Horizons: Can Longduoduo Diversify Beyond Honghai?

Facing contract expiry in mid-2026 without explicit plans disclosed for renewal or replacement represents a critical inflection point. The absence of evident diversification strategies heightens risk that loss or reduction of commissions from Inner Mongolia Honghai would dramatically shrink revenues.

From a strategic perspective, expanding client base beyond Honghai would reduce concentration risk but demands building alternative distributor relationships or developing proprietary service offerings — initiatives not currently apparent in recent filings [S1][S2]. Pursuing greater operational autonomy by cultivating internally controlled subsidiaries instead of agent-based commissions might improve margin profiles but requires upfront investment amid already constrained resources.

Without clear directional shifts communicated, Longduoduo remains exposed to material earnings volatility tied to narrow partnership dependencies amidst an unforgiving regulatory backdrop.

Investor Takeaways: Parsing Risks and Prospects

Longduoduo presents as an archetype of complexity-laden emerging market enterprises leveraging cross-border holding structures entwined with single-partner concentration risk profiles. Its current financial snapshot suggests fragile liquidity buffered only modestly by upstream distributions amid sustained net losses.

Key vulnerabilities stem from:

- Heavy reliance (>97%) on Inner Mongolia Honghai with contract termination looming,

- Regulatory uncertainties linked to PRC rules impacting overseas capital flow,

- Quality assurance risks inherent in outsourced healthcare service delivery,

- Cybersecurity exposures within critical technology infrastructures,

- Absence of transparent strategic planning for client diversification.

While auditor PCAOB oversight provides some confidence regarding reported financials' integrity, it cannot negate substantial operational risks emanating from opaque multi-jurisdictional corporate forms nor offset geopolitical/regulatory headwinds shaping the firm’s prospects.

In summary, Longduoduo operates at a nexus where opportunity exists alongside pronounced execution hazards related chiefly to partner dependence and jurisdictional constraints—a dynamic prospective investors should rigorously analyze against their risk tolerance frameworks prior to engagement.

This analysis is based exclusively on publicly available SEC filings as referenced; it does not constitute investment advice but serves to clarify underlying corporate mechanics and associated business risks inherent within Longduoduo Co Ltd as understood today.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments