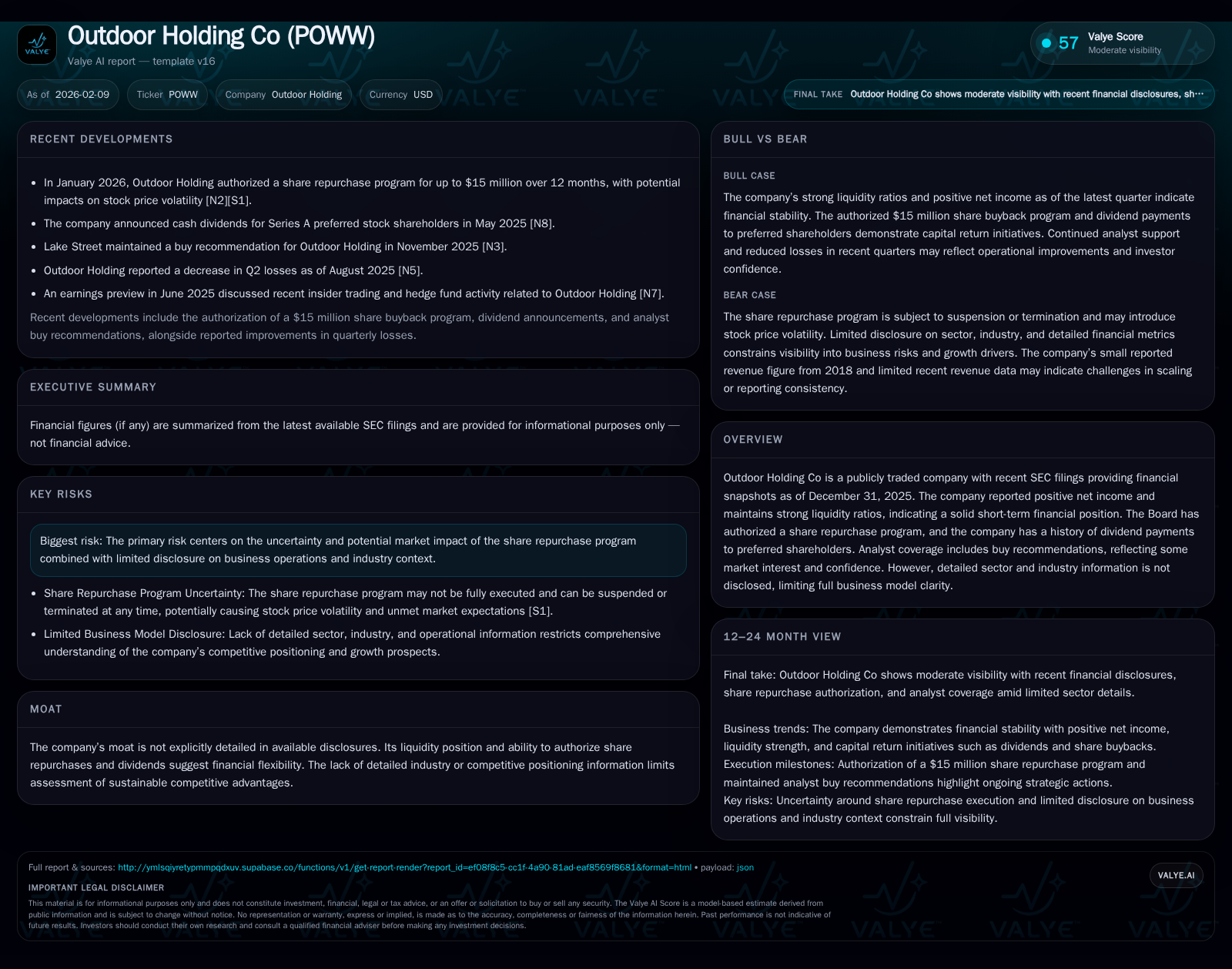

Outdoor Holding Co’s $15 Million Buyback Fuels Market Buzz Amid Financial Transparency Gaps

Strong liquidity and profitability bolster Outdoor Holding's strategic flexibility despite limited industry disclosure.

Outdoor Holding Co’s recent authorization of a $15 million share repurchase program triggered a notable pre-market surge in its stock price, reflecting investor optimism about management’s confidence. The company’s robust liquidity position, with nearly $70 million in cash equivalents and a current ratio of approximately 4, underscores its capacity to fund such capital return initiatives without jeopardizing operational stability. However, the absence of detailed sector or competitive information clouds a comprehensive understanding of its long-term growth prospects and moat. While analyst buy recommendations suggest some market faith, risks persist around the execution and market impact of the repurchase program. Ultimately, Outdoor Holding projects financial resilience and strategic optionality, yet full transparency on its business model remains elusive.

Share Buyback Sparks Market Buzz: The Catalyst for POWW’s Rally

On January 5, 2026, Outdoor Holding Co’s Board announced the authorization of a substantial $15 million share repurchase program [N2]. This decision immediately reverberated through markets, igniting a sharp pre-market surge in POWW’s stock price. The volume and velocity of this reaction underscore how buybacks—especially sizeable ones—often serve as strong signals to investors regarding management’s confidence in the company’s valuation and future prospects.

For a business like Outdoor Holding Co, which notably lacks broad public disclosure about its operating sector or competitive positioning, such a move can compensate for informational opacity by projecting financial strength. Investors appear to have interpreted the program as an implicit endorsement by leadership that shares were undervalued or that capital allocation priorities remain shareholder-friendly. The pre-market trading momentum also suggests that—despite uncertainties—the market is willing to embrace strategic narratives centered on capital return policies.

Dissecting Financial Health: Liquidity Strengths and Profitability Insights

Outdoors Holding Co’s latest quarterly filing as of December 31, 2025 [S2], bolstered by company facts data [F1], reveals a firm financial foundation underpinning these buyback plans. With cash and cash equivalents totaling approximately $69.9 million, the company possesses ample liquid resources to execute repurchases without overextending operational cash flows.

Moreover, current assets standing at roughly $82.5 million against current liabilities near $20.7 million yield an enviable current ratio close to 4:1. Such liquidity strongly suggests short-term solvency resilience—key when deploying significant capital into shares rather than reinvesting directly into potential business growth.

Profitability metrics further reinforce this narrative; a net income figure just above $2.2 million for the period indicates ongoing earnings capability, even though the top-line revenue disclosed remains outdated and minimal at around $489,000 from 2018 [F1]. The disconnect here points towards either limited public reporting or shifts in business scale but does not diminish the positive bottom-line outcome affirmed by reported income.

Together, these numbers portray a company poised with sufficient financial ammunition to support buybacks strategically while sustaining operational health.

Dividend Heritage and Capital Allocation: A Window Into Management’s Confidence

Beyond repurchases, Outdoor Holding Co maintains a history of dividend payments directed toward its preferred shareholders [valye_report_excerpt]. This pattern evidences a consistent shareholder-focused capital policy emphasizing reward distributions that coexist alongside liquidity preservation.

Such dual channels—dividends complemented by share buybacks—demonstrate management’s nuanced approach to capital allocation. It reflects an intent not only to return excess cash but also to modulate shareholder value enhancement according to market valuations and internal forecasts. The timing and size of the recent authorization fit this mold, suggesting deliberate calibration rather than reactive or speculative maneuvers.

The Shadows of Uncertainty: Navigating Missing Industry Context

Conspicuously absent from public disclosures is any detailed description of Outdoor Holding Co’s sector specifics or competitive landscape [valye_report_excerpt]. This omission substantially complicates fundamental analysis efforts aimed at gauging sustainable moats or growth catalysts beyond pure financial positioning.

The lack of stated industry affiliation impairs comparison against peers or identification of structural advantages such as proprietary technologies, regulatory barriers, or brand loyalty dynamics. Nor does it clarify cyclicality exposure or macroeconomic sensitivities intrinsic to many industries.

This opacity compels reliance predominantly on balance sheet strength and corporate actions for investment narratives over qualitative business insights. While pragmatic in preserving certain corporate secrets, it simultaneously constrains informed stakeholder confidence in long-horizon strategic viability.

Investor Sentiment and Analyst Views: Interpreting the Buy-Side Backing

Available reports allude to active analyst coverage featuring buy recommendations for POWW shares [valye_report_excerpt]. Such endorsement hints at pockets of market optimism grounded presumably on observable financial health and anticipated effective execution of capital returns.

Yet this sentiment should be viewed through a balanced lens acknowledging informational gaps and potential overreliance on quantifiable metrics detached from operational visibility. Analysts may weigh management credibility heavily given dividend consistency combined with seemingly robust accounting fundamentals.

In aggregate, this creates an environment where investor appetites are cautiously favorable but may fluctuate as more operational clarity—or lack thereof—emerges over time.

Risk Revisited: The Share Repurchase Program’s Double-Edged Sword

The company’s own SEC filings counsel prudence regarding the share repurchase initiative [S2]. Specifically, risk disclosures detail that the program lacks obligation for any minimum repurchase amount and may be modified or halted depending upon circumstances including market conditions and material non-public information.

This flexibility is double-edged: on one side it protects Outdoor Holding from imprudent expenditures if conditions sour; on the other side it injects uncertainty for investors who might expect steady execution aligned with initial enthusiasm.

Furthermore, the inherent volatility induced by such market signaling efforts can provoke speculative trading swings—sometimes widening bid-ask spreads or inviting short-term technical gyrations contrary to fundamental value creation goals.

Hence, while strategic buybacks often reinforce shareholder returns, they equally demand careful communication and expectation management to avoid undermining trust during their rollout phases.

Looking Ahead: Strategic Flexibility Without Full Transparency

Synthesizing available information paints Outdoor Holding Co as a financially stable entity projecting deliberate strategic maneuvering via combined dividends and repurchase programs [valye_report_excerpt],[S2],[F1]. The substantial cash reserves enable agility in capital deployment decisions while safeguarding operational soundness.

Nevertheless, absent transparent disclosure on business lines or sector focus renders long-term forecasting speculative at best. This strategic opacity may serve protective functions internally but limits external stakeholders’ ability to assess risks from competitive shifts or evolving market dynamics adequately.

Management appears poised on a tightrope balancing optimization of shareholder returns with retention of discretionary scope—a posture demanding continued attentiveness from observers tracking subsequent updates or clarifying communications.

This analysis does not constitute investment advice but aims to provide nuanced insight into Outdoor Holding Co's recent developments and financial standing based on disclosed information as of February 2026.

Disclaimer: This is research-only, informational analysis and not investment advice. It may include AI-generated interpretation and general industry context. Always verify important details using primary sources.

Comments